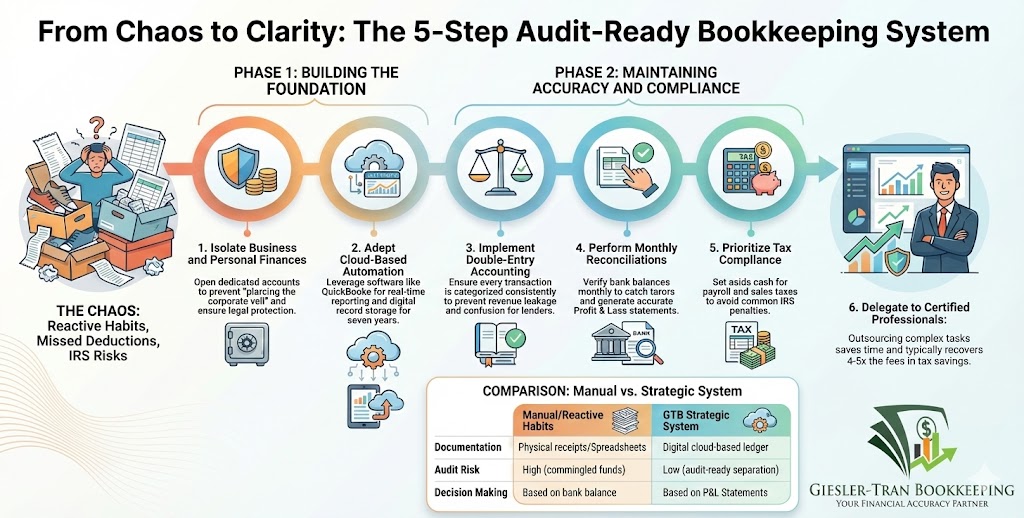

Bookkeeping for small business success starts with a single, non-negotiable goal: keep every transaction organized, accurate, and easy to verify. However, many entrepreneurs view this essential task as a distraction from their “real work,” leading to shoeboxes full of receipts and panic at tax time. Consequently, this lack of organization doesn’t just cause stress; it costs thousands in missed deductions and CPA cleanup fees. At Giesler-Tran Bookkeeping (GTB), we have refined this chaotic process into a clear 5-step system that delivers accuracy, insight, and peace of mind for business owners across all 50 states. Below, we outline exactly how to build an audit-ready financial foundation that saves you time and money.

Effectively, your books are the story of your business told in numbers. If that story is messy, lenders won’t fund you, the IRS may audit you, and you won’t know if you are truly profitable. Therefore, mastering bookkeeping for small business is not just an administrative chore; it is a strategic imperative for survival and growth.

How to Do Bookkeeping for Your Small Business — The GTB Way

Organization turns chaos into clarity.

The Reality Check: Fundamentally, you cannot manage what you do not measure. If you are running your company based on your bank balance rather than a Profit & Loss statement, you are flying blind. True bookkeeping for small business requires a systematic approach that separates your personal life from your professional entity.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Shoebox Bookkeeping Is a Ticking Time Bomb’

Step 1: Gather and Organize Your Financial Documents

Before you can manage your books, you need the right raw materials. Specifically, you must collect everything — invoices, receipts, bank statements, credit card reports, and payroll records. Crucially, you must separate business and personal finances immediately. To do this, open a dedicated business checking account and strictly use a business credit card for operations.

Unfortunately, mixing personal and business spending is a recipe for chaos and potential legal trouble known as “piercing the corporate veil.” Furthermore, keep your records organized by storing digital copies of every document for at least seven years. This habit is not just smart bookkeeping for small business — it is your ultimate audit safety net.

Step 2: Set Up Your Bookkeeping System

Next, your bookkeeping system serves as the backbone of your financial management. Ideally, you should choose a platform that fits your business size, budget, and growth goals. We strongly recommend using cloud-based accounting software like QuickBooks Online or Xero for automation, real-time reporting, and easy collaboration with your CPA.

Additionally, you must create your Chart of Accounts to organize income, expenses, assets, liabilities, and equity logically. At this stage, you must also decide between cash-basis (recording transactions when money changes hands) or accrual-basis (recording when earned/incurred). Generally, accrual gives a more accurate picture of profitability, while cash is simpler for very small entities.

Step 3: Record and Manage Every Transaction

Fundamentally, bookkeeping isn’t just record-keeping — it is accuracy in action. Specifically, proper bookkeeping for small business relies on double-entry accounting, which means every transaction affects two accounts — one debit and one credit — keeping your books perfectly balanced.

Moreover, you must categorize everything consistently, including income, expenses, payroll, taxes, and owner’s draws. Inconsistencies here lead to messy reports that confuse lenders. Also, track accounts payable and receivable diligently to manage cash flow effectively.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify our strategy.

Step 4: Reconcile and Review Regularly

Crucially, your books are only as accurate as your last reconciliation. Therefore, you must reconcile bank accounts and credit cards monthly to catch missing or duplicate transactions. Without this step, you are simply guessing at your bank balance. Once reconciled, you can generate key reports like the Profit & Loss, Balance Sheet, and Cash Flow Statement with confidence.

Furthermore, review your reports every month to identify trends, track growth, and prepare early for tax season. Consistency builds confidence, allowing you to make pivot decisions quickly. If you find errors during this process, it is much easier to fix them in the current month than to dig through a year’s worth of data later.

Step 5: Stay Tax-Compliant (and Know When to Get Help)

Finally, accurate bookkeeping makes tax season painless instead of panic-inducing. You must keep detailed records for sales tax, payroll tax, quarterly estimated payments, and income tax. Failing to set aside cash for these liabilities is the number one reason small businesses face IRS penalties.

At GTB, we provide full-service bookkeeping and tax preparation — seamlessly integrated so you never deal with missing data, communication gaps, or costly delays. If you are currently behind on your taxes, our cleanup services can get you compliant quickly.

Why This Matters: The GTB Advantage

Ultimately, bookkeeping isn’t just about staying organized — it’s about unlocking financial power. When your books are clean, you make better decisions, reduce tax liabilities, and build a stronger business foundation. For as little as $9.99/day, you can have certified professionals — including a Senior Tax Accountant — handle your books, tax readiness, and reporting.

Consider the alternative: spending your evenings fighting with spreadsheets or worrying about an audit. Most clients find that our services save them 4–5x their fees every year in tax savings and recovered time. That is the GTB Advantage.

Common Questions About Bookkeeping for Small Business

Q: Can I just use Excel for my bookkeeping?

A: While you can, it is risky. Spreadsheets do not have audit trails, bank feeds, or reconciliation tools. Using software like QuickBooks is safer and more efficient.

Q: How often should I send invoices?

A: Immediately. Sending invoices as soon as work is complete improves cash flow. Waiting until the end of the month often leads to payment delays.

Q: What is the difference between a bookkeeper and an accountant?

A: Generally, a bookkeeper records daily transactions and reconciles accounts. An accountant analyzes that data for tax planning and filing. GTB handles both seamlessly.

Q: Do I need to keep physical receipts?

A: No. The IRS accepts digital copies as long as they are legible. Scanning them into your accounting software is the best practice.

Q: What if I have never done bookkeeping before?

A: Start now. We can help set up your system correctly from day one, or clean up historical data if you have been operating without a system.

Key Takeaways for Business Owners

- Separate Finances: Always keep business and personal funds distinct to protect your liability.

- Reconcile Monthly: Make this a non-negotiable habit to ensure accuracy.

- Use Software: Leverage automation to save time and reduce human error.

- Delegate Early: Invest in professional help to focus on growing your business, not just counting it.

In Summary: Organization is Profit

Ultimately, proper bookkeeping is the difference between a hobby and a thriving business. By following the GTB 5-step system, you ensure that your financial foundation is solid, your taxes are compliant, and your mind is at ease. Don’t let another month go by with messy books.

The Bottom Line

Ready to Get Your Books Audit-Ready?

Discover how easy professional bookkeeping can be.

Giesler-Tran Bookkeeping

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.