Imagine if bookkeeping fees were charged based on impact—not on how long someone sat in a chair. Currently, most of the industry operates on an outdated model where value is measured by the tick of a clock. Specifically, business owners pay for how fast someone clicks, not for the clarity they bring to cash flow. However, at Giesler-Tran Bookkeeping (GTB), we believe this approach is fundamentally broken. True value isn’t about how many tabs are open in QuickBooks; it’s about the stress removed from an owner’s shoulders and the confidence enabled in hiring, pricing, and tax planning. Therefore, this post challenges the traditional structure of bookkeeping fees and argues for a future built on partnership, not timesheets.

Why Standard Bookkeeping Fees Are Broken (And Why Impact Matters More)

Stop Paying for Hours. Start Paying for Answers.

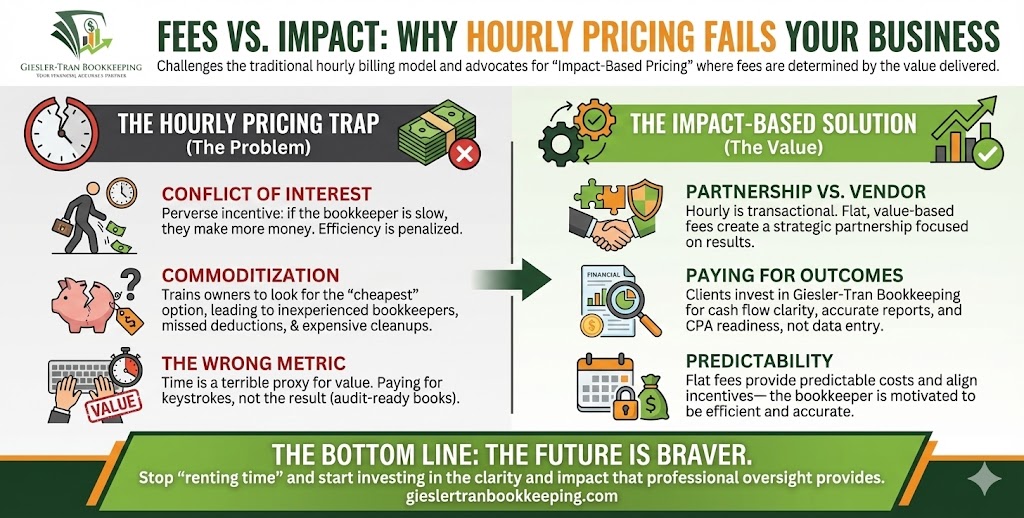

The Reality Check: Fundamentally, hourly bookkeeping fees create a conflict of interest. If your bookkeeper is efficient, they make less money. If they are slow or disorganized, they make more. This perverse incentive punishes experience and rewards inefficiency. Ultimately, you should pay for the result—clean, audit-ready books—not the time it took to get there.

Listen on The Deep Dive — where we explore the industry shift:

‘The Hourly Pricing Trap: Hourly Bookkeeping Traps Reward Slowness’

The Hourly Pricing Trap in Bookkeeping Fees

First, let’s address why hourly pricing sounds fair on the surface. It feels objective and measurable. However, in practice, it is a trap. Here is the uncomfortable truth: Speed comes with experience. Expertise comes from years of learning—and usually from cleaning up other people’s mistakes.

Consequently, when bookkeeping fees are tied to hours, clients are trained to compare professionals like commodities. They look for “Cheaper” or “Faster.” This mindset actively undermines what great bookkeeping actually provides: stability, strategy, and peace of mind.

What Clients Really Pay For (It’s Not Data Entry)

Crucially, business owners don’t hire Giesler-Tran Bookkeeping just to get transactions entered. They hire us for specific outcomes. Specifically, they pay so their cash flow finally makes sense. They pay so their financials stop lying to them. And most importantly, they pay so their CPA stops guessing at year-end.

Furthermore, they invest in our services so their books hold up under scrutiny from banks, buyers, and the IRS. That outcome isn’t accidental; it’s the result of judgment, structure, and reconciliation discipline. None of that shows up on a timesheet, yet it is the primary driver of value behind professional bookkeeping fees.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the industry trend.

Impact-Based Thinking Changes the Relationship

Moreover, how you pay determines who you work with. Hourly pricing creates a vendor relationship. Impact-based thinking creates a partnership. When the conversation shifts from “How long did this take?” to “What did this fix?”, the entire dynamic changes.

Specifically, the focus moves from Cost to Value. It moves from Comparison to Trust. And finally, it moves from Compliance to Strategy. This isn’t about simply slapping a higher price on the same work; it is about recognizing that the ability to diagnose problems and prevent downstream damage is worth far more than mere keystrokes.

For Bookkeepers Reading This: Stop Selling Time

Additionally, if you are a bookkeeper measuring your worth in hours, stop. Time is a terrible proxy for value. Instead, start measuring yourself by the messes you prevent. Measure yourself by the clarity you create for your clients.

Ultimately, the future of bookkeeping fees isn’t cheaper. It isn’t faster. And it is definitely not automated into irrelevance. The future belongs to professionals willing to price—and operate—based on the impact they deliver to the client’s bottom line.

Why “Cheap” Bookkeeping Is Expensive

Often, business owners choose the lowest hourly rate they can find, thinking they are saving money. However, this “cheap” option usually has hidden costs. Missed tax deductions, duplicated expenses, and costly cleanups later often dwarf the monthly savings.

In reality, paying a professional a flat, value-based fee ensures that the work is done correctly the first time. You are paying for the assurance that you won’t have to pay someone else to fix it later. That is the true definition of value.

Q&A: Understanding Pricing Models

Q: What is the average hourly rate for a bookkeeper?

A: Typically, rates range from $40 to $100+ per hour depending on expertise. However, focusing on the rate ignores the efficiency of the worker.

Q: Why does GTB use flat monthly fees?

A: Because it aligns our incentives with yours. We want to be efficient and accurate, and you want predictable costs without surprise bills.

Q: Doesn’t hourly billing save me money if there is less work?

A: Rarely. Bookkeeping requires constant monitoring. Even in “quiet” months, we are reconciling accounts and checking for automated errors.

Q: What if I have a complex cleanup project?

A: We price cleanups based on the volume and complexity of the mess, not the hours. This gives you a guaranteed price to get audit-ready.

Q: Do I pay extra for software?

A: Usually, our packages include the necessary tech stack to keep your books efficient. This consolidates your costs into one simple investment.

Key Takeaways

- Value Over Hours: Stop paying for time and start paying for clarity, accuracy, and peace of mind.

- Align Incentives: Flat fees ensure your bookkeeper is motivated to be efficient, not to drag out the work.

- Avoid “Cheap”: Low hourly rates often lead to expensive mistakes and missed deductions later.

- Partnership Model: Impact-based pricing fosters a strategic relationship rather than a transactional one.

In Summary: The Future is Braver

Finally, the future of bookkeeping is braver. It is led by professionals willing to price—and operate—based on impact. At Giesler-Tran Bookkeeping, we don’t sell hours; we sell the result. If you are ready to stop watching the clock and start watching your business grow, it is time to switch to a model that values results. Your business deserves a partner, not a timesheet.

Stop Renting Time. Invest in Clarity.

Get a transparent, impact-based quote for your business.

See the difference a partner makes.

Book Your Free Pricing Consultation

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.