Cash Flow Management Diagnostic: Why Profit Isn’t Cash

Effective cash flow management is the single biggest challenge for growing businesses. You might have had a record-breaking sales month. However, if your bank account is empty while your Profit & Loss statement shows a surplus, you are experiencing the “Profit Paradox.” Consequently, understanding the difference between theoretical profit (taxable income) and actual cash (operational […]

Reconciliation Services Camas: The First Line of Defense for Your Business

If you are a business owner searching for reconciliation services Camas, you likely already suspect that your books are not telling you the whole truth. Messy or unreconciled books aren’t just a minor administrative inconvenience; they are a significant liability. Consequently, bank reconciliation serves as the absolute foundation of trustworthy financials, yet it remains one […]

The Defensible Audit Trail: Why Spreadsheets Fail & How QBO Protects You

Effectively, creating a defensible audit trail is the single most important step you can take to protect your growing business from IRS scrutiny. However, many small business owners start with spreadsheets because they are flexible, familiar, and “free.” Unfortunately, what works for a hobbyist fails when revenue streams become complex. Specifically, spreadsheets lack the ability […]

Oil & Gas Bookkeeping: Managing JIBs, AFEs, and Revenue with Precision

Effectively, Oil & Gas bookkeeping requires a level of precision that few other industries demand. Specifically, managing Joint Interest Billings (JIBs), tracking Authorization for Expenditures (AFEs), and reconciling complex revenue statements can overwhelm generalist bookkeepers. However, without specialized financial oversight, operators and investors risk massive cash leaks and compliance failures. Below, we outline exactly how […]

Missing Receipts & The Cohan Rule: What the IRS Really Accepts

Recently, a business owner asked if they could simply “estimate” their travel expenses because they lost the paperwork. Technically, a legal precedent exists for this, but relying on it is dangerous. In reality, dealing with missing receipts isn’t just about showing you paid; you must prove the expense was ordinary, necessary, and business-related. Below, we […]

Cheap Bookkeeping: The Hidden Costs Affordably Avoided

Cheap bookkeeping convinces many business owners that hiring a professional firm is something you do only after hitting a certain revenue number. They tell themselves, “Once I hit $1 million, I’ll hire a real firm.” But focusing solely on finding a cheap bookkeeping solution often backfires. The Hidden Bill: Why Cheap Bookkeeping Alternatives Often […]

Service Business Deductions: The Ultimate Guide to Stop Overpaying Taxes

Effectively, identifying valid service business deductions is the single most impactful way to lower your tax bill legitimately. However, running a service-based business—whether you’re a freelancer, consultant, or agency owner—means wearing many hats, often causing tax strategy to fall through the cracks. Specifically, nearly 60% of small businesses overpay taxes because they miss these critical […]

Security & Privacy in Bookkeeping: Our Commitment to Protecting Your Data

Protecting your business involves more than just generating profit; it demands a rigorous defense of your digital assets. When you share your financial records, you are sharing the blueprint of your livelihood. Therefore, security & privacy must be the non-negotiable foundation of any bookkeeping relationship. Unlike casual providers who might share passwords via email or […]

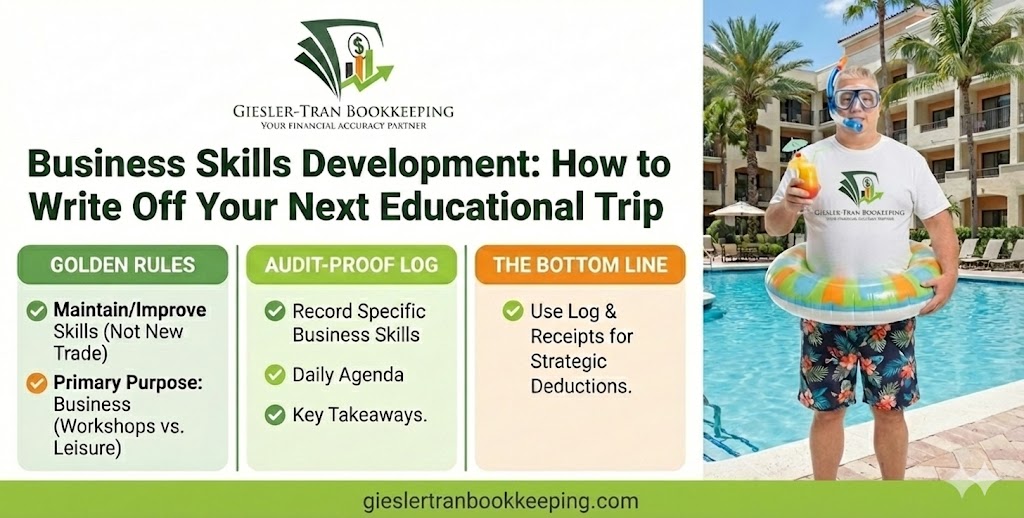

Business Skills Development: How to Write Off Your Next Educational Trip

Investing in yourself is the best investment you can make, but investing with pre-tax dollars is even better. For ambitious entrepreneurs, business skills development is not just a buzzword; it is a critical strategy for survival in a competitive market. However, many business owners hesitate to book that conference in Las Vegas or that workshop […]

Real Estate Bookkeeping: The Ultimate Guide to Commissions & Compliance

Recently, I worked with a high-performing agent who assumed their net commission deposit was their total revenue. After carefully reviewing six months of their data, we found that referral fees and broker splits were never recorded, and deductible marketing expenses were missing receipts entirely. Consequently, their tax liability was wildly inaccurate because they were underreporting […]