Running a nonprofit organization requires a delicate balance between passion and prudence. While your heart drives the mission, your financial data must drive the strategy. Specifically, bookkeeping for nonprofits is not merely about balancing a checkbook; it is about stewardship, transparency, and regulatory survival. Unlike for-profit businesses that focus solely on the bottom line, nonprofits must track where money comes from, what restrictions are attached to it, and exactly how it is used to further the cause. Therefore, Giesler-Tran Bookkeeping (GTB) provides the specialized expertise required to navigate these unique challenges, ensuring that your organization remains audit-ready and grant-eligible at all times.

Bookkeeping for Nonprofits: Specialized Knowledge That Sets Us Apart

Mission-driven organizations need more than standard accounting.

The Reality Check: Fundamentally, a generalist bookkeeper can accidentally jeopardize a nonprofit’s tax-exempt status. If they do not understand the difference between restricted and unrestricted net assets, they might erroneously report that you have cash available for operations when, in reality, those funds are legally tied to a specific project. Effective bookkeeping for nonprofits prevents these critical errors, protecting your reputation with donors and the IRS.

Listen on The Deep Dive — where we explore the sector:

‘Nonprofit Cash Flow Crisis Solved_ How to Build a 6-Month Rolling Forecast and Negotiate Grant Advances’

Why Bookkeeping for Nonprofits Requires a Different Mindset

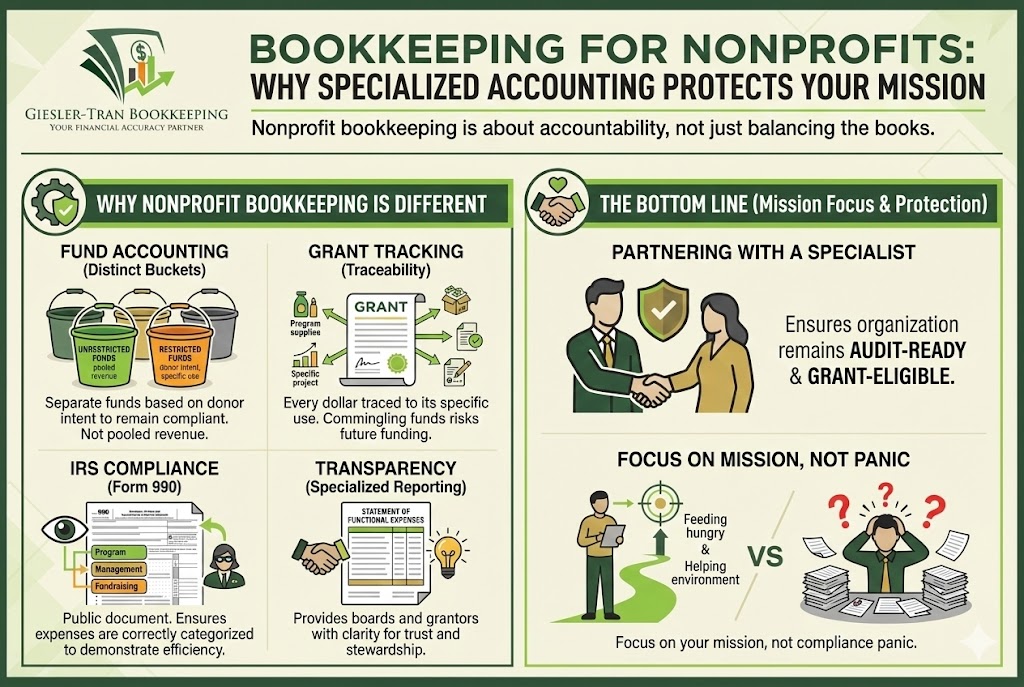

First, we must distinguish standard commercial accounting from the specialized needs of the charitable sector. In a standard business, the primary goal is profit generation. Conversely, in the nonprofit world, the goal is impact. This fundamental difference necessitates a unique accounting framework known as “Fund Accounting.” Unlike commercial entities that throw all revenue into one pot, effective bookkeeping for nonprofits requires separating funds into distinct “buckets” based on donor intent.

Furthermore, tracking these buckets accurately is non-negotiable. If a donor gives $10,000 specifically for a youth scholarship program, you cannot use that money to pay the electric bill, even if the bank account balance looks healthy. Consequently, we design your Chart of Accounts to track restrictions meticulously. For more on why specialized setup matters, read about how bookkeeping isn’t a commodity.

Fund Accounting: The Backbone of Your Organization

Crucially, Fund Accounting is what allows you to sleep at night. Without it, you are essentially guessing at your financial health. At Giesler-Tran Bookkeeping, we implement systems that track grants, donations, and restricted funds in strict accordance with nonprofit standards (GAAP). Specifically, we focus on three core areas:

- Restricted vs. Unrestricted: We clearly delineate funds that are available for general operations versus those tied to specific programs.

- Grant Tracking: Every dollar is traced back to its source, ensuring you can report back to foundations with precision.

- Program Allocation: We help you allocate overhead costs correctly, so you know the true cost of delivering your services.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the industry standard.

IRS Compliance and Form 990 Readiness

Moreover, the IRS watches nonprofits closely. Your annual Form 990 is not just a tax return; it is a public relations document. Potential donors, grantors, and watchdogs like GuideStar review it to assess your efficiency. Therefore, accurate bookkeeping for nonprofits is essential for presenting a healthy financial face to the world.

Additionally, we ensure you stay on top of critical compliance tasks. From tracking donor acknowledgments (required for gifts over $250) to maintaining charitable solicitation registrations, we handle the details. By keeping your books audit-ready year-round, we eliminate the panic that typically sets in during tax season.

Transparency for Boards and Grantors

Often, nonprofit board members are volunteers who may not have financial backgrounds. Consequently, presenting them with a standard “Profit and Loss” statement can be confusing or misleading. Instead, we provide custom financial dashboards that highlight key performance indicators (KPIs) relevant to your mission. This ensures your leadership team can make informed decisions without getting bogged down in accounting jargon.

Similarly, grantors demand transparency. They want to see exactly how their funds were utilized. With our specialized bookkeeping for nonprofits, you can generate “Statement of Functional Expenses” reports at the click of a button. This level of clarity improves your ability to win future grants and demonstrates excellent stewardship. For further reading on maintaining standards, the National Council of Nonprofits offers excellent resources on financial management.

Tailored Solutions for Your Mission

Finally, no two nonprofits are alike. A food bank has different inventory needs than a performing arts organization. Therefore, we offer custom onboarding to set up your chart of accounts and workflows for maximum transparency. Whether you need to track in-kind donations of goods or manage complex payroll allocations across multiple grants, we build the infrastructure that supports your specific model.

Ultimately, your mission is too important to be derailed by bad data. By partnering with GTB, you gain a strategic ally who understands the nonprofit landscape. We ensure that your financial story is told accurately, protecting your legacy and fueling your future impact. If you are wondering about costs, check out our guide on what to expect to pay for quality service.

Q&A: Nonprofit Bookkeeping Essentials

Q: Why can’t I just use standard business bookkeeping?

A: Standard bookkeeping focuses on profit, while bookkeeping for nonprofits focuses on accountability. Without fund accounting, you risk mixing restricted and unrestricted funds, which can lead to legal trouble.

Q: Do I really need to track every grant separately?

A: Yes. Most grant agreements require detailed reporting on how every penny was spent. Commingling funds makes this reporting nearly impossible and jeopardizes future funding.

Q: What is a Statement of Functional Expenses?

A: It is a report that breaks down your costs into three categories: Program, Management, and Fundraising. Donors look at this to ensure the majority of their money goes to the mission, not administration.

Q: How does GTB help with the Form 990?

A: We maintain your books in a way that aligns perfectly with the Form 990 categories. This allows your CPA to prepare the return quickly and accurately, saving you money on tax prep fees.

Q: Can you handle in-kind donations?

A: Absolutely. Non-cash gifts (like goods or services) must be recorded at fair market value. We ensure these are tracked correctly to reflect the true size of your organization’s support.

Key Takeaways

- Implement Fund Accounting: You must track grants, donations, and restricted funds separately to ensure compliance.

- Protect Your Status: Proper bookkeeping prevents the errors that lead to IRS penalties or loss of tax exemption.

- Empower the Board: Clear, customized dashboards help volunteer leaders make better strategic decisions.

- Win More Grants: Accurate reporting demonstrates stewardship, making you a more attractive candidate for funding.

In Summary: Protect Your Mission

Ultimately, specialized knowledge is the best insurance policy for your organization. Bookkeeping for nonprofits is complex, but with the right partner, it becomes a powerful tool for growth. At Giesler-Tran Bookkeeping, we are dedicated to supporting those who do good. Ready for bookkeeping that understands the nonprofit world? Book your free consultation today and see the difference specialized expertise makes for your mission.

Your Mission Deserves Expert Oversight

Don’t let compliance worries distract you from your cause.

Partner with a nonprofit specialist today.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.