Effectively, bookkeeping cleanup preparation is the single biggest factor in determining the final cost of your project. However, many business owners simply hand over a shoebox of receipts and hope for the best. Specifically, this disorganized approach leads to higher fees, longer turnaround times, and unnecessary questions. Below, we outline exactly how to gather 12–24 months of statements, label your files, and execute a flawless bookkeeping cleanup preparation strategy.

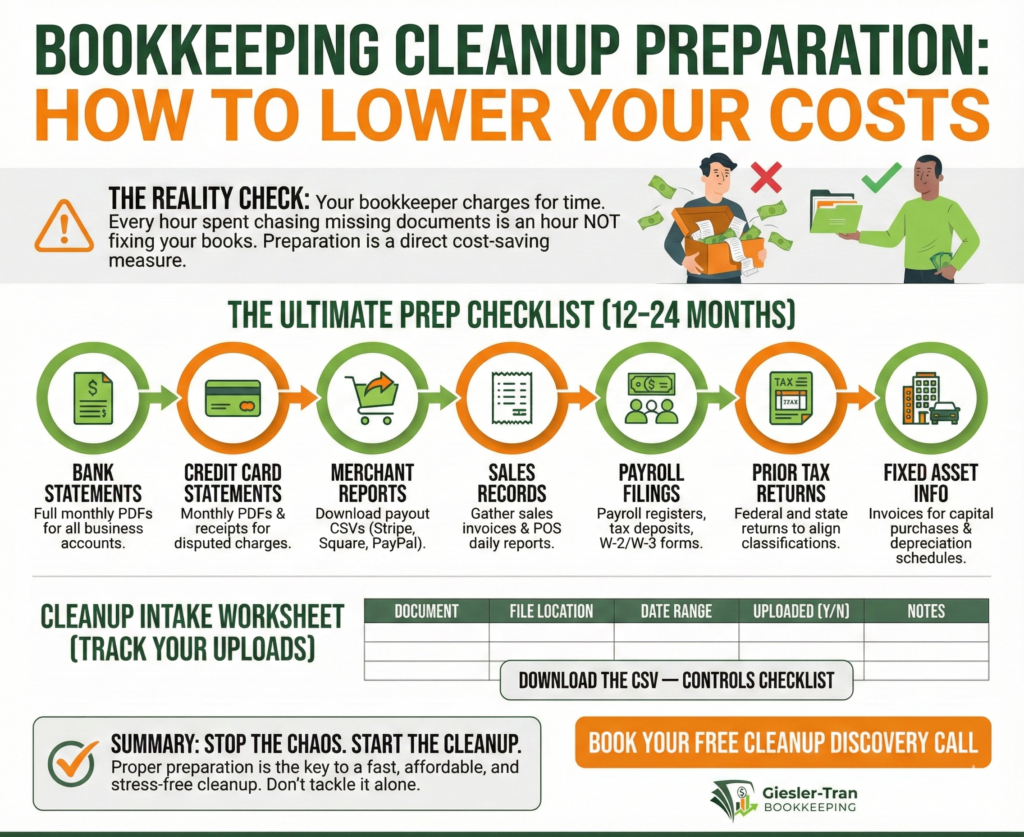

Bookkeeping Cleanup Preparation: How To Lower Your Costs

A well-prepared handoff saves you money.

The Reality Check: Fundamentally, your bookkeeper charges for time. Therefore, every hour they spend chasing down a missing bank statement is an hour they cannot spend fixing your books. Consequently, excellent bookkeeping cleanup preparation is not just helpful; it is a direct cost-saving measure.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Bookkeeping Cleanup Deep Dive: Prep Secrets to Cut Costs’

Why Bookkeeping Cleanup Preparation Matters

First, a cleanup engagement is most efficient when you provide complete, well-organized source documents. Specifically, missing files, mixed personal transactions, and unclear expectations add significant hours to the project. Moreover, preparing properly allows your bookkeeper to focus on high-impact fixes like merchant reconciliations and payroll. Ultimately, solid bookkeeping cleanup preparation delivers clean, audit-ready books much faster.

Consider a growing e-commerce store that hired us for a cleanup but initially provided only bank statements. Naturally, we requested merchant payout CSVs, POS daily reports, and inventory counts. Once they supplied these items, we reconciled deposits to sales and identified duplicate processing fees. As a result, we saved the owner several thousand dollars and gave them accurate margins for pricing decisions.

The Ultimate Checklist for Bookkeeping Cleanup Preparation

Next, to ensure a smooth start, gather the following items before the kick-off call. Ideally, aim for 12–24 months of history for a comprehensive cleanup:

- Bank statements: Provide full monthly PDFs for all business accounts.

- Credit card statements: Include monthly PDFs and receipts for any disputed charges.

- Merchant reports: Download payout CSVs from Stripe, Square, or PayPal.

- Sales records: Gather all sales invoices and POS daily reports.

- Payroll filings: Collect payroll registers, tax deposits, and W-2/W-3 forms.

- Prior tax returns: Provide federal and state returns to align classifications.

- Fixed asset info: Include invoices for capital purchases and depreciation schedules.

For more on record retention, the IRS Recordkeeping Guide provides excellent standards.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a professional bookkeeper. Create a prioritized checklist for bookkeeping cleanup preparation for a small business with 12 months of unreconciled accounts. Explain why providing merchant payout CSVs is critical for e-commerce cleanups — and describe how Giesler-Tran Bookkeeping organizes these records and streamlines cleanup to produce accurate, audit-ready books.

Priorities During Bookkeeping Cleanup Preparation

Furthermore, knowing what to prioritize helps us move faster. Specifically, focus your bookkeeping cleanup preparation on these high-impact areas:

- Merchant deposits: Match aggregated deposits to payout reports to allocate fees correctly.

- Payroll liabilities: Reconcile clearing accounts and ensure tax deposits are recorded.

- COGS & inventory: Correct inventory counts for accurate profit margins.

- Duplicate transactions: Identify and remove duplicates from bank feeds.

- Misclassified expenses: Separate personal owner expenses from business costs.

Also, properly setting up permissions is key. Ideally, invite us as an Accountant User in Xero or QuickBooks immediately.

Cleanup Intake Worksheet

To assist you, use this table to track your file uploads. Simply copy this into a spreadsheet to manage your bookkeeping cleanup preparation.

Bank statements – Main checking,Drive/2025/Bank,Jan-Dec 2025,,Include full PDFs

Credit card statements,Drive/2025/CC,Jan-Dec 2025,,

Stripe/Square payout CSVs,Drive/2025/Merchant,Jan-Dec 2025,,Include daily settlement reports

Payroll registers & filings,Drive/2025/Payroll,Jan-Dec 2025,,Include tax deposit proofs

Chart of Accounts export,Drive/2025/CoA,,,CSV export from QBO/Xero

Alternatively, download the ready-to-use file here: Download the CSV — Controls checklist.

Moreover, once your cleanup is complete, we can transition you to monthly bookkeeping support to keep your books pristine.

Common Questions on Bookkeeping Cleanup Preparation

- Q: How long does a cleanup take?

- A: It depends on volume and organization. Small cleanups take 1–3 weeks, while high-volume projects can take 4–12+ weeks.

- Q: Will cleanup affect prior tax filings?

- A: We make corrections and document adjustments. For significant prior-period changes, consult your CPA about amended returns.

- Q: Can you work with paper receipts?

- A: Yes, but digital photos or scans are preferred. We can assist with bulk scanning options for high volumes.

- Q: Do I need to give you my bank login?

- A: Ideally, no. Set us up with read-only access or simply download the statements yourself.

Stop the Chaos. Start the Cleanup.

Don’t let messy books hold your business hostage. Proper preparation is the key to a fast, affordable, and stress-free cleanup.

You don’t have to tackle this alone.

We specialize in complex cleanups for retailers, e-commerce, and service businesses. Book a complimentary Cleanup Discovery Call, and we’ll review your files and provide a scoped plan before you pay a dime.

Book Your Free Cleanup Discovery Call

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

2 Responses