Historical bookkeeping cleanup is more than just data entry; it is a financial rescue mission. For many business owners, the initial goal is simple: survive the startup phase. However, the reality of running a growing company often means that back-office tasks, like reconciling bank feeds, get pushed to the bottom of the pile.

Consequently, months turn into years, and suddenly you are facing a tax deadline with a ledger that makes no sense. At Giesler-Tran Bookkeeping, we specialize in historical bookkeeping cleanup services that take messy, incomplete, or non-existent financial data and turn it into pristine, audit-ready financial statements. Today, we explain exactly how we fix the past so you can secure your future.

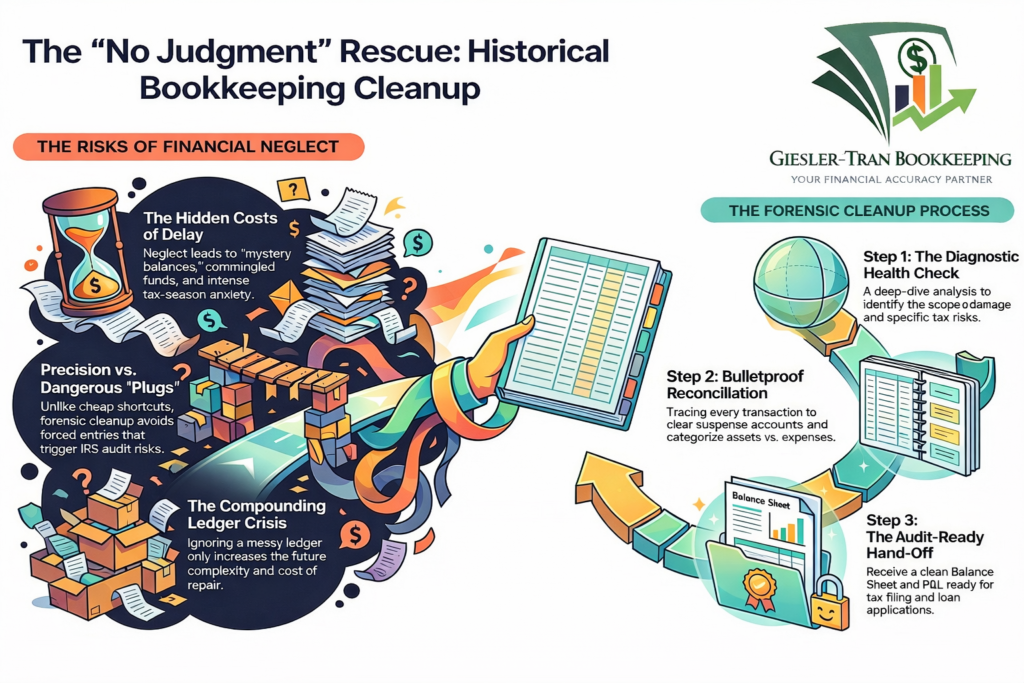

Historical Bookkeeping Cleanup: The “No Judgment” Rescue Service

Life happens. Business moves fast. Sometimes, the books get left behind.

Key Takeaway: The Cost of Delay

Fundamentally, ignoring a messy ledger does not make it go away; it compounds the cost. Because the IRS requires accurate records to substantiate every deduction, delaying your historical bookkeeping cleanup puts you at risk of massive penalties. Therefore, the most profitable decision you can make is to stop hiding from your numbers and start fixing them today.

Signs You Need a Historical Bookkeeping Cleanup

Eventually, every business owner realizes that “winging it” no longer works. If you find yourself dreading the mail because it might be an IRS notice, or if you simply have no idea how much money you actually made last year, it is time for an intervention.

Specifically, our clients usually come to us when they face one of these four critical scenarios:

- The “Tax Anxiety”: You filed an extension because your numbers weren’t ready, and now the new deadline is looming aggressively.

- The “Mystery Balance”: Your QuickBooks balance says one thing, but your actual bank account says something completely different.

- The “Commingle”: Personal expenses are mixed with business expenses, and you don’t know what is actually deductible.

- The “DIY Mess”: You tried to keep up, but now you have duplicate entries and uncleared checks everywhere.

Consequently, these issues paralyze your decision-making. Without a clean set of historical books, you cannot secure a loan, sell your business, or plan for growth.

How The “Rescue” Process Works

We treat a historical bookkeeping cleanup like forensic accounting. We don’t just delete things to make them balance; we investigate every discrepancy to ensure it stands up to scrutiny.

Our process is designed to minimize your stress while maximizing accuracy:

- Phase 1: The Diagnostic. Before we touch a single transaction, we perform a deep-dive Health Check. We identify the scope of the damage and the tax risks involved.

- Phase 2: The Clean-Up. We go back to the start date of the mess. We reconcile every bank and credit card account, clear out “Ask My Accountant” suspense accounts, and correctly categorize assets vs. expenses.

- Phase 3: The Hand-Off. We deliver a clean, closed set of books (Balance Sheet and P&L) ready for your CPA to file taxes.

Ultimately, we hand you a clean slate. Then, we transition you to our Monthly Maintenance Plan to ensure you never fall behind again.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify the risks.

Why “Cheap” Clean-Ups Cost More

Many firms will offer to “fix” your books by simply making a massive Journal Entry to force your bank balance to match QuickBooks. This is dangerous.

If you are audited, the IRS will see that “plug” entry and disallow your deductions. At Giesler-Tran, we do the hard work of tracing the actual transactions. We build a bulletproof audit trail so you can sleep at night. For additional context, you can review the IRS Recordkeeping Standards to see why detailed receipts and ledgers are mandatory, not optional.

Q&A: Everything About Clean-Ups

Q: How far back can you clean up my books?

A: Generally, we can go back as far as you have bank statements. Most clients need the current year and the prior tax year cleaned up to file late returns.

Q: Do I need to switch software?

A: No, we work within your existing QuickBooks or Xero file. However, if your file is corrupted beyond repair, we may recommend starting a fresh file with accurate opening balances.

Q: Will you judge my spending habits?

A: Never. We have seen it all. Our only focus is ensuring that personal expenses are separated from business expenses to protect you from an audit.

Q: How much does a historical bookkeeping cleanup cost?

A: Every mess is unique. We provide a flat-fee quote after our initial diagnostic so you know exactly what the investment will be before we start.

Key Takeaways

- Don’t Wait: Delaying a clean-up only increases the complexity and the cost.

- Avoid Plugs: Never hire a bookkeeper who uses “journal entries” to force balances to match.

- Tax Compliance: Clean historical books are the only defense against an IRS audit.

- Start Fresh: A clean-up is the best way to reset your financial foundation for growth.

Final Word: Stop Avoiding Your Books

The longer you wait, the harder (and more expensive) the historical bookkeeping cleanup becomes. Let’s fix it today. Your peace of mind is worth the investment.

The Bottom Line

We fix years of neglect so you can focus on the future.

Get a judgment-free diagnostic today.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

2 Responses