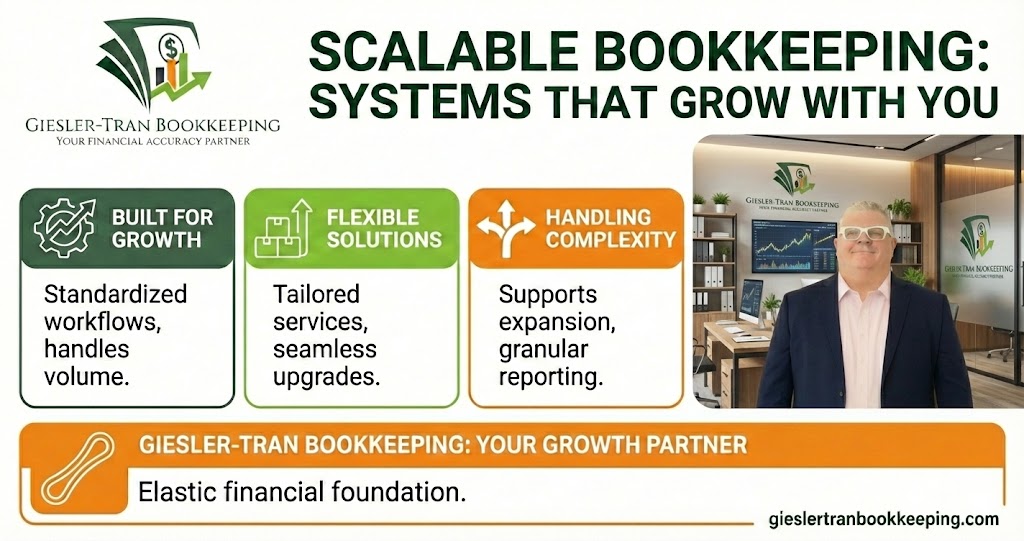

Scalable Bookkeeping: Systems That Grow With Your Business

Every business owner starts with a vision of growth, but few anticipate the administrative chaos that success brings. While generating revenue is exciting, the backend complexity often cripples operations before they can mature. Therefore, establishing scalable bookkeeping early is not just a smart move; it is a survival strategy. Unlike static accounting methods that break […]

Bookkeeping Cleanup Cost Guide: Transparent Pricing for Financial Clarity

Understanding the true bookkeeping cleanup cost is the first step toward reclaiming control of your business finances. For many business owners, the fear of an unknown price tag is often more stressful than the messy books themselves. However, delaying the process only increases the risk of tax penalties and lost deductions. At Giesler-Tran Bookkeeping (GTB), […]

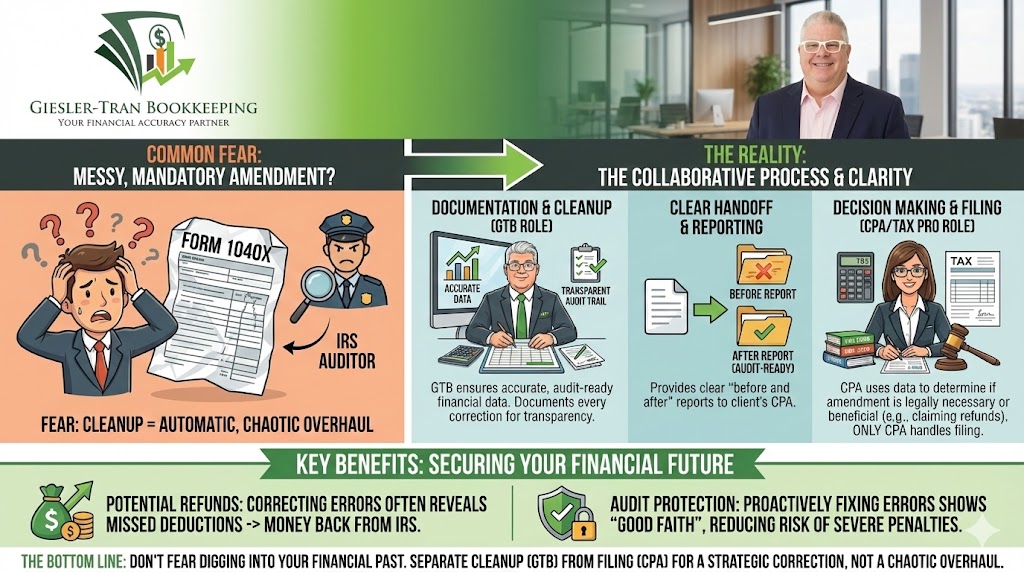

Past Tax Filings: Will Bookkeeping Cleanup Force You to Amend Returns?

Many business owners hesitate to fix their financial records because they fear the consequences with the IRS. Specifically, a common anxiety is that organizing historical data will automatically trigger a mandatory change to past tax filings, leading to penalties or audits. Consequently, this fear often paralyzes entrepreneurs, leaving them stuck with messy books for years. […]

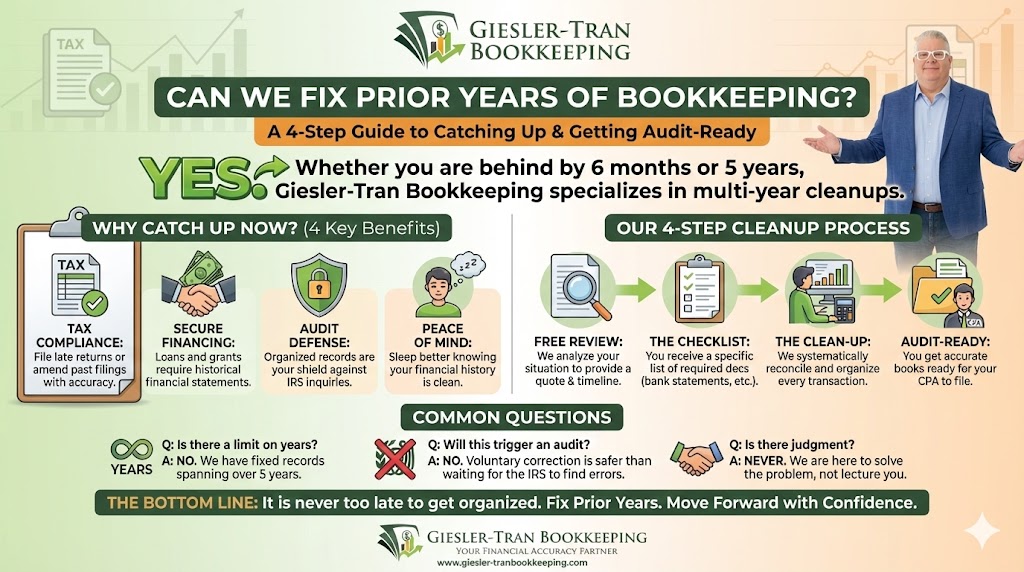

Can We Fix Prior Years of Bookkeeping? A Guide to Catching Up

The urgent need to fix prior years of financial records is the primary reason many business owners approach us, worried that their bookkeeping challenges span far beyond the current calendar year. Naturally, they feel overwhelmed and ask if we only handle current records or if we possess the capability to help with older, messier situations. […]

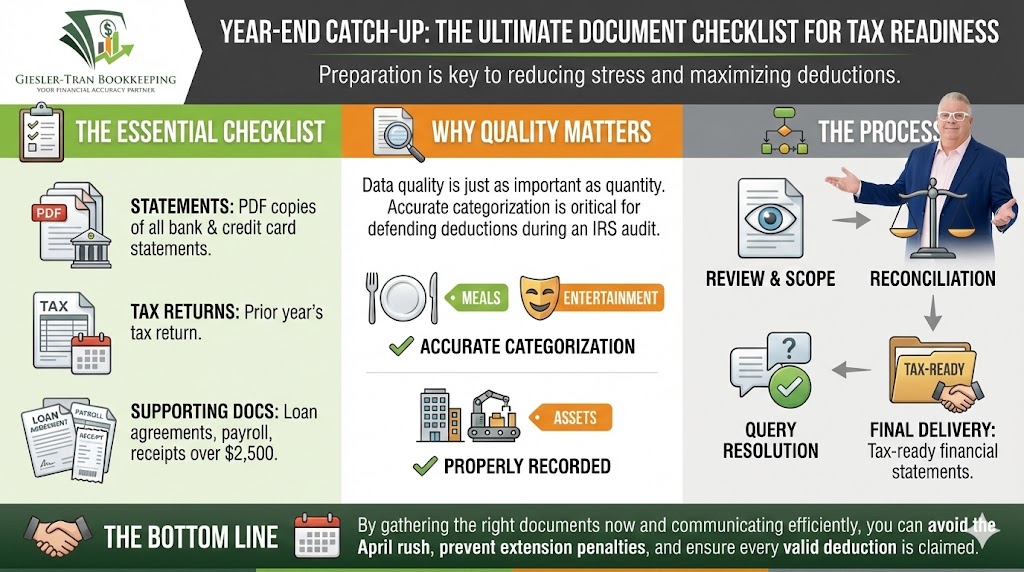

Year-End Catch-Up: The Ultimate Document Checklist for Tax Readiness

Performing a comprehensive year-end catch-up is the single most effective way to prepare for tax season without the usual stress and anxiety. Recently, many clients have asked us how to navigate this process efficiently. Specifically, they want to know exactly what documents they must gather to get their books audit-ready before the filing deadline. Fortunately, […]

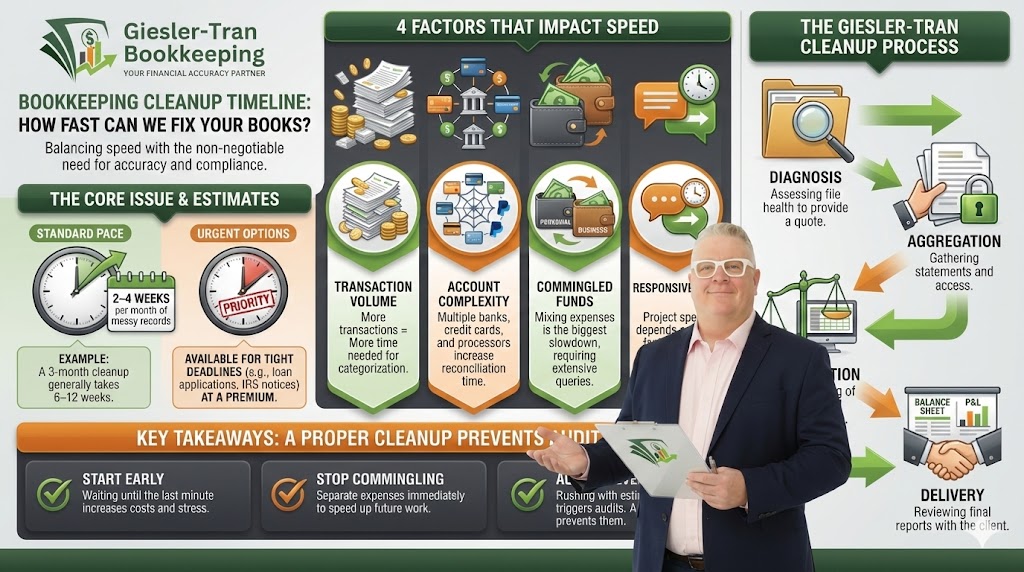

Bookkeeping Cleanup Timeline: How Long Does a Financial Reset Take?

Recently, new clients have come to us in a panic because tax deadlines are looming and their financial records are in disarray. Naturally, their first anxious question is often: “How fast can you get my books in order?” While we pride ourselves on efficiency at Giesler-Tran Bookkeeping, the honest answer depends on several specific variables […]

Fast Bookkeeping Cleanup: The Emergency Plan for Tax Deadlines

Recently, business owners have been contacting us in a state of panic because tax season is arriving, and their books are simply not ready. Specifically, they realize that without a fast bookkeeping cleanup, they face steep penalties, missed deductions, and sleepless nights. Effectively, procrastination has turned a routine task into a financial emergency. Below, we […]

Bookkeeping Cleanup Preparation: How To Lower Your Costs

Effectively, bookkeeping cleanup preparation is the single biggest factor in determining the final cost of your project. However, many business owners simply hand over a shoebox of receipts and hope for the best. Specifically, this disorganized approach leads to higher fees, longer turnaround times, and unnecessary questions. Below, we outline exactly how to gather 12–24 […]

Mastering Payroll Taxes and Filings: A Strategic Guide for Business Owners

I recently encountered a small business owner who was treating their payroll responsibilities as a simple administrative task, unaware of the severe risks involved. In reality, managing payroll taxes and filings is often the most dangerous compliance minefield a growing company faces. A single missed deposit deadline or a miscalculated withholding amount, for instance, can […]

Merchant Reconciliation Guide: How to Unscramble Stripe, Square & PayPal Payouts

Merchant reconciliation is the often-overlooked backbone of accurate financial reporting for modern businesses. Whether you operate a bustling e-commerce store or a high-traffic local cafe, your payment processor—be it Stripe, Square, or PayPal—is not just a bank account; it is a complex holding area for your revenue. Unfortunately, many business owners make the critical mistake […]