Specialized medical practice bookkeeping is not just about organizing receipts; it is the financial backbone of a thriving healthcare facility. Many clinic owners assume that any accountant can handle their books. However, generic financial tracking often fails to capture the nuances of patient copays, insurance reimbursements, and complex inventory management. Consequently, without a system built specifically for medicine, you risk significant profit leaks.

Effective financial management allows you to focus on patient care while we handle the complexity of compliance. Specifically, our team brings decades of corporate financial discipline to the private practice sector. Ultimately, understanding the difference between general accounting and specialized medical practice bookkeeping is the first step toward securing your clinic’s legacy.

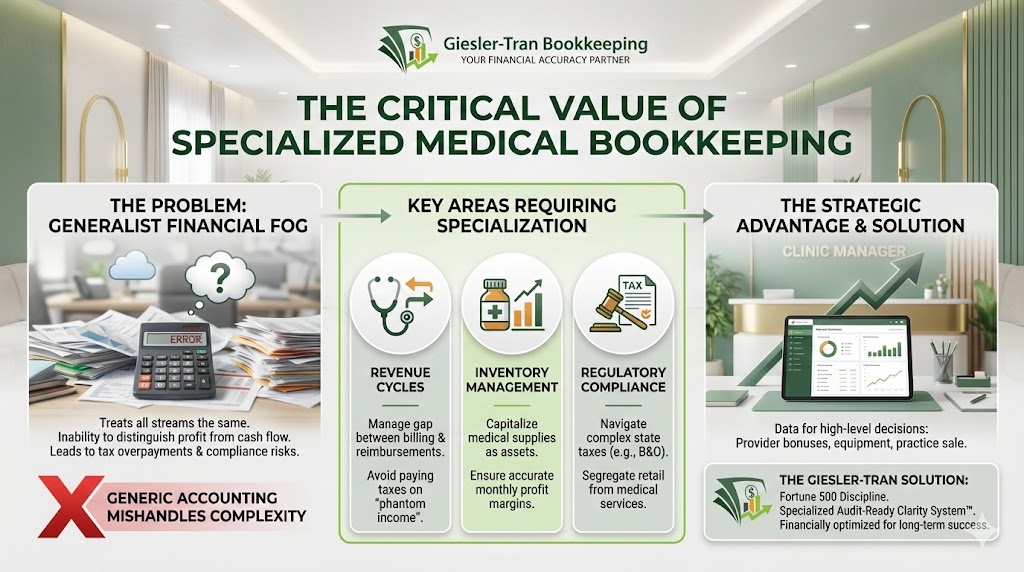

Why Generic Bookkeeping Fails Medical Practices

A generalist sees expenses; a specialist sees clinical workflow.

Key Takeaway: The Cost of Generalization

Fundamentally, generic bookkeeping treats a medical laser purchase the same as a laptop for a retail store. However, the tax implications, depreciation schedules, and usage tracking are vastly different. Therefore, relying on specialized medical practice bookkeeping ensures that every asset is leveraged for maximum tax benefit, rather than just being recorded as a simple cost.

Trusted By

“As a physician and owner of ShillMed Weight Loss & Lifestyle Medicine Center, I know that patient care comes first—yet the business side of medicine can be overwhelming. Giesler-Tran Bookkeeping brought clarity to our complex financial operations, handling everything from insurance reconciliation to separating service and product revenue. Their specialized approach to medical bookkeeping eliminated the ‘financial fog’ we’d experienced with generic solutions. Thanks to their expertise, our practice not only stays audit-ready and compliant, but I have real confidence in our numbers, tax strategy, and growth potential. I highly recommend Giesler-Tran Bookkeeping to any healthcare provider looking to scale with peace of mind.”

— Dr. Otto, ShillMed Weight Loss & Lifestyle Medicine Center

The Unique Complexity of Medical Revenue Cycles

Medical revenue is rarely straightforward. Unlike a coffee shop where a sale is immediate, a clinic must track what is billed, what is allowed by insurance, and what the patient actually owes. Furthermore, this gap between service delivery and payment receipt creates a “phantom income” problem if not managed correctly.

Specifically, specialized medical practice bookkeeping addresses these distinct challenges:

- Accrual vs. Cash: Medical practices often need to view their books on an accrual basis to understand true production, even if they pay taxes on a cash basis.

- Insurance Adjustments: We properly categorize write-offs versus bad debt, ensuring you don’t pay taxes on money you never collected.

- Provider Compensation: Tracking production by provider is essential for calculating bonuses accurately.

- Refund Management: Handling patient refunds requires precise tracking to avoid skewing monthly revenue reports.

Consequently, using a specialist ensures that your Profit and Loss statement reflects reality. Because we understand the lifecycle of a medical claim, we can help you forecast cash flow with far greater accuracy than a generalist ever could. For more insights on cash flow management, the Healthcare Financial Management Association offers excellent resources for practice administrators.

Managing Inventory and COGS in a Clinical Setting

Inventory management in a medical setting is critical for both compliance and profitability. Whether you sell supplements, skincare products, or orthotics, these items are not just “supplies.” Instead, they are assets that sit on your shelf until sold.

When a general bookkeeper expenses $10,000 of Botox immediately upon purchase, your books show a massive loss for that month. However, this is inaccurate. Proper specialized medical practice bookkeeping records that purchase as inventory and only expenses it as Cost of Goods Sold (COGS) when it is actually used. Thus, your profit margins remain smooth and accurate month over month.

Additionally, this precise tracking helps prevent theft and waste. If your usage logs don’t match your inventory counts, you have an operational problem that financial data can expose. Ultimately, detailed tracking transforms inventory from a headache into a measurable profit center.

Compliance and the Washington State B&O Tax

Operating a medical practice in Washington State adds another layer of difficulty: the Business & Occupation (B&O) tax. Unlike federal income tax, B&O is a gross receipts tax. This means you are taxed on your revenue, not your profit.

However, there are specific deductions and classifications for medical services versus retail sales. For example, prescription drugs administered by a physician may have different tax treatments than over-the-counter supplements sold at the front desk. Specialized medical practice bookkeeping ensures these revenue streams are segregated correctly.

If you commingle these funds, you risk overpaying taxes or, worse, triggering an audit for underpayment. Therefore, our team meticulously separates revenue channels to ensure you take advantage of every legal deduction available under Washington law. You can learn more about our cleanup services for tax readiness on our Bookkeeping Cleanup page.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify the importance of specialization.

Strategic Planning with Specialized Medical Practice Bookkeeping

Finally, the goal of bookkeeping is not just compliance; it is growth. Once your data is accurate, we can help you answer strategic questions. Specifically, should you hire another associate? Or, is it time to invest in that new MRI machine?

Using data from specialized medical practice bookkeeping, we can model these scenarios. We look at your historical trends, seasonal fluctuations, and provider productivity to give you a clear “Yes” or “No.” Without this specialized data, you are simply guessing.

Moreover, if you ever plan to sell your practice, potential buyers will demand rigorous financial records. They want to see clear separation of personal and business expenses, accurate EBITDA calculations, and defensible revenue trends. Thus, investing in high-quality bookkeeping now builds the valuation of your future exit. Your financial health requires a team. We handle the operational discipline—ensuring every dollar is tracked—so that strategic partners like Swank CPA have clean, defensible data to guide your growth, profitability, and tax strategy.

Q&A: Specialized Medical Bookkeeping Essentials

Q: Do I really need a specialist for my small clinic?

A: Yes, absolutely. Even small clinics face complex tax rules and liability risks. Specialized medical practice bookkeeping protects you from errors that generalists often miss, regardless of your size.

Q: How do you handle HIPAA compliance with financial data?

A: We prioritize security. While we do not need access to patient medical records, any financial data that crosses our path is handled with strict bank-level encryption and security protocols.

Q: Can you work with my existing EMR software?

A: Yes, we can. Our team is experienced in extracting the necessary financial reports from various EMR systems to reconcile them with QuickBooks or Xero.

Q: Why is accrual accounting better for medical practices?

A: It provides a clearer picture. Because insurance payments lag behind service dates, cash basis accounting makes revenue look “lumpy.” Accrual accounting matches revenue to the month the work was done.

Q: How often should my medical books be updated?

A: Ideally, weekly. This frequency ensures that cash flow issues are spotted immediately and that month-end closing is smooth and timely.

The Giesler-Tran Standard of Excellence

Leading a team with 75+ years of combined experience, we bring Fortune 500 discipline to small business. For medical practices, this means a level of oversight that goes far beyond data entry. We act as your financial guardians.

Whether you manage a medical office or a service-based business, we replace tax-time panic with financial confidence. Our Audit-Ready Clarity System™ ensures your numbers are always defensible. Ultimately, we want you to have the freedom to be a doctor, not an accountant. External resources like the Medical Group Management Association can further support your practice leadership journey.

The Bottom Line

Your clinical expertise deserves financial expertise.

Get audit-ready, specialized medical books today.

Schedule Your Free Consultation

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response