Understanding the true bookkeeping cleanup cost is the first step toward reclaiming control of your business finances. For many business owners, the fear of an unknown price tag is often more stressful than the messy books themselves. However, delaying the process only increases the risk of tax penalties and lost deductions. At Giesler-Tran Bookkeeping (GTB), we believe that transparency is the foundation of trust. Therefore, we have structured our pricing to be predictable, fair, and directly tied to the value we provide. By removing the guesswork from the bookkeeping cleanup cost, we empower you to make a decision that benefits your bottom line immediately. Ultimately, a clean set of books is not just an expense; it is an investment in your company’s future stability.

Demystifying Your Bookkeeping Cleanup Cost

Transparent pricing. Expert results. Zero surprises.

The Reality Check: Fundamentally, avoiding a cleanup because of cost concerns is a false economy. If your books are messy, you are likely overpaying taxes or missing out on loans. Consequently, the bookkeeping cleanup cost is often far less than the money you are currently losing through disorganization. Furthermore, paying for a professional cleanup prevents the nightmare of an IRS audit, which carries a much higher price tag in both money and stress.

Listen on The Deep Dive — pricing transparency:

‘The Real Cost of Messy Books vs. Clean Books’

How We Calculate Your Bookkeeping Cleanup Cost

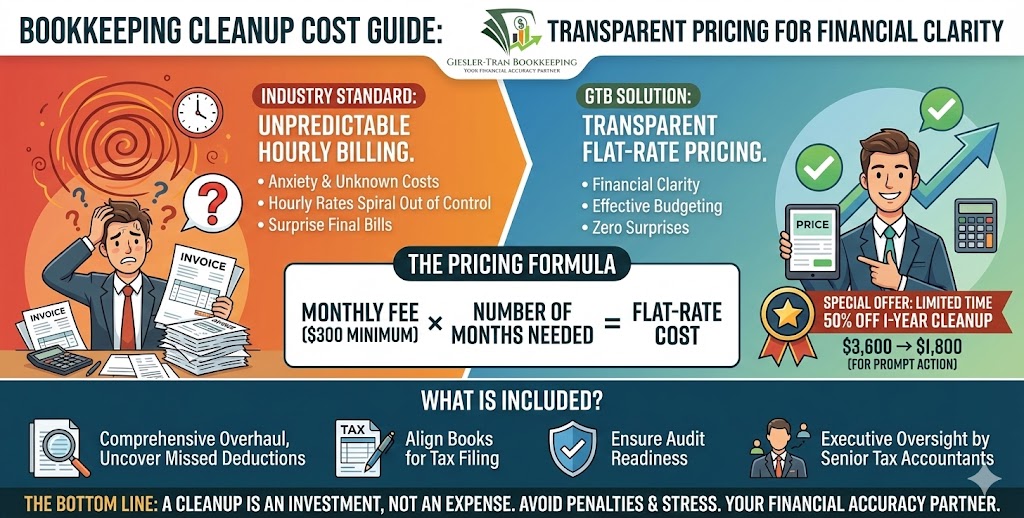

Many business owners worry about the bookkeeping cleanup cost when they realize their financial records are behind. However, we believe in transparent, predictable pricing. You will face no surprises or hourly guessing games that inflate your bill. Specifically, at Giesler-Tran Bookkeeping, we calculate your cleanup fee by multiplying your set monthly fee by the number of months that need attention. This straightforward formula ensures you know exactly what to expect before we even touch a spreadsheet.

Simple Formula for Your Bookkeeping Cleanup Cost

- The Equation: Cleanup Cost = Your Monthly Fee × Number of Months.

- First, note that our minimum monthly fee is $300.

- For instance: If you need a full year of catch-up, your total bookkeeping cleanup cost comes to $300 × 12 = $3,600.

- Finally, if you need more than a year, simply multiply your monthly fee by the number of months requiring cleanup.

Compared to industry standards where hourly billing can spiral out of control, our flat-rate model provides peace of mind. According to FreshBooks, hourly rates for cleanup can vary wildly, making budgeting impossible. With GTB, the price we quote is the price you pay.

Limited Offer: Reduce Your Bookkeeping Cleanup Cost

In fact, every year we offer a limited number of 50% OFF 1-Year Bookkeeping Cleanup spots to help businesses get back on track. Consequently, you could secure a full year cleanup for only $1,800 (normally $3,600)! This significant discount makes professional help accessible to businesses that might otherwise struggle to afford it.

However, these offers go extremely fast and operate on a strict first-come, first-served basis. Therefore, ask us immediately if we have any spots left. This remains your best chance to save thousands on your bookkeeping cleanup cost while receiving top-tier service. Don’t let hesitation cost you this opportunity.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to validate our pricing model.

What Is Included in Your Bookkeeping Cleanup Cost?

Crucially, our process involves much more than just number crunching or data entry. Specifically, when you pay the bookkeeping cleanup cost with Giesler-Tran Bookkeeping, you are investing in a comprehensive financial overhaul. Here is exactly what your investment delivers:

- Maximizing Deductions: We uncover hidden expenses and missed deductions—so you keep more of what you earn.

- Tax Alignment: We align your books for tax filing and financial clarity, ensuring your CPA has clean data.

- Audit Readiness: Our team creates audit-ready books that are fully documented and compliant with IRS standards.

- Executive Oversight: Moreover, senior tax accountants and executives oversee every project to ensure quality control.

- Expertise Access: Ultimately, you get much more than average service. Our team brings 75+ years’ combined expertise and a Gold Star Network of professionals.

Why Invest in a Professional Bookkeeping Cleanup Cost?

Simply put, the cost of doing nothing is higher than the cost of cleanup. When you ignore your books, you invite stress and financial loss. Conversely, paying the bookkeeping cleanup cost now sets you up for future success.

First, you reduce stress at tax time and avoid costly errors that trigger penalties. Next, you gain peace of mind with precise, organized, and up-to-date records that reflect the true health of your business. Also, you prepare effectively for audits, loan applications, and business growth opportunities that require clean financials. Finally, you save time and focus on running your business instead of chasing paperwork. For more on the importance of financial records, the Small Business Administration offers excellent resources.

“They transferred our books and cleaned up years of inefficiency—made the whole process quick and pain free.”

– Carlie Poole, General Contractor

Q&A: Cleanup Pricing & Process

Q: Is there a setup fee included in the bookkeeping cleanup cost?

A: Generally, yes. We include the onboarding and system setup within our quoted price, so there are no hidden “initiation” fees.

Q: What if I have multiple years of back taxes?

A: We can handle it. We simply apply the monthly formula to the total number of months needed. Often, we prioritize the most recent year to get you compliant quickly.

Q: Can I pay in installments?

A: We discuss payment options during your consultation. Our goal is to make the bookkeeping cleanup cost manageable for your cash flow.

Q: Does this include filing the tax returns?

A: The cleanup fee covers the books. However, as a full-service firm, we can also quote you for tax preparation, keeping everything under one roof.

Q: How long does the cleanup take?

A: Typically, we can turn around a year of books in 2-4 weeks, depending on how quickly we receive your documents. Speed is a priority.

Key Takeaways

- Predictable Pricing: Our flat-rate formula removes the uncertainty from the bookkeeping cleanup cost.

- Value Driven: You pay for expert oversight and audit-ready results, not just data entry.

- Limited Discounts: Act fast to potentially secure one of our 50% off spots for catch-up work.

- Investment, Not Expense: Clean books pay for themselves by uncovering deductions and preventing tax penalties.

In Summary: Ready for Financial Clarity?

Our process starts with a free, no-obligation review. Then, you receive a custom quote and timeline before any work begins. Experience the difference of true expertise and see why our clients trust us year after year. Ultimately, the bookkeeping cleanup cost is a small price to pay for the freedom and confidence of knowing your business is built on a solid foundation. Let us do the heavy lifting so you can get back to business.

Get Your Custom Quote Today

Curious what your bookkeeping cleanup cost will be?

Book your free consultation for a clear, personalized quote—and don’t forget to ask if a 50% Off spot is still available!

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

2 Responses