How to Reconcile Chiropractic Insurance Reimbursements Like a Pro

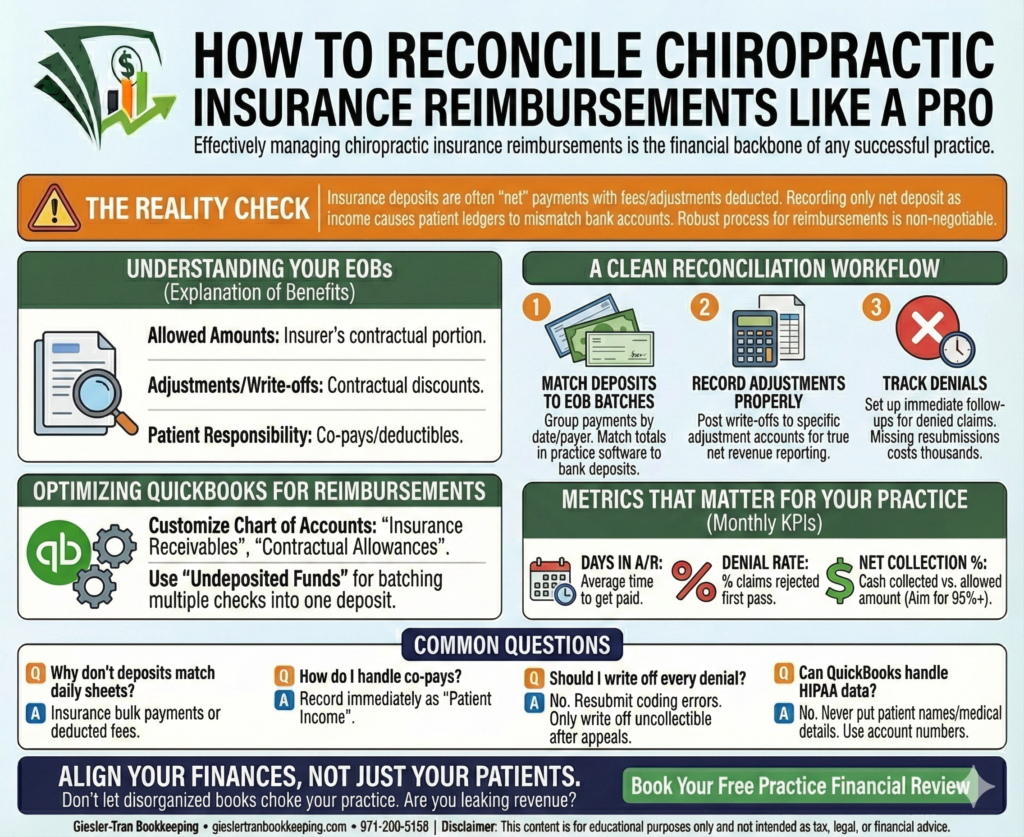

The Reality Check: Fundamentally, insurance deposits are often “net” payments—meaning fees and adjustments are already deducted. If you record only the net deposit as income without tracking the write-offs, your patient ledgers will never match your bank account. Therefore, a robust process for chiropractic insurance reimbursements is non-negotiable.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Stop Losing Thousands: The Chiropractic Cash Flow Secret to Mastering EOBs’

Understanding Your EOBs for Better Reimbursements

First, before you can reconcile chiropractic insurance reimbursements, you must understand the data within your EOBs. Essentially, each statement details what was billed versus what was paid. However, most practices overlook critical fine print.

Specifically, break down these key elements:

- Allowed Amounts: The portion the insurer contractually agrees to pay.

- Adjustments/Write-offs: The discount you must apply based on your provider agreement.

- Patient Responsibility: Co-pays and deductibles you must collect directly.

For official coding guidelines, refer to the CMS Chiropractic Services Guide.

A Clean Reconciliation Workflow for Chiropractic Insurance Reimbursements

Next, creating a repeatable process ensures consistency. Ideally, follow these three steps monthly:

Step 1: Match Deposits to EOB Batches

Crucially, group your payments by date and payer. Then, match these totals in your practice management software to your bank deposits.

Step 2: Record Adjustments Properly

Furthermore, never bury write-offs in a miscellaneous category. Instead, post them to specific adjustment accounts so your reports reflect true net revenue.

Step 3: Track Denials

Finally, set up immediate follow-ups for denied claims. Otherwise, missing a single resubmission cycle can cost thousands annually.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Optimizing QuickBooks for Chiropractic Insurance Reimbursements

Moreover, software configuration is key. Specifically, customize your Chart of Accounts to include distinct line items for “Insurance Receivables” and “Contractual Allowances.” Additionally, utilizing the “Undeposited Funds” feature allows you to batch multiple checks into one deposit, mirroring your actual bank statement.

Also, see QuickBooks Reconciliation Tips for technical steps.

Metrics That Matter for Your Practice

To ensure growth, track these KPIs monthly. Ultimately, data drives decisions regarding your chiropractic insurance reimbursements:

- Days in A/R: The average time it takes to get paid.

- Denial Rate: The percentage of claims rejected on the first pass.

- Net Collection %: Cash collected vs. allowed amount (aim for 95%+).

If your metrics are lagging, our cleanup services can identify the bottlenecks. Then, we can implement our monthly oversight to keep collections high.

Common Questions on Chiropractic Reimbursements

- Q: Why don’t my bank deposits match my daily sheets?

- A: This is usually due to insurance bulk payments including multiple patients, or credit card processing fees being deducted before deposit.

- Q: How do I handle patient co-pays?

- A: Record co-pays immediately at the time of service as “Patient Income.” Do not wait for the insurance EOB to record this cash.

- Q: Should I write off every denial?

- A: Absolutely not. Most denials are due to simple coding errors. Resubmit them. Only write off uncollectible amounts after exhausting appeals.

- Q: Can QuickBooks handle HIPAA data?

- A: No. Never put patient names or medical details in QuickBooks. Use account numbers or generic “Daily Patient Sales” entries to maintain compliance.

Align Your Finances, Not Just Your Patients

Don’t let disorganized books choke your practice. Accurate reconciliation protects your profits and ensures you get paid for every adjustment.

Is your practice leaking revenue?

We specialize in healthcare bookkeeping. Book a complimentary Practice Financial Review today. We’ll audit your reimbursement workflow and find your missing cash.

Book Your Free Financial Review

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.