Small Business Financial Management is the absolute bedrock of stability in an increasingly volatile global economy. Specifically, business owners today face tightening capital requirements and fluctuating labor markets that make the margin for error slimmer than ever before. However, many entrepreneurs still treat their finances as an afterthought, focusing solely on product development while their cash flow silently bleeds out. Consequently, mastering the spectrum of financial discipline—from basic bookkeeping to advanced forecasting—is the only way to transition from a struggling startup to a sustainable enterprise. Below, we outline a comprehensive roadmap to mastering your numbers and securing your legacy.

Effectively, the prosperity of our local communities relies heavily on the success of Small and Medium Enterprises (SMEs) like yours. Yet, the path to sustainability is fraught with challenges, including increased capital requirements under new banking regulations that create significant barriers for funding. Therefore, establishing sound Financial Management for a Small Business is not just about keeping the IRS happy; it is about building a fortress around your hard work.

Small Business Financial Management: The Complete Lifecycle Guide

Sustainability starts with a plan, not a guess.

The Reality Check: Fundamentally, a checking account balance is a liar; it does not reflect your true profit or your future obligations. If you are making decisions based solely on your bank login screen, you are driving blind. True Small Business Financial Management requires looking at the Profit & Loss for performance and the Balance Sheet for health.

Listen on The Deep Dive — where we dig deeper into this topic:

‘From Ledger to Legacy: Mastering Small Business Finance’

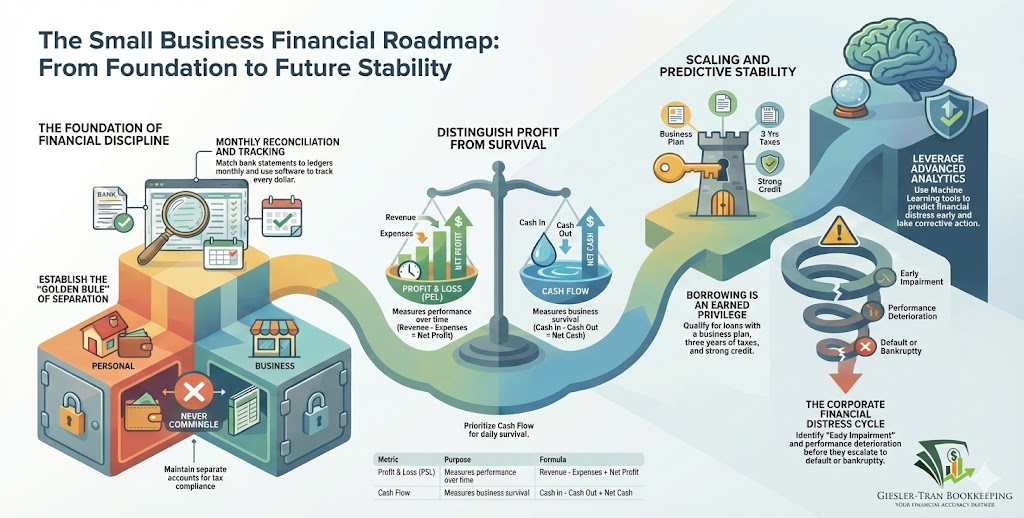

The Foundation: Establishing Sound Small Business Financial Management

Quality financial management is the primary avenue to success for any small business owner. It provides the tools necessary to determine profitability, select office locations, manage inventory, and plan for overall growth. Effective management allows an owner to chart a course for the future and adjust directions during challenging times.

First, creating a budget is the essential initiating step. A budget is a categorized list of monthly or yearly expenses that helps a business track spending, plan for expansion, and ultimately ensure a profit. By comparing budgeted figures with actual expenditures, owners can identify where to economize and how to allocate resources more effectively.

The 11 Essential Bookkeeping Steps

Furthermore, bookkeeping is the organized process of tracking every income and expense transaction. Sound bookkeeping is the basis for all Small Business Financial Management and leads to better decisions regarding financing and taxes. According to industry standards, a business should follow these eleven steps:

- Obtain Software: Secure robust business accounting software (like QuickBooks or Xero).

- Separate Funds: Open a separate business checking account to avoid mixing personal and business funds.

- Reconcile Monthly: Reconcile the checking account monthly to catch errors early.

- Track Sales: Track sales using a consistent system like invoices or register tapes.

- Deposit Correctly: Deposit all sales into the business account; total sales should always equal total deposits.

- Paper Trail: Write business checks or use digital transfers for all expenses rather than using petty cash.

- Credit Separation: Obtain a separate business credit card to track expenses clearly.

- Prioritize Payments: Pay business expenses first; personal expenses are paid second from personal accounts.

- Review Reports: Run a Profit and Loss (P&L) statement regularly to monitor health.

- Owner Pay: Pay yourself through an owner’s draw, assigning these to an equity account.

- Identity Separation: Maintain a clear separation between personal and professional financial identities.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify our strategy.

Act as a CFO for a small business. Explain the difference between Financial Distress and Bankruptcy, making clear that distress is an early, reversible warning stage while bankruptcy is a legal end-state after problems have gone too far. Describe how a business owner can use machine learning or simple data analytics (trend analysis, anomaly detection, and rolling averages) to predict financial distress before it becomes fatal, and identify three key ratios they should monitor. Conclude by explaining how Giesler-Tran Bookkeeping enables this approach through timely, reconciled monthly data, clean historical records, and consistent reporting that makes predictive analysis reliable, while also helping owners interpret the ratios and act before distress turns into collapse.

Measuring Success: P&L Statements and Cash Flow in Small Business Financial Management

While a checking account balance might seem like a good indicator of health, it does not accurately reflect profit. Specifically, the P&L statement is the best tool for knowing if a business is truly profitable. It measures revenue and expenses over a specific period—be it a month, quarter, or year.

Ideally, you should understand the basic formula: Sales minus Cost of Goods Sold (COGS) equals Gross Profit; Gross Profit minus Overhead equals Net Profit. Net profit is what remains to pay for equipment, loan repayment, and the owner’s draw. Additionally, managing cash flow—the balance of cash received minus the cash paid out—is vital. Projections provide the visibility needed to avoid liquidity problems, which is especially useful for seasonal businesses that must make large inventory investments.

Financing and Growth: The Earned Privilege

Financing is the act of getting the money needed to start, operate, or grow a business. Small business financing generally falls into two categories: equity (funds that stay in the business) and debt (borrowed funds that must be repaid). Successful owners understand that borrowing is an earned privilege, not a right. Lenders want to see “skin in the game,” meaning the owner has invested their own money first.

To qualify for a loan, owners must present a comprehensive package. This typically includes:

- A business plan with a profit plan.

- Financial statements (P&L, balance sheet, and cash flow projections).

- Personal and business tax returns for the past three years.

- A credit report showing a good credit score.

- Identified collateral to be pledged as security.

IRS Best Practices and Advanced Analytics

Maintaining compliance with the Internal Revenue Service is a critical component of small business longevity. The first step is correctly classifying the business entity, as this choice affects tax filing requirements. Owners should also leverage digital tools like the IRS Business Tax Account and be vigilant against phishing scams.

Looking forward, modern research highlights the use of Machine Learning (ML) to improve Small Business Financial Management. Techniques such as Artificial Neural Networks are used to analyze bookkeeping features and determine a company’s viability. Unlike older models that use crude financial ratios, these new models look at the progression of ratios through different periods to identify trends. By identifying financial distress early—distinct from bankruptcy—owners can take healing actions that prevent insolvency.

Moreover, recent data from late 2025 suggests a complex environment. While profits held steady, hiring has slowed, and credit card balances per client have risen by 3%. This suggests that some firms are beginning to carry debt forward rather than paying it off monthly, highlighting the need for proactive management.

Summary Guide: Financial Indicators & Risk Factors

To help you visualize the full spectrum of financial management, we have compiled this reference guide. Use this table to identify which stage of management you are currently in and what risks you need to mitigate next.

| SME Topic | Metric / Formula | Key Risk Factors | Strategic Importance | Source |

|---|---|---|---|---|

| Credit Risk & Distress Prediction | Machine Learning models (RVM, ANN) or Z-Score | High debt; past-due history; staff changes; legal disputes | Helps lenders determine borrower reliability and identifies early warning signs. | 1 |

| Financial Profitability | Inflow-to-Outflow Ratio (Cash In / Cash Out) | Revenue growth weakness; payment growth outpacing deposits | Serves as a real-time measure of small business profitability and well-being. | 2 |

| Profitability Analysis | Net Profit = Gross Profit – Overhead | High overhead; low gross margins; seasonal cash shortages | The best tool for knowing if a business is truly profitable. | 3 |

| Cash Management | Cash Flow = Cash Received – Cash Paid Out | Liquidity issues; high receivables; inventory backlog | Ensures the business can pay bills on time and avoid liquidity crises. | 3 |

| Debt & Financing | Leverage / Debt Service (Credit card balances) | Carrying debt forward; high interest rates; personal liability | Properly structured debt supports growth without exhausting working capital. | 2, 3 |

| Tax Compliance | Tax Liability = Income – Deductible Expenses | Incorrect classification; tax debt; lack of recordkeeping | Ensures legal compliance and protects business from penalties. | 4 |

[1] Financial Distress Prediction For Small And Medium Enterprises Using Machine Learning Techniques – arXiv

[2] Small Business Checkpoint: Profits growing, jobs slowing – Bank of America Institute

[3] Financial Management for a Small Business

[4] Publication 5965 (Rev. 5-2025) – IRS

Common Questions About Small Business Financial Management

Q: What is the most important financial report?

A: While the P&L shows performance, the Cash Flow Statement is critical for survival. It tells you if you can pay your bills tomorrow.

Q: How much should I pay myself?

A: Generally, pay yourself a reasonable salary based on your role, but only after business expenses and savings for taxes are covered. Consult your CPA for the best tax strategy.

Q: Do I need a separate business bank account if I am a sole proprietor?

A: Yes. Commingling funds pierces the corporate veil and makes audits a nightmare. Always keep finances separate.

Q: What is “Financial Distress” vs Bankruptcy?

A: Distress is a temporary difficulty in meeting commitments, which can be healed. Bankruptcy is a legal state often resulting from unaddressed distress.

Q: How often should I review my books?

A: Ideally, review them monthly. Waiting until tax season leaves you blind to problems for too long.

Key Takeaways for Owners

- Start with Basics: Master the 11 bookkeeping steps before worrying about advanced analytics.

- Monitor Cash: Remember that profit does not equal cash; watch your liquidity closely.

- Earn Borrowing: Build equity and a strong credit profile to access debt financing when needed.

- Stay Compliant: Use IRS digital tools and protect your business from scams to ensure longevity.

In Summary: A Holistic Approach to Financial Health

Ultimately, the journey of a small business requires a blend of traditional discipline and modern innovation. Success begins with the basics: maintaining a budget, keeping meticulous books, and understanding the nuances of the P&L statement. As the business scales, leveraging machine learning to monitor for signs of early impairment can provide the “visibility” needed to avoid catastrophic failure. Sound Small Business Financial Management is not just about keeping the doors open today; it is about building the foundation for long-term global economic strength.

The Bottom Line

Need a financial partner who understands the full lifecycle?

From cleanup to advanced forecasting, we help you secure your legacy. Check our pricing guide or book a call today.

Book Your Free Financial Review

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.