Messy Books Cleanup Portland: A Real-World Financial Rescue Case Study

Messy books cleanup Portland is one of the most requested services we offer, yet it is also the one business owners are most afraid to ask for. For many entrepreneurs in the Rose City, the rain isn’t the only thing causing gloom; the looming shadow of unfiled taxes and disorganized ledgers creates a constant state […]

Historical Bookkeeping Cleanup Services | Giesler-Tran Bookkeeping

Historical bookkeeping cleanup is more than just data entry; it is a financial rescue mission. For many business owners, the initial goal is simple: survive the startup phase. However, the reality of running a growing company often means that back-office tasks, like reconciling bank feeds, get pushed to the bottom of the pile. Consequently, months […]

Is Your Business Bleeding Cash? The Critical Bookkeeping Health Check

Performing a comprehensive bookkeeping health check is the single most effective way to determine if your business is actually profitable or just moving money around. Most business owners erroneously believe their books are “fine” simply because their bank account balance remains positive. However, a positive bank balance often masks deep, systemic financial issues. Consequently, relying […]

Why Your Clinic Needs Specialized Medical Practice Bookkeeping to Thrive

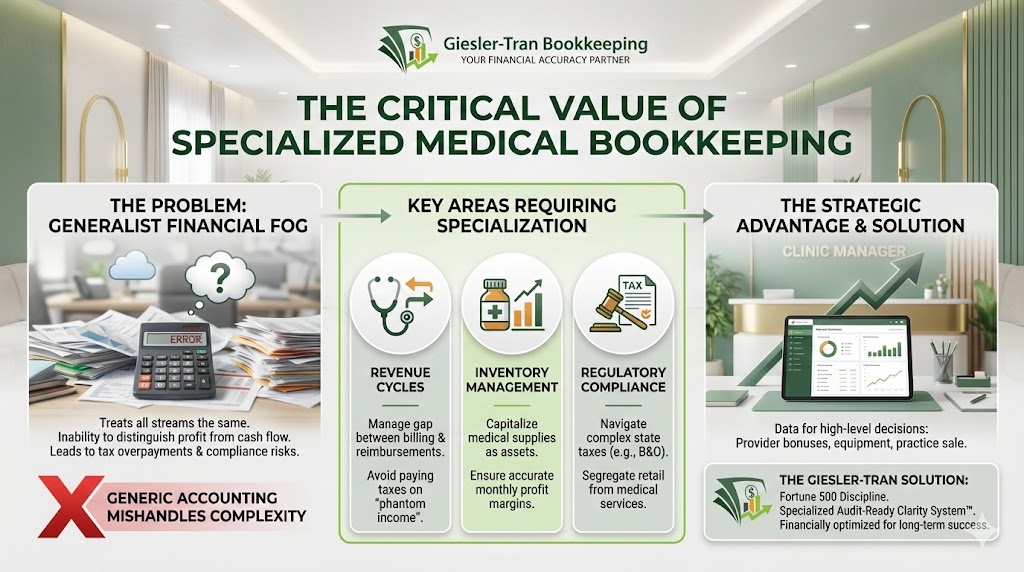

Specialized medical practice bookkeeping is not just about organizing receipts; it is the financial backbone of a thriving healthcare facility. Many clinic owners assume that any accountant can handle their books. However, generic financial tracking often fails to capture the nuances of patient copays, insurance reimbursements, and complex inventory management. Consequently, without a system built […]

Scaling a Private Practice in WA: How ShillMed Balances Patient Care with Financial Health.

For most owners, the mission is deceptively simple: heal patients. But the reality of scaling a private practice in Washington State—from Vancouver to Spokane—involves a level of complexity that goes far beyond the exam room. Between insurance compliance, inventory management for supplements, and the overhead of a physical office, the “business” side of medicine can […]

10 Deducciones Fiscales Ocultas Que Ahorran Miles a las Empresas de Servicios

Deje de perder dinero pasando por alto las críticas deducciones fiscales para empresas de servicios. En realidad, para consultores, agencias y firmas profesionales, la diferencia entre una factura de impuestos masiva y una justa a menudo se reduce al conocimiento. Específicamente, entender la gama completa de deducciones fiscales para empresas de servicios disponibles para usted […]

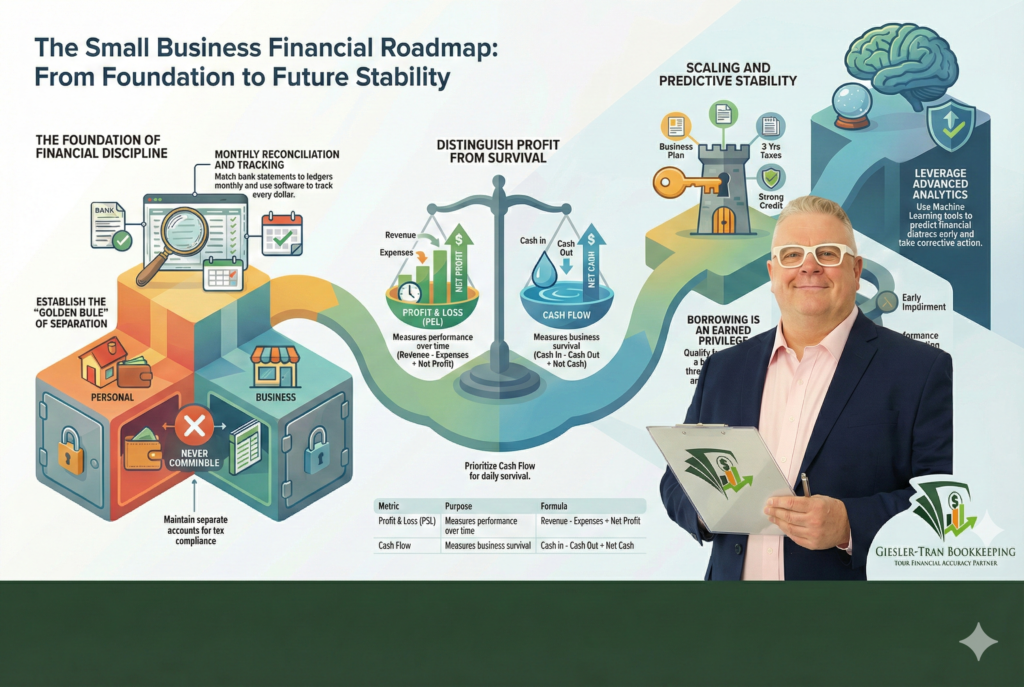

Small Business Financial Management: From Basic Books to Advanced Growth

Small Business Financial Management is the absolute bedrock of stability in an increasingly volatile global economy. Specifically, business owners today face tightening capital requirements and fluctuating labor markets that make the margin for error slimmer than ever before. However, many entrepreneurs still treat their finances as an afterthought, focusing solely on product development while their […]

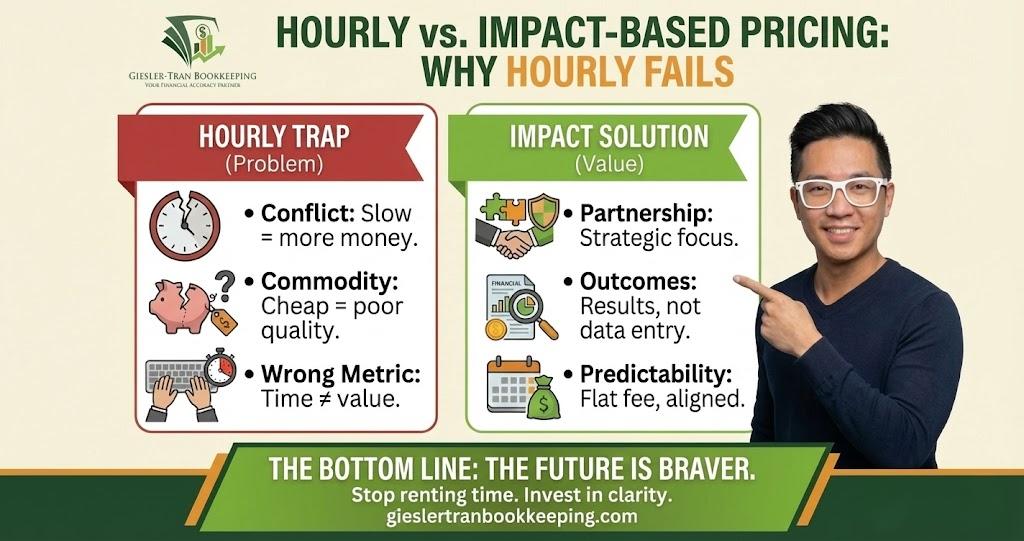

Bookkeeping Fees vs. Impact: Why Hourly Pricing Is Fails Your Business

Imagine if bookkeeping fees were charged based on impact—not on how long someone sat in a chair. Currently, most of the industry operates on an outdated model where value is measured by the tick of a clock. Specifically, business owners pay for how fast someone clicks, not for the clarity they bring to cash flow. […]

Conference Expense Deductions: Turn Your Business Travel Into Tax Savings

Maximizing conference expense deductions should be a priority for every growth-minded business owner this year. While many entrepreneurs view industry events solely as a cost, they are actually a powerful investment vehicle. Specifically, attending these events is one of the fastest ways to uncover real growth opportunities—not just from the keynote sessions, but from the […]

Beyond Tax Compliance: How Monthly Financial Statements Drive Growth

Historically, many small business owners treat their bookkeeping as a compliance chore—something to be endured once a year to keep the IRS happy. Consequently, they only see their Profit & Loss statement when their accountant hands it to them in March. By then, the data is 14 months old and useless for decision-making. However, high-growth […]