Building a successful business requires more than just a great product; it requires a fortress of financial intelligence. However, many business owners make the critical mistake of keeping their financial professionals in silos. Specifically, they hire a bookkeeper to handle the day-to-day data entry and a CPA to file taxes once a year, never encouraging the two to talk. This lack of communication is a recipe for missed deductions and year-end stress. At Giesler-Tran Bookkeeping (GTB), we believe that seamless bookkeeper cpa collaboration is the secret weapon of high-growth companies. Therefore, we have built our entire service model around proactive partnership, ensuring your financial team speaks the same language all year long.

Bookkeeper CPA Collaboration: How the Power of Teamwork Saves You Money

Your financial left hand needs to know what the right hand is doing.

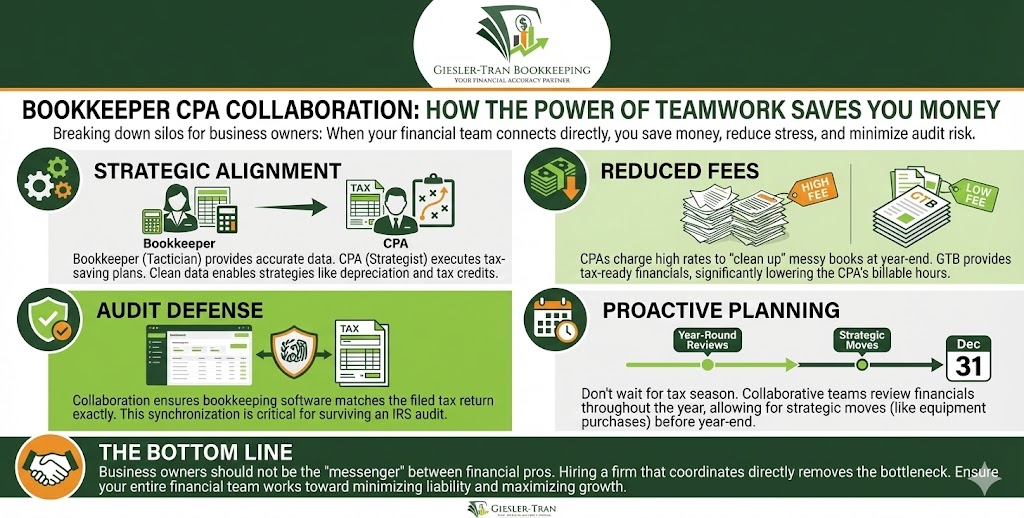

The Reality Check: Fundamentally, your CPA is a strategist, and your bookkeeper is a tactician. If the tactician (bookkeeper) does not provide accurate data, the strategist (CPA) cannot execute a tax-saving plan. Unfortunately, when these two parties fail to communicate, you pay the price in the form of expensive “cleanup” fees at tax time. Effective bookkeeper cpa collaboration eliminates this friction, turning your accounting expense into an investment.

Listen on The Deep Dive — discussing the financial team:

‘The Bridge Between Data and Strategy’

Why Bookkeeper CPA Collaboration is Your Secret Weapon

First, let’s clarify the distinct roles involved. While a bookkeeper records the history of your transactions, a CPA uses that history to file taxes and plan for the future. However, without consistent communication, the history may be recorded in a way that is useless for the CPA. For example, if a bookkeeper categorizes a new truck purchase as “Auto Expense” instead of a “Fixed Asset,” the CPA might miss a massive depreciation deduction. This is exactly where bookkeeper cpa collaboration saves the day.

Furthermore, this synergy allows for real-time tax planning. Instead of waiting until April to discover you owe a massive tax bill, a collaborative team spots high profits in October. Consequently, your CPA can advise you to make strategic purchases or retirement contributions before the year ends. You can read more about the importance of year-round accounting from the AICPA (American Institute of CPAs).

Our Process for Seamless Bookkeeper CPA Collaboration

Crucially, at GTB, we don’t just “hand over the books” and walk away. We actively bridge the gap. Specifically, our process is designed to make your CPA’s life easier, which ultimately lowers your billable hours with them. Here is how we execute effective bookkeeper cpa collaboration:

- Direct Coordination: We speak directly to your tax preparer to answer technical questions about your ledger, sparing you the middle-man headache.

- Clean Documentation: Every transaction is supported by digital records. CPAs love us because they don’t have to hunt for receipts during crunch time.

- Executive Oversight: Our internal Senior Tax Accountants review your books before they ever reach your CPA, ensuring a double layer of accuracy.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see how this partnership benefits you.

How Bookkeeper CPA Collaboration Reduces Audit Risk

Moreover, nothing triggers an IRS audit faster than inconsistent data. If your tax return says one thing, but your Quickbooks file says another, you are waving a red flag at the government. Often, this happens when a CPA makes “Adjusting Journal Entries” (AJEs) at year-end that never get recorded back into the bookkeeping software. Through tight bookkeeper cpa collaboration, we ensure that your books match your tax return to the penny.

Additionally, this synchronization protects you in case of an actual audit. Because we maintain rigorous documentation standards, your CPA has immediate access to the proof needed to defend your deductions. If your books are currently a mess, consider our cleanup services to get you audit-ready before tax season hits.

Saving Time and Reducing Stress

Perhaps the biggest benefit of our approach is the peace of mind it offers you. As a business owner, you should not be the messenger between your financial pros. When we handle the bookkeeper cpa collaboration directly, we remove the bottleneck. Instead of forwarding emails and trying to explain accounting jargon you don’t understand, you can focus on running your business.

Similarly, this proactive relationship prevents the “Tax Season Panic.” Because we communicate throughout the year, there is no frantic scramble in March to find missing receipts. If you are wondering what professional oversight costs, check our guide on bookkeeping pricing expectations.

Shared Goals: The Heart of Bookkeeper CPA Collaboration

Finally, it is important to remember that we are all on the same team. Our goal is to minimize your tax liability and maximize your growth. When we identify a potential issue—like a contractor who hasn’t submitted a W-9—we flag it immediately. This allows your CPA to address it before filing deadlines. For more insights on how small businesses can leverage financial teams, Entrepreneur.com offers excellent advice on building a financial support system.

Ultimately, this partnership model transforms your accounting from a compliance burden into a strategic asset. By prioritizing bookkeeper cpa collaboration, we ensure that every dollar you earn is tracked, protected, and optimized. If you are still shopping for a partner, read our tips on choosing the right bookkeeper.

Q&A: Optimizing Your Financial Team

Q: Does GTB replace my current CPA?

A: No. We partner with them. While we handle the daily records and monthly reporting, your CPA handles the annual tax filing and high-level tax strategy.

Q: Will my CPA charge me less if I use GTB?

A: Often, yes. CPAs typically bill by the hour for “cleanup” work. Because we provide them with pristine, tax-ready financials, they spend less time fixing errors and more time on strategy.

Q: Do I need to be on the emails between you and my CPA?

A: Only if you want to be. We usually copy you on correspondence for transparency, but we handle the technical back-and-forth so you don’t have to.

Q: What if I don’t have a CPA yet?

A: That is not a problem. We have a network of trusted tax professionals we work with regularly and can provide a referral that fits your industry and budget.

Q: How does this collaboration help with tax estimates?

A: By keeping your books current monthly, we can give your CPA accurate profit numbers quarterly. This allows them to calculate precise estimated tax payments, helping you avoid penalties.

Key Takeaways

- Unify Your Team: Don’t let your financial pros work in silos; encourage direct communication.

- Save on Fees: Clean books from GTB reduce the billable hours your CPA spends on year-end cleanup.

- Reduce Audit Risk: Synchronization between your ledger and tax return is the best defense against IRS scrutiny.

- Plan Proactively: Real-time collaboration allows for tax-saving moves before the year ends, not after.

In Summary: Better Together

Ultimately, the synergy between your bookkeeper and your tax professional is the bedrock of a healthy business. Bookkeeper CPA collaboration is not just a nice-to-have; it is a financial necessity for anyone serious about growth. At Giesler-Tran Bookkeeping, we pride ourselves on being the team player your business deserves. Ready to experience the difference a unified team makes? Let’s start the conversation today.

Build Your Financial Dream Team

Stop playing “telephone” with your accountant.

Get a partner who speaks their language.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.