Chiropractic Pricing Strategy: Triangulation for Higher Profit and Acceptance

Recently, I reviewed the financials of a thriving chiropractic clinic that was seeing record patient numbers but struggling with stagnant profits. In reality, their issue wasn’t a lack of patients; it was a lack of pricing structure. For instance, they were using a simple fee-for-service model that forced patients into a binary “yes or no” […]

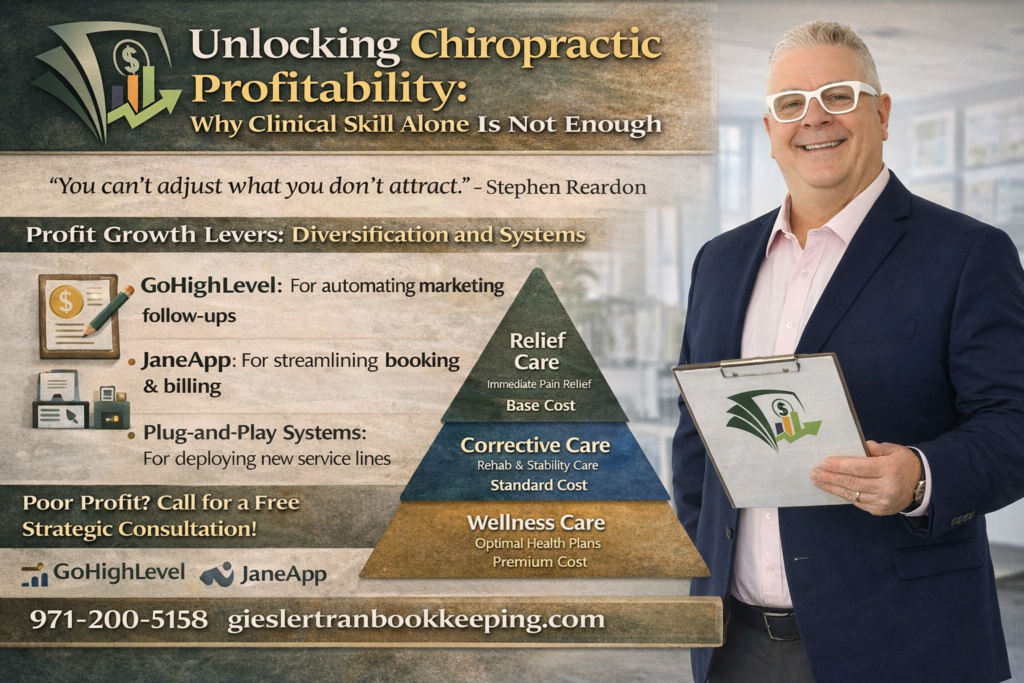

Unlocking Chiropractic Profitability: Why Clinical Skill Alone Is Not Enough

Chiropractic profitability is rarely a result of clinical skill alone; it is the product of intentional business strategy. In reality, many highly skilled practitioners struggle to make payroll because they treat their practice strictly as a clinic rather than a business. For instance, analysis shows that high earners distinguish themselves through diversified service lines and […]

Cheap Bookkeeping: The Hidden Costs Affordably Avoided

Cheap bookkeeping convinces many business owners that hiring a professional firm is something you do only after hitting a certain revenue number. They tell themselves, “Once I hit $1 million, I’ll hire a real firm.” But focusing solely on finding a cheap bookkeeping solution often backfires. The Hidden Bill: Why Cheap Bookkeeping Alternatives Often […]

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

Overwhelmingly, fixing a full year of bad accounting can feel like an impossible task, but the right bookkeeping cleanup process can turn chaos into clarity faster than most business owners realize. Often, one missed month quietly becomes three, three roll into twelve, and suddenly you’re staring at financial reports that don’t match reality. Consequently, ignoring […]

Medical Office Tax Deductions: 10 Commonly Missed Write-Offs

Every year, thriving practices across the country overlook valuable medical office tax deductions—not because they are evading taxes, but simply because their bookkeeping isn’t structured to capture them. Unfortunately, clean patient files do not equal clean financial records. After completing hundreds of cleanups for chiropractors, dentists, PT clinics, and wellness centers, one hard truth has […]

Top Bookkeeping Mistakes That Trigger IRS Audits

Recently, I told a client something I genuinely believe: I surround myself with people smarter than I am so we can accomplish our mission at the highest level. In fact, successful business owners adopt this exact mindset when they stop trying to DIY their tax compliance and decide to hire a professional. Specifically, you need […]

The Audit-Ready Chart of Accounts: Structure Your Books for Compliance

Fundamentally, your Chart of Accounts (COA) is the backbone of your entire bookkeeping system. If it is messy, overly generic, or missing essential categories, your financials will always be wrong—no matter how diligently you reconcile. Unfortunately, most business owners do not realize that errors in their COA create massive IRS exposure and missed deductions. Consequently, […]

How to Reconcile Chiropractic Insurance Reimbursements

Effectively, managing chiropractic insurance reimbursements is the financial backbone of any successful practice. However, between delayed payments, partial denials, and confusing Explanation of Benefits (EOB) statements, your books can easily drift out of sync. Specifically, failing to reconcile these payments accurately leads to lost revenue and compliance risks. Below, we break down a professional workflow […]

5 Critical Bookkeeping for Chiropractors Mistakes & How to Fix Them

Effectively, mastering bookkeeping for chiropractors is the silent engine behind every profitable clinic. However, between managing patient care, staff schedules, and complex insurance reimbursements, financial organization often falls through the cracks. Specifically, small accounting errors can compound rapidly, leading to tax nightmares or cash flow shortages. Below, we identify the five most dangerous mistakes in […]

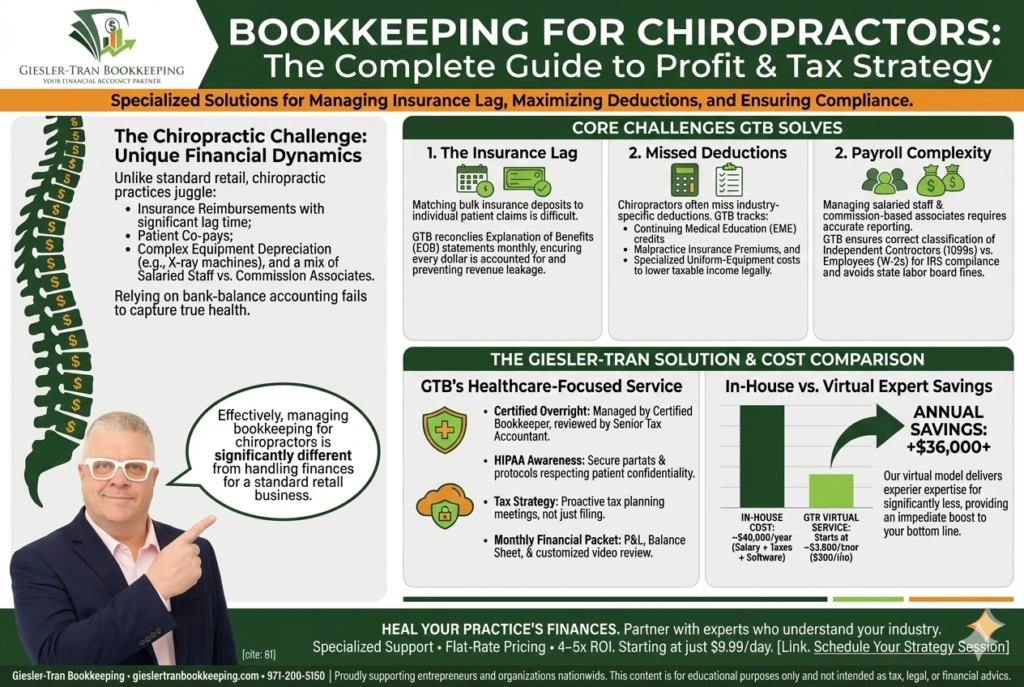

Bookkeeping for Chiropractors: The Complete Guide to Profit & Tax Strategy

Effectively, managing bookkeeping for chiropractors is significantly different from handling finances for a standard retail business. Because your practice juggles insurance reimbursements, patient co-pays, and complex equipment depreciation, a generic approach often leads to lost revenue. However, many chiropractors still rely on bank-balance accounting, which fails to capture the true health of their clinic. Specifically, […]