Clarity Begins With Education

- Home

- Tips & Resources (Blog Posts)

Practical bookkeeping and tax guidance for medical and service-based businesses that want clean books, smarter taxes, and audit-ready financials year-round.

This library shares practical bookkeeping guidance for business owners who want clean, audit-ready books, smarter tax positioning, and reliable reporting—written and reviewed by working bookkeeping professionals.

Editorial Standards (EEAT)

- Written by: Giesler‑Tran Bookkeeping (certified QuickBooks ProAdvisors)

- Reviewed for accuracy: Senior Tax Accountant oversight (when tax implications are discussed)

- How we update content: We review and refresh posts when tax rules, QuickBooks features, or best practices change

- What we don’t do: We don’t publish generic, mass-produced content or rely on AI to replace professional judgment

- Important note: This content is educational and not legal or tax advice for your specific situation

Want help applying this to your business? Schedule a free financial health evaluation. We’ll identify what’s off, which reports to pull, and the cleanup steps needed to get accurate, audit-ready books.

Who These Resources Are For

- Medical offices and clinics

- Service-based businesses

- Owners using QuickBooks Online who want clean reconciliations and reliable monthly reporting

- Businesses preparing for tax filing, financing, or an audit-ready cleanup

Audit-Ready Bookkeeping Help

Want these checklists applied to your business with clean reconciliations and CPA-friendly reporting? Learn more about our audit-ready bookkeeping service.

Clean Books. Clear Decisions. Bigger Profits.

GTB shares simple, no-fluff guides that turn messy records into clarity—Based in Vancouver–Portland. Serving clients nationwide remotely.

Got a bookkeeping or tax question? Tap the mail link below and request a topic—we’ll cover it and give you answers that actually help your business.

FEATURED INSIGHTS

Looking For a Particular Topic - SEARCH IT HERE!

Browse by Category:

Giesler-Tran Blog Library

Sources We Reference

When relevant, we reference primary sources such as IRS publications and official QuickBooks documentation, plus GAAP-based bookkeeping best practices. Links are included within articles when a source materially impacts the guidance.

Small Business Bookkeeping Support: The 7-Day “Sunday Scaries” Cure

Historical Bookkeeping Cleanup Services | Giesler-Tran Bookkeeping

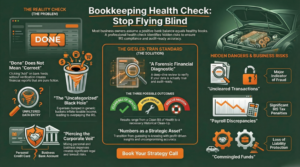

Is Your Business Bleeding Cash? The Critical Bookkeeping Health Check

Bookkeeping Pricing Calculator: See Your Exact Rate Instantly (No Email Required)

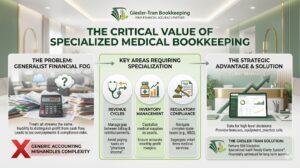

Why Your Clinic Needs Specialized Medical Practice Bookkeeping to Thrive

Scaling a Private Practice in WA: How ShillMed Balances Patient Care with Financial Health.

10 Deducciones Fiscales Ocultas Que Ahorran Miles a las Empresas de Servicios

Small Business Financial Management: From Basic Books to Advanced Growth

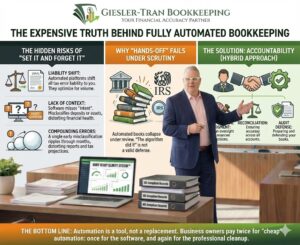

The Expensive Truth Behind Fully Automated Bookkeeping: Why “Set It and Forget It” Fails

Bookkeeping Fees vs. Impact: Why Hourly Pricing Is Fails Your Business

Conference Expense Deductions: Turn Your Business Travel Into Tax Savings

Reconciliation Services Camas: The First Line of Defense for Your Business

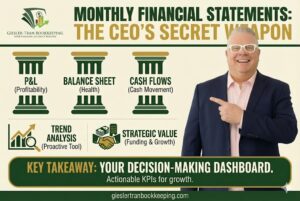

Beyond Tax Compliance: How Monthly Financial Statements Drive Growth

Hiring a Tax Professional: Filtering the Noise During Tax Season

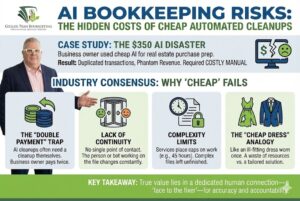

The Compounding Cost of AI Bookkeeping Errors: Why Autopilot Failures Lead to Expensive Cleanups

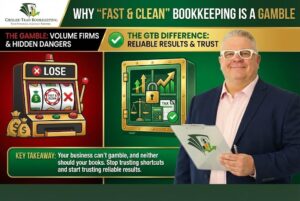

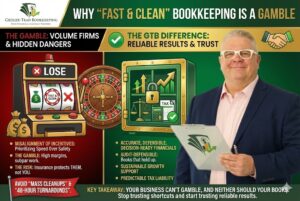

Why “Fast & Clean” Bookkeeping Services Are Gambling With Your Business

The Truth Problem: Why Your Business Needs a Bookkeeping Health Check Now

Chiropractic Pricing Strategy: Triangulation for Higher Profit and Acceptance

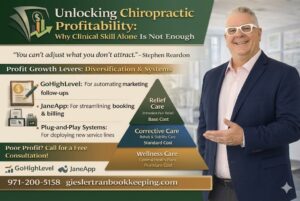

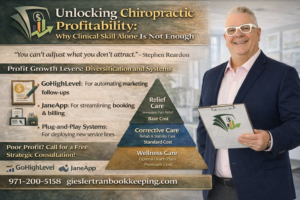

Unlocking Chiropractic Profitability: Why Clinical Skill Alone Is Not Enough

The Scale Factor: Why Specialized Bookkeeping Firms Outpace In-House Teams

Precision in Production: The Ultimate Guide to Manufacturing & Sales Bookkeeping for Profitability

Small Business Website Verification Guide: Protect Financial Data from Fraud

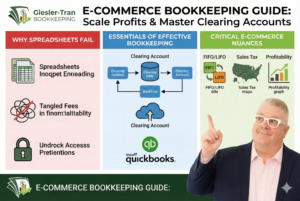

E-Commerce Bookkeeping Guide: Scale Profits & Master Clearing Accounts

The Defensible Audit Trail: Why Spreadsheets Fail & How QBO Protects You

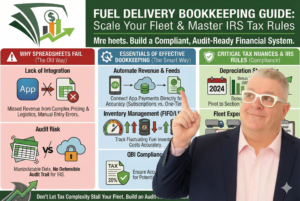

Fuel Delivery Bookkeeping Guide: Scale Your Fleet & Master IRS Tax Rules

QBO Setup for Realtors: Why Customization Beats Spreadsheets

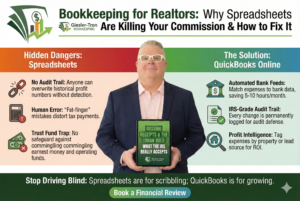

Bookkeeping for Realtors: Why Spreadsheets Are Killing Your Commission & How to Fix It

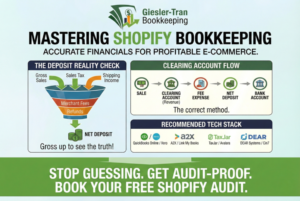

Shopify Bookkeeping Guide: How to Master E-Commerce Financials & Avoid Audits

Mineral Rights Bookkeeping: Mastering Royalty Payments and Division Orders

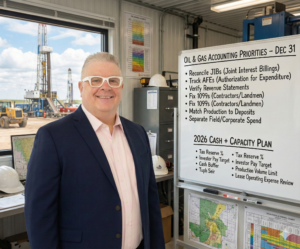

Oil & Gas Bookkeeping: Managing JIBs, AFEs, and Revenue with Precision

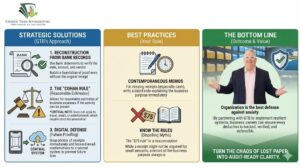

Missing Receipts & The Cohan Rule: What the IRS Really Accepts

Should I Pay $9.99–$19.99/day for Virtual Bookkeeping? | GTB Value Guide

Bookkeeping Services Near Me: Why the Best Local Solution is Virtual

Strategic Bookkeeping: Unlocking Growth and Stability for Entrepreneurs

“I’ll Clean This Up in January” Is the Most Expensive Sentence in Business: The Truth About Year-End Bookkeeping

Service Business Deductions: The Ultimate Guide to Stop Overpaying Taxes

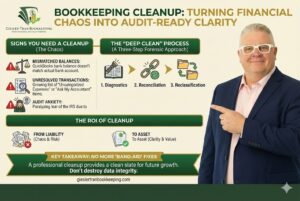

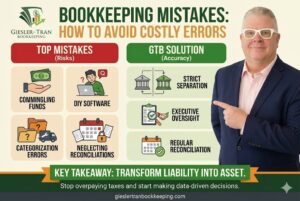

Bookkeeping Cleanup: Turning Financial Chaos Into Audit-Ready Clarity

Why 60% of Small Businesses Overpay Taxes: The Hidden Cost of DIY Bookkeeping

Bookkeeping Cleanup: How to Fix a Year of Messy Books in 30 Days

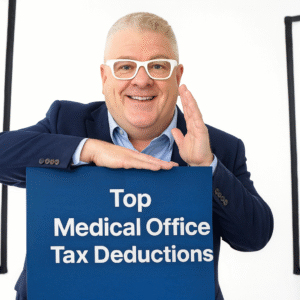

Medical Office Tax Deductions: 10 Commonly Missed Write-Offs

The Audit-Ready Chart of Accounts: Structure Your Books for Compliance

10 Hidden Tax Deductions That Save Service Businesses Thousands

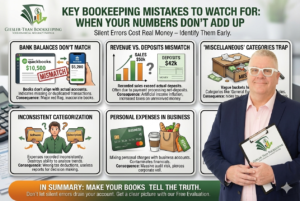

Key Bookkeeping Mistakes to Watch For: Are Your Books Lying to You?

Review of QuickBooks Online: A Game-Changer for Bookkeeping Professionals

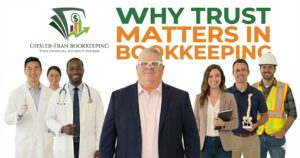

Bookkeeping Service Near Me: Why Local Trust Matters in a Digital World

Bookkeeping Service Cost: Average Prices, Inclusions & Best Value Guide

Good Bookkeeper Cost: Average Prices, Inclusions & Value Guide

Fixed Price Bookkeeping: Why Flat Rates Beat Hourly Billing Every Time

Cutting Corners on Your Books: Why Cheap Financial Fuel Crashes Businesses

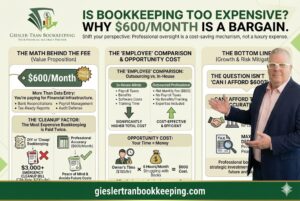

Is Professional Bookkeeping Too Expensive? Why $600/Month Is Actually a Bargain

Does Loyalty Matter When You Could Be Saving Thousands? | Giesler-Tran Bookkeeping

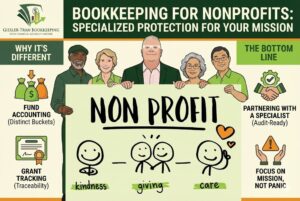

Bookkeeping for Nonprofits: Why Specialized Accounting Protects Your Mission

The Value of Executive Oversight: How Senior Tax Accountants Add Extra Assurance

Why Trust Matters in Bookkeeping: How We Build Lasting Client Relationships

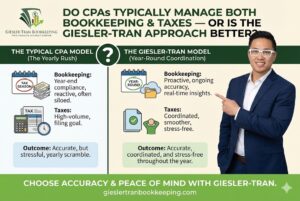

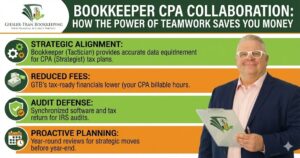

Bookkeeper–CPA Collaboration: How GTB Works With Your CPA (and Why Collaboration Matters)

Our Proven Process: How We Keep Your Business Audit-Ready Every Month

Security & Privacy in Bookkeeping: Our Commitment to Protecting Your Data

Real Client Success Stories: Turning Financial Chaos into Audit-Ready Clarity

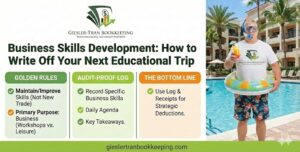

Business Skills Development: How to Write Off Your Next Educational Trip

Why Giesler-Tran Is the Strategic Financial Partner Your Business Needs

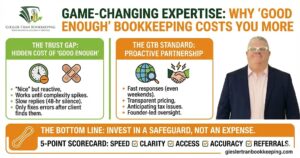

Game-Changing Expertise: Why “Good Enough” Bookkeeping Costs You More

Comprehensive Bookkeeping: The Unified Financial Strategy Your Business Needs

Reliable and Accurate Bookkeeping: The Foundation of Trust and Growth

Automated Bookkeeping Solutions: Blending Speed with Expert

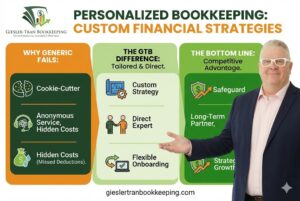

Personalized Bookkeeping: Custom Financial Strategies for Unique Businesses

Giesler-Tran’s Expertise: The Strategic Financial Advantage Your Business Needs

Bookkeeping Cleanup Cost Guide: Transparent Pricing for Financial Clarity

Missing Receipts? The Ultimate Guide to Audit-Proofing Your Business Expenses

Past Tax Filings: Will Bookkeeping Cleanup Force You to Amend Returns?

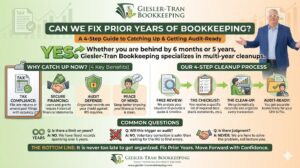

Can We Fix Prior Years of Bookkeeping? A Guide to Catching Up

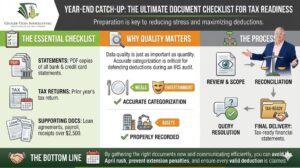

Year-End Catch-Up: The Ultimate Document Checklist for Tax Readiness

Bookkeeping Cleanup Timeline: How Long Does a Financial Reset Take?

Fast Bookkeeping Cleanup: The Emergency Plan for Tax Deadlines

Real Estate Bookkeeping: The Ultimate Guide to Commissions & Compliance

Nonprofit Internal Controls: The Essential Guide to Fraud Prevention

Nonprofit Cash Flow: 6 Steps to Stop the Panic and Start Planning

Restricted vs Unrestricted Funds: Nonprofit Accounting Guide

Nonprofit Bookkeeping Grant Tracking: The Fund Accounting Guide

Cash vs Accrual Accounting: Which Method Fits Your Business?

Bookkeeping Services Near Me: Local Expertise, Nationwide Reach

Chart of Accounts: The Strategic Blueprint for Business Profitability

Embezzlement Prevention: How to Detect and Stop Employee Theft

Documents for Your Bookkeeper: The Ultimate Checklist for a Smooth Handoff

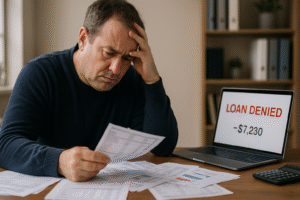

Bank Loan Denial: How Disorganized Books Kill Funding (and How to Fix it)

The Hidden Cost of “Good Enough Books”: Why Accurate Financials Matter

Your CPA Looks Backward — We Look Forward: How Blind Loyalty Could Be Costing You Thousands.

Stipend vs. Reimbursement: The Tax Truth Every Business Needs

Bookkeeping for Content Creators: Track Income, Fees & Taxes

Sales Tax Guide: Nexus, Compliance & Audit Protection for Sellers

Will AI Replace Bookkeeping? Why Business Owners Still Need Human Expertise

How to Choose the Right Bookkeeping Software for Your Business

Virtual Bookkeeping: Secure, Remote Financial Clarity for Small Businesses

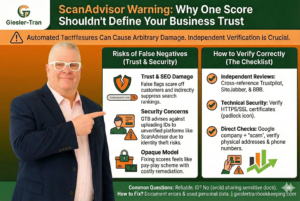

Why you should treat ScamAdvisor with extreme caution — and how to verify a site the right way

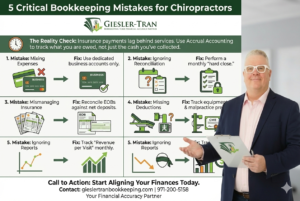

5 Critical Bookkeeping for Chiropractors Mistakes & How to Fix Them

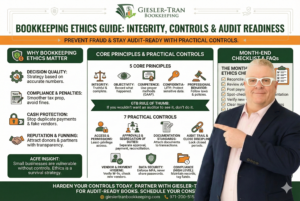

Bookkeeping Ethics Guide: Integrity, Controls & Audit Readiness

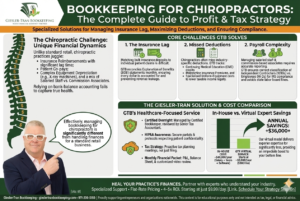

Bookkeeping for Chiropractors: The Complete Guide to Profit & Tax Strategy

The Ultimate Business Tax Season Checklist: Organize, Reconcile, and File with Confidence

Bank Reconciliation: The Hidden Control That Stops Fraud and Saves Your Cash Flow

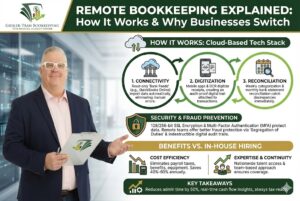

Remote Bookkeeping Explained: How It Works & Why Businesses Switch

Bookkeeping Services in Vancouver, WA: The Local Advantage for Growing Brands

Portland Bookkeeping Services: The Strategic Advantage for Local Business Growth

Do Bookkeepers Reconcile Bank Accounts? The Ultimate Guide to Cash Accuracy

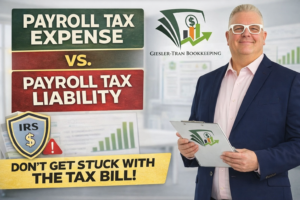

Mastering Payroll Taxes and Filings: A Strategic Guide for Business Owners

Virtual Bookkeeping Services: The Strategic Switch for Modern Business Growth

Merchant Reconciliation Guide: How to Unscramble Stripe, Square & PayPal Payouts

Bookkeeping vs Accounting: Why Your Business Needs Both for Financial Health

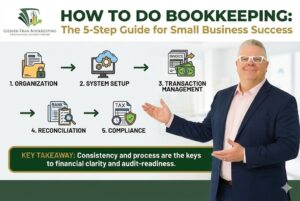

How to Do Bookkeeping: The 5-Step Guide for Small Business Success

How Bookkeeping Works: Unlocking Financial Clarity for Your Business

AI Bookkeeping Dangers: The $350 Shortcut That Cost a Business Thousands

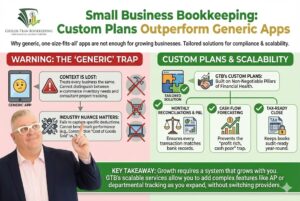

Small Business Bookkeeping Services: Why Custom Plans Outperform Generic Apps

The Hidden Cost of “Cheap”: A No-Nonsense Guide to Choosing a Bookkeeper Who Protects Your Profits

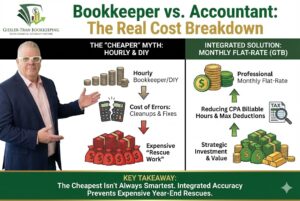

Is a Bookkeeper Cheaper? The Truth About Bookkeeper vs Accountant Cost

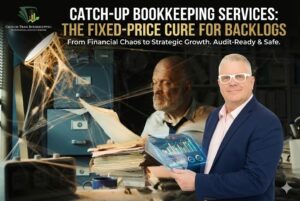

Catch-up Bookkeeping Services: The Fixed-Price Cure for Backlogs

Affordable Bookkeeping Services: High-Quality Support on a Budget

The Ultimate Monthly Bookkeeping Checklist: Transforming Chaos into Clarity

Bookkeeping for Small Business: The 5-Step GTB System for Audit-Ready Books

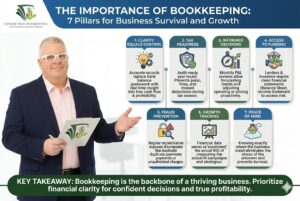

The Importance of Bookkeeping: 7 Pillars for Business Survival and Growth

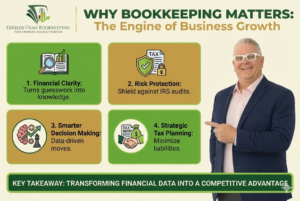

Why Bookkeeping Matters: The Hidden Power Behind Business Success

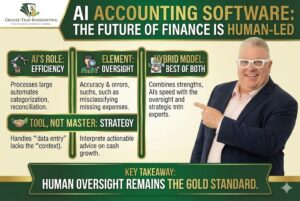

AI Bookkeeping and the Future of Accounting | Will Artificial Intelligence Replace Bookkeepers?

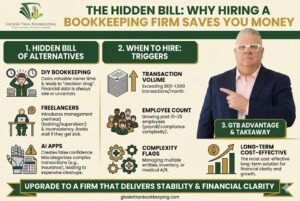

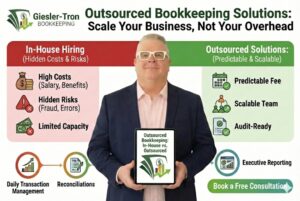

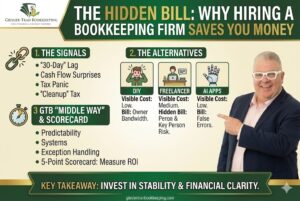

The Hidden Bill: Why Hiring a Bookkeeping Firm Saves You Money

FAQ: Using These Bookkeeping Resources

Q: Are these articles written by real bookkeepers?

A: Yes. Our content is written by working bookkeeping professionals and reviewed for accuracy, especially when tax implications are discussed.