The Truth Problem: Why Your Business Needs a Bookkeeping Health Check Now

Most business owners do not have a bookkeeping problem; they have a truth problem. Specifically, after reviewing hundreds of real QuickBooks files, I can tell you this with certainty: the most dangerous books are not the messy ones—they are the ones that look clean but are quietly wrong. Consequently, performing a rigorous bookkeeping health check […]

The Defensible Audit Trail: Why Spreadsheets Fail & How QBO Protects You

Effectively, creating a defensible audit trail is the single most important step you can take to protect your growing business from IRS scrutiny. However, many small business owners start with spreadsheets because they are flexible, familiar, and “free.” Unfortunately, what works for a hobbyist fails when revenue streams become complex. Specifically, spreadsheets lack the ability […]

QBO Setup for Realtors: Why Customization Beats Spreadsheets

Effectively, a professional QBO setup for realtors is the difference between a tax-time nightmare and a profitable year. However, if you are like most busy agents, you have probably lived inside Google Docs and spreadsheets longer than you care to admit. Initially, these manual methods work; yet, they inevitably fail when volume increases. Specifically, when […]

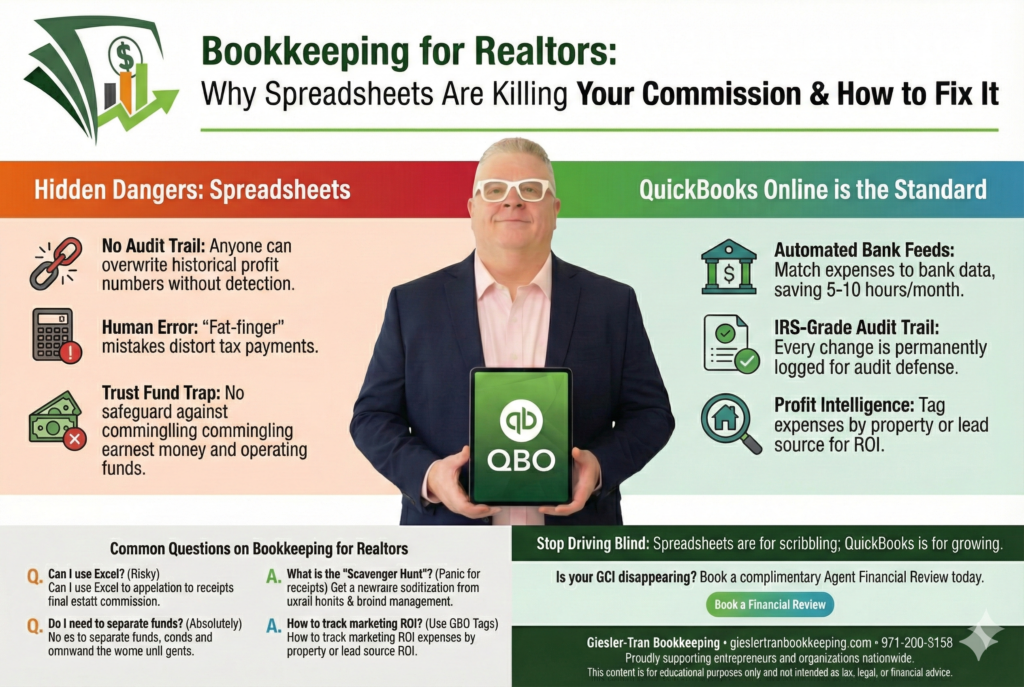

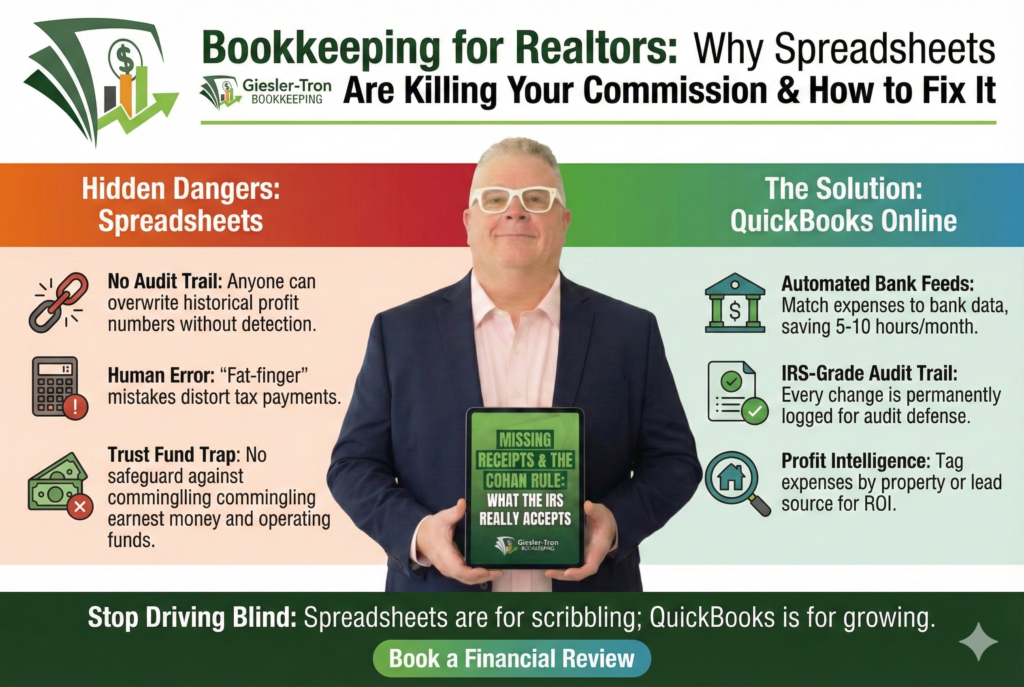

Bookkeeping for Realtors: Why Spreadsheets Are Killing Your Commission & How to Fix It

Effectively, professional bookkeeping for realtors is the foundation of a scalable real estate business. However, many agents still rely on “digital napkins”—otherwise known as spreadsheets—to track their financial lives. Specifically, while Excel or Google Sheets might feel convenient for scribbling down expenses, they are dangerous tools for managing business records. Below, we explore why relying […]

“I’ll Clean This Up in January” Is the Most Expensive Sentence in Business: The Truth About Year-End Bookkeeping

Every single December, as we approach the holidays, I hear the same dangerous phrase from business owners regarding their year-end bookkeeping. Specifically, they tell me: “I’m too busy right now. I’ll just clean up the books in January.” Let’s be honest. That isn’t a strategy; it is a procrastination trap. Unfortunately, this mindset is likely […]

Service Business Deductions: The Ultimate Guide to Stop Overpaying Taxes

Effectively, identifying valid service business deductions is the single most impactful way to lower your tax bill legitimately. However, running a service-based business—whether you’re a freelancer, consultant, or agency owner—means wearing many hats, often causing tax strategy to fall through the cracks. Specifically, nearly 60% of small businesses overpay taxes because they miss these critical […]

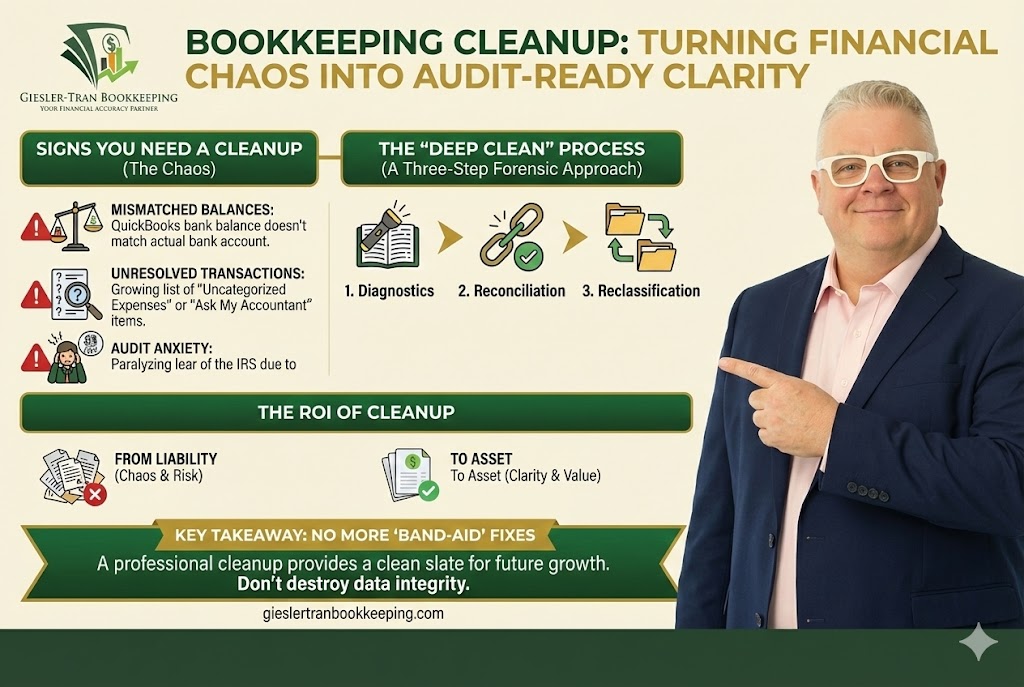

Bookkeeping Cleanup: Turning Financial Chaos Into Audit-Ready Clarity

Eventually, every growing business hits a period of chaotic expansion where the administrative tasks simply cannot keep up with the revenue. Consequently, the monthly reconciliation gets pushed to “next weekend,” and then to “next month.” Before you know it, you are six months behind, tax season is looming, and your financial data is a black […]

Why 60% of Small Businesses Overpay Taxes: The Hidden Cost of DIY Bookkeeping

Shockingly, industry statistics suggest that nearly 60% of small business owners overpay taxes every single year. Often, entrepreneurs assume this is because the tax code is rigged against them or because rates are simply too high. However, the real culprit is rarely the tax rate itself; rather, it is the quality of the financial data […]

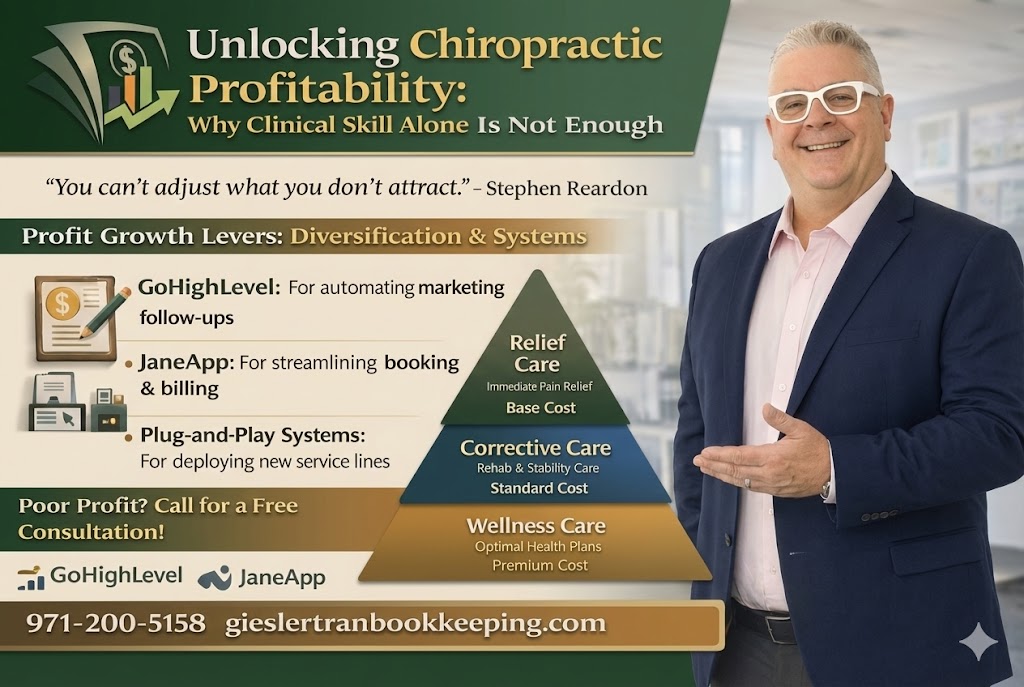

Medical Office Tax Deductions: 10 Commonly Missed Write-Offs

Every year, thriving practices across the country overlook valuable medical office tax deductions—not because they are evading taxes, but simply because their bookkeeping isn’t structured to capture them. Unfortunately, clean patient files do not equal clean financial records. After completing hundreds of cleanups for chiropractors, dentists, PT clinics, and wellness centers, one hard truth has […]

The Audit-Ready Chart of Accounts: Structure Your Books for Compliance

Fundamentally, your Chart of Accounts (COA) is the backbone of your entire bookkeeping system. If it is messy, overly generic, or missing essential categories, your financials will always be wrong—no matter how diligently you reconcile. Unfortunately, most business owners do not realize that errors in their COA create massive IRS exposure and missed deductions. Consequently, […]