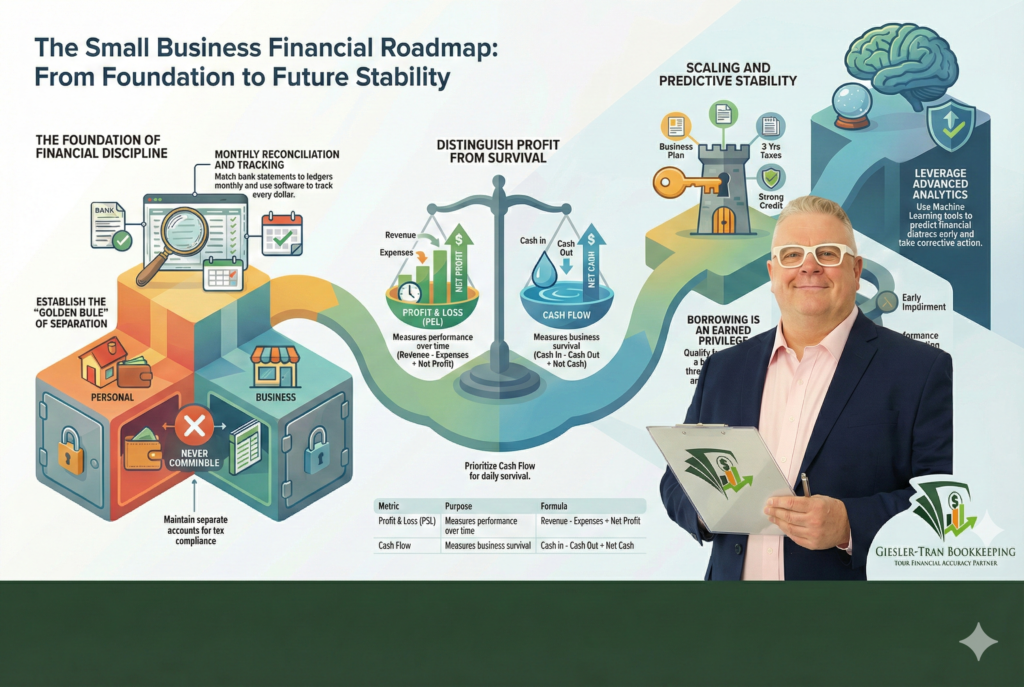

Small Business Financial Management: From Basic Books to Advanced Growth

Small Business Financial Management is the absolute bedrock of stability in an increasingly volatile global economy. Specifically, business owners today face tightening capital requirements and fluctuating labor markets that make the margin for error slimmer than ever before. However, many entrepreneurs still treat their finances as an afterthought, focusing solely on product development while their […]

The Truth Problem: Why Your Business Needs a Bookkeeping Health Check Now

Most business owners do not have a bookkeeping problem; they have a truth problem. Specifically, after reviewing hundreds of real QuickBooks files, I can tell you this with certainty: the most dangerous books are not the messy ones—they are the ones that look clean but are quietly wrong. Consequently, performing a rigorous bookkeeping health check […]

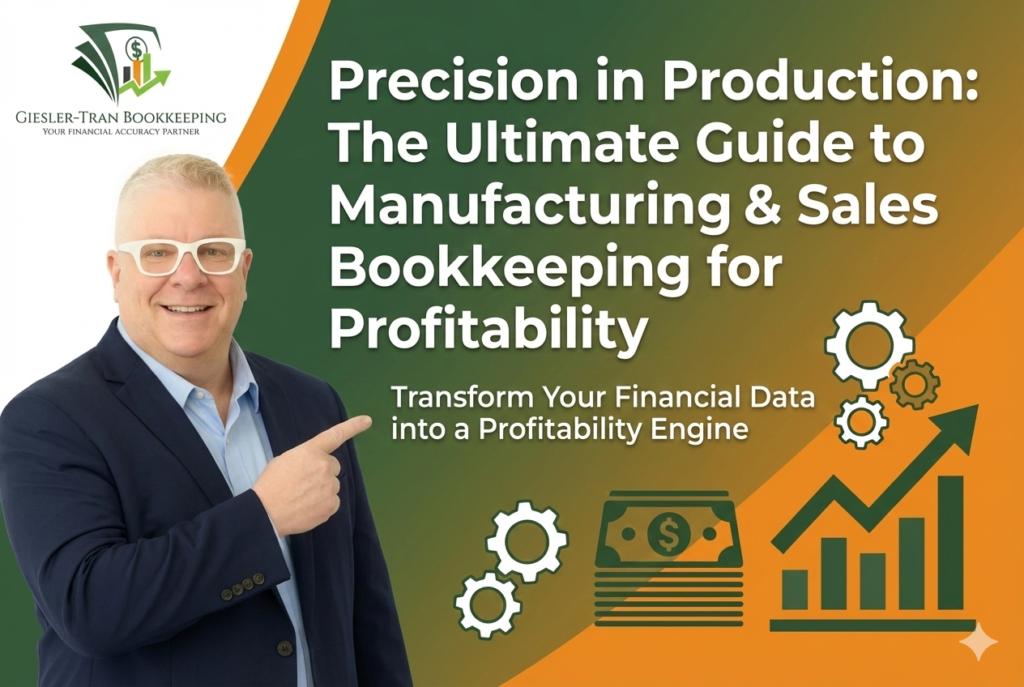

Precision in Production: The Ultimate Guide to Manufacturing & Sales Bookkeeping for Profitability

Recently, I’ve noticed a concerning trend where product-based business owners approach their financials with the same mindset as service providers. In reality, managing manufacturing & sales bookkeeping is nothing like balancing a checkbook for a consultant or a marketing agency. For instance, a service business primarily tracks money in and money out. However, in manufacturing, […]

The Defensible Audit Trail: Why Spreadsheets Fail & How QBO Protects You

Effectively, creating a defensible audit trail is the single most important step you can take to protect your growing business from IRS scrutiny. However, many small business owners start with spreadsheets because they are flexible, familiar, and “free.” Unfortunately, what works for a hobbyist fails when revenue streams become complex. Specifically, spreadsheets lack the ability […]

Fuel Delivery Bookkeeping Guide: Scale Your Fleet & Master IRS Tax Rules

Effectively, mastering fuel delivery bookkeeping is the operational backbone of modern mobile energy providers like Juiced Fuel. However, simply delivering gas to North Dallas fleets isn’t enough if your back office is a mess. Specifically, the unique combination of volatile commodity pricing, complex excise taxes, and fleet depreciation makes standard accounting methods obsolete. Below, we […]

Shopify Bookkeeping Guide: How to Master E-Commerce Financials & Avoid Audits

Effectively, mastering Shopify bookkeeping is the difference between running a profitable e-commerce brand and merely churning cash. However, many store owners fall into the trap of assuming that their Shopify dashboard equals their financial reality. Specifically, ignoring the complexities of payment gateways, sales tax nexus, and inventory costs can lead to disastrous tax filings. Below, […]

Oil & Gas Bookkeeping: Managing JIBs, AFEs, and Revenue with Precision

Effectively, Oil & Gas bookkeeping requires a level of precision that few other industries demand. Specifically, managing Joint Interest Billings (JIBs), tracking Authorization for Expenditures (AFEs), and reconciling complex revenue statements can overwhelm generalist bookkeepers. However, without specialized financial oversight, operators and investors risk massive cash leaks and compliance failures. Below, we outline exactly how […]

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

Overwhelmingly, fixing a full year of bad accounting can feel like an impossible task, but the right bookkeeping cleanup process can turn chaos into clarity faster than most business owners realize. Often, one missed month quietly becomes three, three roll into twelve, and suddenly you’re staring at financial reports that don’t match reality. Consequently, ignoring […]

Our Proven Process: How We Keep Your Business Audit-Ready Every Month

Maintaining audit-ready financial records is the single most effective way to protect your business from regulatory nightmares. While many business owners view bookkeeping as a simple data-entry chore, Giesler-Tran Bookkeeping (GTB) treats it as a critical defense strategy. Specifically, we believe that the best results come from a clear, consistent process that leaves nothing to […]

Audit-Ready Books: Your Best Defense and Biggest Asset

Initially, most business owners view bookkeeping as a simple administrative chore. However, as the business grows, the stakes get higher. Suddenly, you aren’t just recording expenses; you are building a legal defense. At Giesler-Tran Bookkeeping (GTB), we deliver more than just accurate records; we build audit-ready books. This strategic approach helps you save money, reduce […]