If you are a business owner searching for reconciliation services Camas, you likely already suspect that your books are not telling you the whole truth. Messy or unreconciled books aren’t just a minor administrative inconvenience; they are a significant liability. Consequently, bank reconciliation serves as the absolute foundation of trustworthy financials, yet it remains one of the most skipped, misunderstood, and poorly executed tasks for small businesses. At Giesler-Tran Bookkeeping (GTB), we believe that a proper reconciliation service in Camas doesn’t just “match transactions” blindly. Instead, it verifies reality. Ultimately, that reality is exactly what lenders, tax agencies, buyers, and smart business owners care about most.

Reconciliation Services Camas: Why Accurate Books Start With Bank Reconciliation

Why Matching Your Books to the Bank is Non-Negotiable

The Reality Check: Fundamentally, if your accounting software says you have $50,000, but your bank account says you have $10,000, you have a massive problem. This discrepancy often stems from ignored reconciliations. When it is done poorly—or not at all—errors quietly compound. Duplicate expenses, missing deposits, unrecorded fees, and even internal fraud can sit undetected for months. That is precisely how profitable businesses in Camas end up thinking they are broke.

Listen on The Deep Dive — where we reveal the truth:

‘The Phantom Cash: Why Reconciliation Matters’

What Bank Reconciliation Actually Does (And Why It Matters)

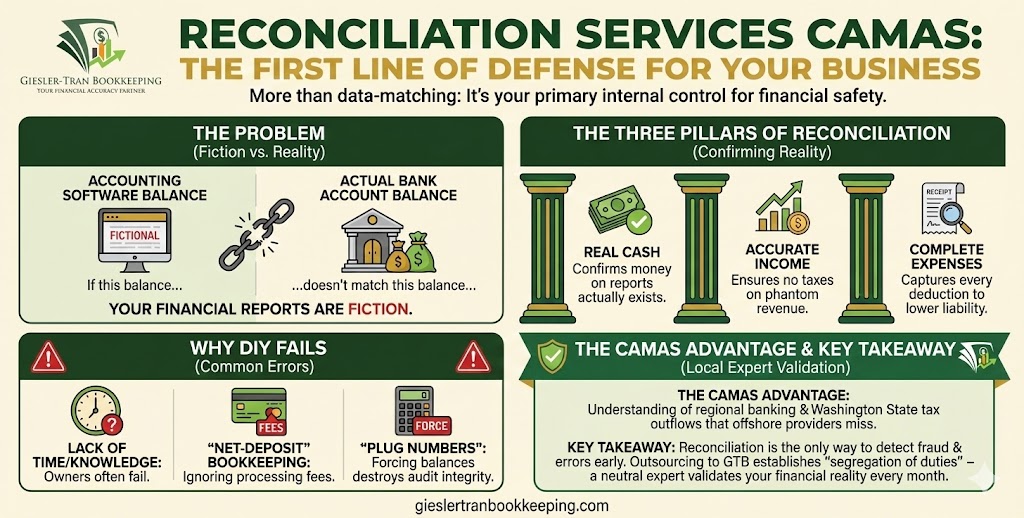

Specifically, bank reconciliation is the process of matching your internal accounting records to your bank and credit card statements line by line, every single month. However, effective reconciliation services Camas go deeper than simple data matching. When done correctly by our team, this process confirms three critical financial facts.

- Your cash balance is real: You can trust that the money you see in your reports is actually available to spend.

- Your income isn’t overstated: We ensure that sales are recorded accurately, preventing you from paying taxes on money you never received.

- Your expenses are complete: Every deduction is captured and correctly categorized, which is vital for reducing tax liability.

According to Investopedia, regular reconciliation is the primary internal control tool for detecting fraud. Without it, you are essentially leaving your financial doors unlocked.

Common Reconciliation Problems We See in Camas Businesses

Through our forensic-level bookkeeping cleanup work, we encounter frequent failures that plague local companies. Specifically, these issues distort cash flow and destroy credibility with banks. Here are the most common red flags that indicate a need for professional reconciliation services Camas.

First, we often see accounts that have been unreconciled for months, or even years. This negligence leads to a snowball effect of errors. Second, “net-deposit” bookkeeping from processors like Stripe or Square causes massive headaches. If you record the deposit amount but ignore the processing fees, you are underreporting your expenses and overpaying taxes. Third, “plug numbers” are frequently entered to force reports to balance. These are not small mistakes; they are fictional entries that will not stand up to an audit.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to verify the risk.

Why DIY Reconciliation Fails

Most business owners attempt reconciliation themselves—until they don’t. Here is the hard truth: reconciliation requires consistency, judgment, and independence. It is not simple data entry; it is an internal control. Consequently, DIY reconciliation usually fails for predictable reasons.

First, it gets skipped during busy months when sales take priority. Second, discrepancies are often ignored rather than investigated. Third, and most importantly, the same person entering transactions is often the one “verifying” them. This lack of segregation of duties defeats the entire purpose of the exercise. Therefore, outsourcing to a dedicated reconciliation services Camas provider ensures that a neutral third party is validating your data.

What Professional Reconciliation Services Camas Should Include

A legitimate service provider should deliver more than just a balanced checkbook. At GTB, our reconciliation services Camas package is comprehensive. We include the monthly reconciliation of all bank and credit card accounts as a standard baseline. Furthermore, we investigate and resolve discrepancies immediately.

Additionally, we identify missing, duplicated, or miscategorized transactions that could trigger an audit. Finally, we provide documentation that supports your audit-ready books. Anything less than this rigorous standard is merely cosmetic bookkeeping that looks good on the surface but rots underneath.

Local Matters: Why Camas Businesses Need a Dedicated Partner

Camas businesses face the same risks as any small business—but with higher stakes if you are growing, seeking financing, or planning an exit. Specifically, a local-focused reconciliation services Camas provider understands the regional economic landscape. We know the regional banking practices and the specific expectations of local CPAs and lenders.

Moreover, context matters when numbers are questioned. If you are a construction firm in Clark County dealing with Washington State B&O taxes, you need a reconciler who understands those specific outflows. Generic, offshore providers often miss these nuances, labeling critical tax payments as “uncategorized.” Therefore, partnering with a firm that understands the Pacific Northwest business environment is a strategic advantage.

Experience, Expertise, and Trust (E-E-A-T)

Effective reconciliation requires a specific set of skills. First, it demands the experience to spot patterns and anomalies that software misses. Second, it requires expertise in accounting systems and internal controls. Third, the provider must have the authority to challenge bad data instead of accepting it.

Finally, trustworthiness is built through documented, repeatable processes. If your reconciliations can’t be explained clearly, they can’t be trusted. With over 75 years of combined experience, our team brings this high level of E-E-A-T to every client file. See the IRS Recordkeeping page for why these standards are non-negotiable.

Q&A: Mastering Reconciliation

Q: How often should I reconcile my accounts?

A: Ideally, every single month. Waiting until year-end makes it nearly impossible to find errors efficiently.

Q: What if my bank balance doesn’t match QuickBooks?

A: Then you have an error. We perform a diagnostic review to find the discrepancy, whether it’s a missing deposit or a duplicate check.

Q: Does this include credit cards?

A: Absolutely. Credit card liability accounts must be reconciled just like cash accounts to ensure expenses are captured.

Q: I am six months behind. Can you help?

A: Yes. Our Cleanup services are designed specifically to catch you up and get you reconciled quickly.

Q: Why can’t I just use the “bank feed” feature?

A: Because the bank feed only brings data in; it doesn’t verify accuracy. Reconciliation is the check-and-balance against the feed.

Key Takeaways

- Verify Reality: Reconciliation services Camas confirm that your financial reports match the actual money in the bank.

- Detect Fraud: Regular review is the only way to catch unauthorized transactions before they drain your account.

- Tax Compliance: Accurate reconciliation prevents you from overpaying taxes on phantom income.

- Local Expertise: GTB brings regional knowledge and deep experience to protect your business.

In Summary: Clean Books Don’t Happen by Accident

Reconciliation isn’t optional; it is the backbone of financial integrity. If you are searching for a reconciliation service in Camas, don’t settle for someone who just checks boxes once a year. Demand monthly accuracy, accountability, and numbers you can defend. Clean books are built—one reconciliation at a time. Let Giesler-Tran Bookkeeping build that foundation for you.

Stop Guessing. Start Knowing.

Your bank balance should be a fact, not a theory.

Get reconciled today.

Read about our monthly reporting standards.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.