Effectively, mastering bookkeeping for content creators is the secret to turning a creative passion into a sustainable business. However, tracking multiple income streams—like ads, sponsorships, and affiliate commissions—can quickly become overwhelming. Specifically, ignoring platform fees or failing to set aside taxes can lead to a financial nightmare. Below, we outline a simple system for bookkeeping for content creators that organizes your finances and protects your profits.

Bookkeeping for Content Creators: Track Income, Fees & Taxes

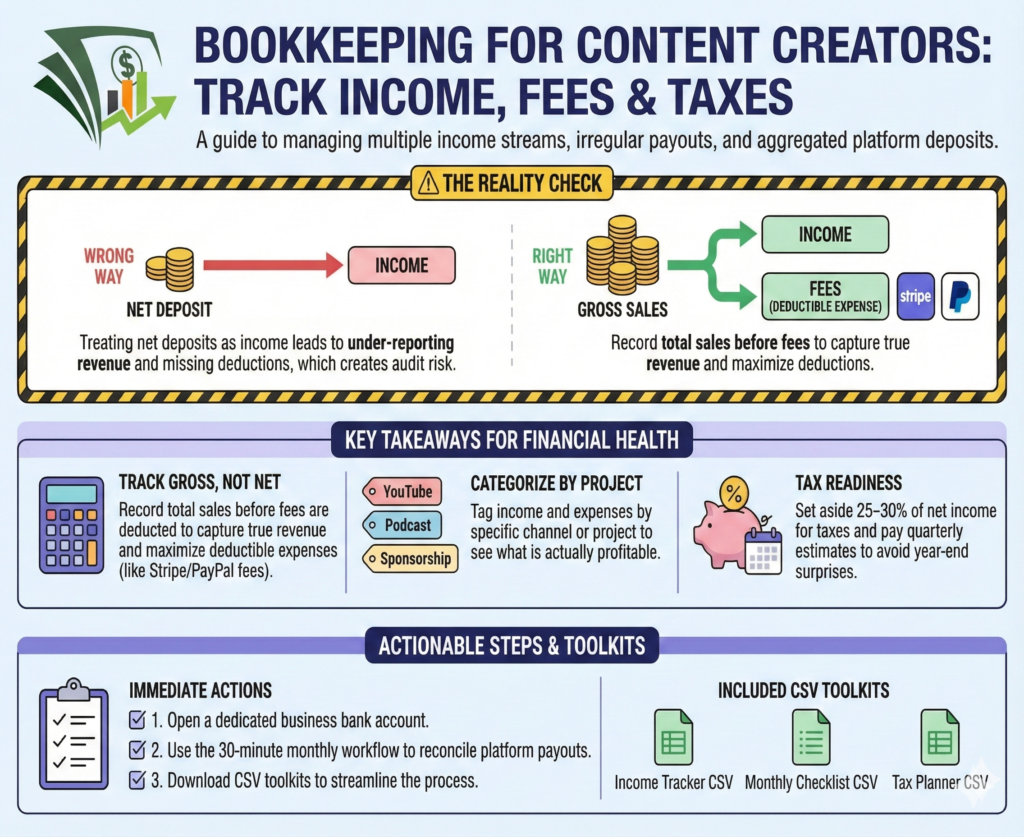

The Reality Check: Fundamentally, creators juggle fast-moving projects and irregular payouts. If you treat Stripe deposits as “income” without recording the gross sales and fees, you are under-reporting your revenue and missing deductions. Therefore, precise bookkeeping for content creators is essential for accurate tax filing and confident spending.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Stop Paying Tax on Money You Never Got: Creator Bookkeeping Hacks’

Why Bookkeeping for Content Creators Matters

First, creators often face irregular income that aggregates many small transactions into single deposits. Specifically, without tidy bookkeeping for content creators, you risk overpaying taxes or missing deductible expenses like software and equipment. Moreover, good bookkeeping allows you to plan upgrades and manage cash flow predictability. Ultimately, it lets you focus on creating rather than calculating.

For official guidance, review the IRS Gig Economy Tax Center.

Core Concepts in Bookkeeping for Content Creators

Next, you must track specific data points to stay compliant. Ideally, your system should capture the following:

- Income streams: Tag sponsorships, ads, affiliate sales, and tips separately.

- Platform fees: Record PayPal, Stripe, and YouTube fees as expenses, not just net income.

- Project expenses: Tag costs by project (e.g., “Summer Vlog” vs “Tech Review”).

- Mixed-use assets: Track the business percentage of home office, internet, and devices.

- Estimated taxes: Set aside 25–30% of net income to avoid year-end surprises.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a CPA for influencers. Explain the importance of bookkeeping for content creators, particularly in distinguishing gross versus net income, and why platform fees must be recorded as an expense rather than simply recording the net deposit. Then describe how Giesler-Tran Bookkeeping helps creators maintain accurate, reconciled books, track all revenue and expenses properly, and ensure tax-ready financials that maximize deductions and minimize audit risk.

Monthly Bookkeeping for Content Creators Workflow

Furthermore, a consistent routine saves time. Specifically, follow this 30-minute workflow:

- Import transactions: Sync your business bank and credit card feeds.

- Record gross income: Log total sales before fees are deducted.

- Tag expenses: Assign every cost to a project or channel.

- Reconcile deposits: Match platform payouts to your gross sales records.

- Review contractors: Ensure you have W-9s for freelancers paid over $600.

- Update tax reserve: Transfer your tax percentage to a savings account.

Also, consider using MileIQ to automatically track travel deductions.

Moreover, if your accounts are currently messy, our cleanup services can reset your books. Then, we can maintain them with our monthly bookkeeping support.

Creator Toolkits (Downloadable CSVs)

To assist you, we have created ready-to-use templates. Simply download these CSVs and open them in Excel or Google Sheets.

1. Income & Expense Tracker

⬇ Download the CSV — Content Creator Income Tracker

2. Monthly Bookkeeping Checklist

⬇ Download the CSV — Monthly Checklist

3. Quarterly Tax Planner

⬇ Download the CSV — Estimated Tax Planner

Common Questions on Bookkeeping for Content Creators

- Q: Do I need to track gross or net income?

- A: Track gross income. Then, record fees separately. This gives you a clear picture of true revenue and deductible expenses.

- Q: Do I really need a business bank account?

- A: Yes. It simplifies bookkeeping, separates personal expenses, and significantly reduces audit risk.

- Q: How long should I keep receipts?

- A: Generally, keep them for 3–7 years. Digital copies organized by year and project are best.

- Q: When should I start paying estimated taxes?

- A: If you expect to owe $1,000 or more when you file your return, you should pay quarterly estimated taxes.

- Q: Can I deduct my home studio?

- A: If you use a portion of your home exclusively and regularly for business, you may be able to take the home office deduction.

Create More, Worry Less

Don’t let financial stress kill your creative flow. With the right system, you can track your success as easily as you create content.

Is your bookkeeping creator-friendly?

We specialize in the creator economy. Book a complimentary Creator Finance Review today. We’ll audit one month of your payouts and show you how to simplify your tracking.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.