Recently, I reviewed a client’s books who believed their cash flow was tight due to low sales. In reality, their sales were fine, but they were leaking money through duplicate payments and uncancelled subscriptions that no one had noticed for months. For instance, without regular checks, a $50 recurring charge or a double-paid invoice can disappear into the noise of daily operations. However, treating bank reconciliation as a monthly ritual rather than a year-end chore instantly shines a light on these leaks. Because accurate financial data is the bedrock of every profitable decision you make, skipping this step is essentially gambling with your bank balance. Therefore, mastering bank reconciliation is the single most effective control you can implement to stop leaving cash on the table.

Bank Reconciliation: Stop Leaving Cash on the Table

Your bank statement is the truth; make your books match it.

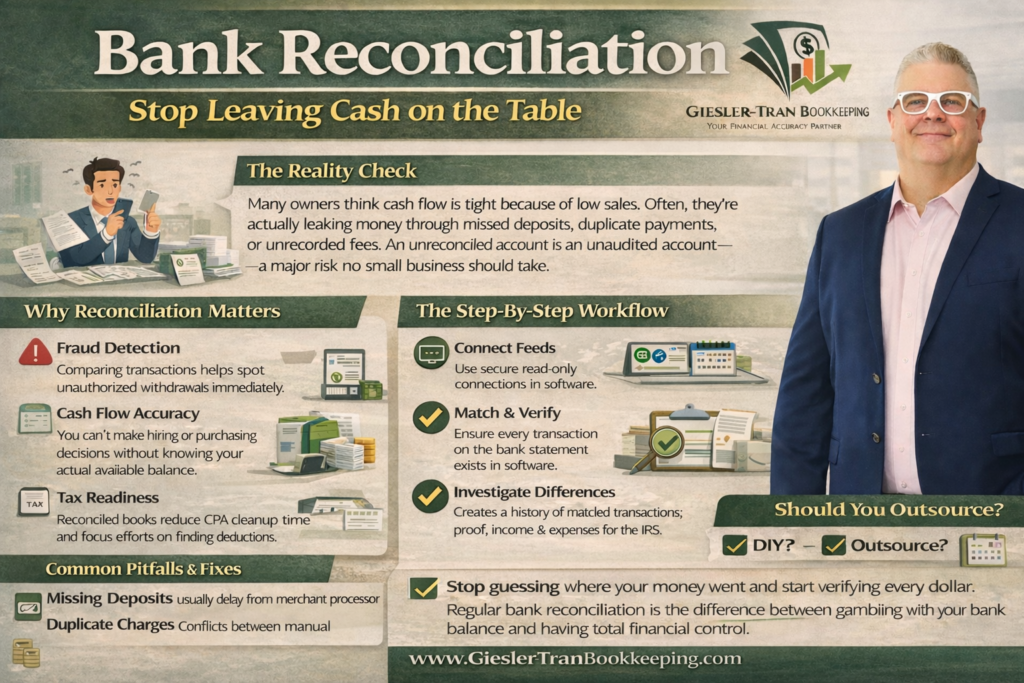

The Reality Check: Fundamentally, bank reconciliation is the process of comparing your internal records against the bank’s records to ensure they match perfectly. Therefore, it is the only way to catch missing deposits, unauthorized transactions, or bank errors before they become permanent losses. Remember, an unreconciled account is an unaudited account, and that is a risk no business owner should take.

Listen on The Deep Dive — where we explore this topic further:

‘Stop Leaving Cash on the Table: The Strategic Deep Dive into Bank and Credit Card Reconciliations’

Why Bank Reconciliation Matters: More Than Just Balancing

Initially, many business owners view reconciliation as a tedious compliance task that only keeps the accountant happy. However, it is actually a strategic tool for cash management. Here is why regular bank reconciliation is critical for your survival:

- Fraud Detection: Specifically, comparing transactions helps you spot unauthorized withdrawals or duplicate checks immediately.

- Cash Flow Accuracy: Furthermore, you cannot make hiring or purchasing decisions if you don’t know your true available balance.

- Tax Readiness: Ultimately, reconciled books mean your CPA spends less time cleaning up errors and more time finding deductions.

- Audit Trail: Creating a history of matched transactions provides proof of income and expenses if the IRS ever comes knocking.

If you want to see how this fits into a broader financial strategy, check out our guide on How Bookkeeping Works.

How to Perform Bank Reconciliation (Step-by-Step)

Undoubtedly, the process can seem daunting if you haven’t done it in a while. To simplify, we break it down into a repeatable workflow. Here are the steps to flawless bank reconciliation:

- Connect Feeds: Ensure secure, read-only bank and credit-card feeds are active in your accounting software (like QuickBooks Online or Xero).

- Import & Categorize: Review all transactions, categorize them to the correct chart of accounts, and attach digital receipts.

- Run Statement Import: Obtain the PDF statement from your bank for the period you are reconciling ending date.

- Match Transactions: Verify that every transaction on the statement exists in your software; use rules to automate this where safe.

- Investigate Differences: Identify timing issues (outstanding checks), missing deposits, or bank errors and document them.

- Post Adjustments: Record any necessary entries for interest earned or bank service fees that were missed.

- Lock the Period: Finally, close the books for that month to prevent accidental changes to historical data.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI financial analyst suggests regarding your reconciliation process.

Act as a forensic accountant working alongside Giesler-Tran Bookkeeping. I’m a small business owner and want to better understand internal controls. Explain why bank reconciliation is considered one of the most important defenses against fraud and embezzlement. Then list three specific red flags I should look for during the reconciliation process that could indicate money is being stolen, diverted, or mishandled — and what each one usually means.

Common Reconciliation Issues and Quick Fixes

Admittedly, things don’t always balance to the penny on the first try. Here are common pitfalls in bank reconciliation and how to fix them:

- Missing Deposits: Often caused by merchant processor delays. Check your settlement reports and record a deposit adjustment.

- Duplicate Charges: Frequently happens when a manual entry conflicts with a bank feed import. Void the duplicate to clear it.

- Unrecorded Bank Fees: Easily missed if small. Set up a recurring expense rule for monthly service charges.

- Out-of-Balance Statements: Usually a date error. Run a trial balance and check for transactions dated outside the reconciliation period.

Worksheet — Should You Hire GTB?

Deciding whether to DIY or outsource is a strategic choice. Use this simple worksheet to score your need for professional bank reconciliation help. Rate each statement: 0 (No), 1 (Sometimes), 2 (Yes).

| Statement | Score (0-2) |

| I spend 5+ hours/week on bookkeeping tasks. | _____ |

| My bank reconciliations are often late or incomplete. | _____ |

| I have multiple deposit sources (Stripe, Square, PayPal). | _____ |

| I frequently find unexpected bank or processing fees. | _____ |

| Tax season causes last-minute cleanups and stress. | _____ |

| TOTAL SCORE | _____ |

Scoring Guide:

- 0–3: DIY is likely fine for now.

- 4–7: Consider a hybrid review to catch errors.

- 8–10: You are a strong fit for full-service bookkeeping.

Q&A: Mastering Bank Reconciliation

Q: How often should I perform bank reconciliation?

A: Ideally, you should reconcile monthly at a minimum. For high-volume businesses, weekly reconciliation is better to catch cash flow issues early.

Q: What if my beginning balance doesn’t match?

A: This usually means a transaction from a prior, closed period was changed or deleted. Don’t force it; use the reconciliation discrepancy report to find the specific change.

Q: Can I automate bank reconciliation?

A: Partially. You can use bank rules to match transactions automatically, but a human must still review exceptions and verify the final ending balance matches the statement.

Q: Why do I need to attach receipts if the bank feed brings in the data?

A: Because the bank feed only proves you spent money, not what you bought. Receipts provide the line-item detail required by the IRS for deductions.

Q: Is reconciling credit cards necessary?

A: Absolutely. Credit cards are liabilities. If you don’t reconcile them, you might be paying for unauthorized charges or understating your business debt.

In Summary: Reclaim Your Cash and Control

Ultimately, businesses that reconcile regularly have fewer surprises and stronger cash control. Stop leaving money on the table through fees, errors, and fraud. If you are ready to get reconciliation right today, we are here to help.

The Bottom Line

Stop guessing where your money went.

Start verifying every dollar.

Book Your Free Reconciliation Review

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

3 Responses