Effectively, proper e-commerce bookkeeping is the difference between a thriving online store and a tax nightmare. However, running a digital business often feels like juggling flaming swords. Specifically, between managing inventory, tracking shipping costs, and reconciling payment processors like Stripe, financial clarity often gets lost. Unfortunately, many entrepreneurs rely on spreadsheets until the revenue grows too large to manage manually. Below, we explain why implementing a professional system is critical for your survival and profitability.

E-Commerce Bookkeeping Guide: Scale Profits & Master Clearing Accounts

Listen on The Deep Dive — where we dig deeper into this topic:

‘Master the E-commerce Clearing Account Workflow’

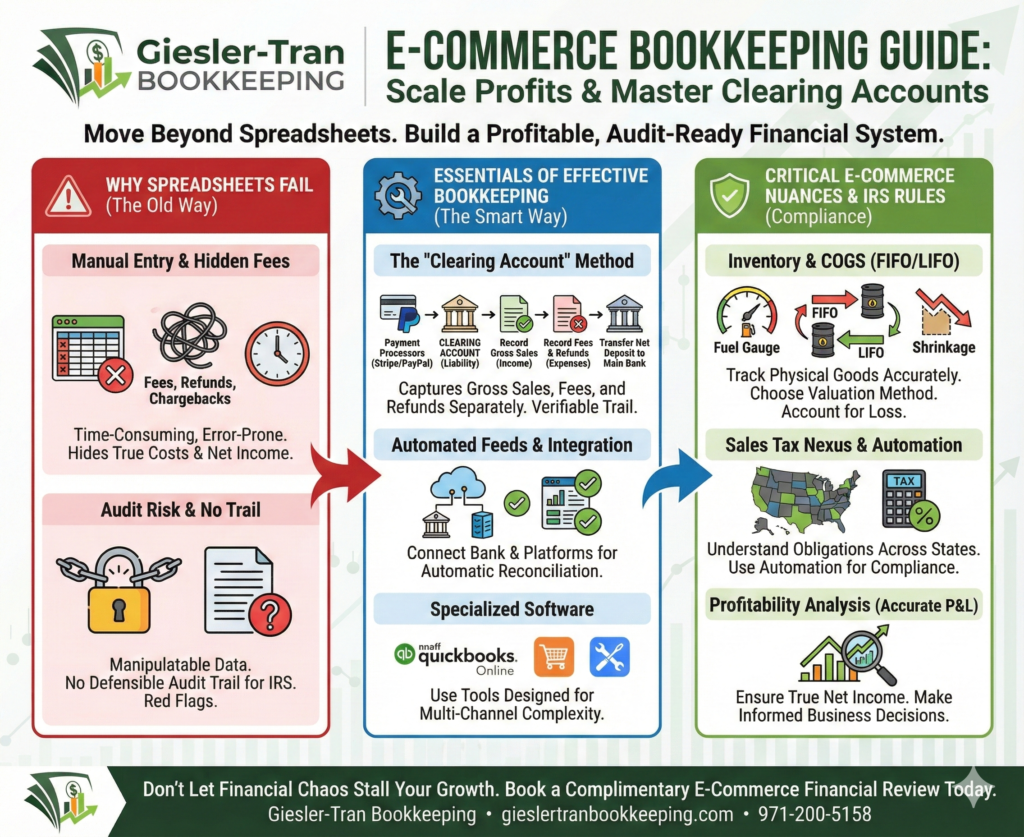

The Reality Check: Fundamentally, an online store is not a simple service business. Because you deal with multiple channels (Amazon, Shopify, Etsy) and complex payment processors, a standard bank feed setup will fail. Therefore, accurate e-commerce bookkeeping requires specialized “Clearing Accounts” to capture the true story behind every deposit.

Why E-Commerce Bookkeeping Requires Specialized Systems

First, let’s look at the revenue complexity. Unlike a consultant who sends an invoice and gets a check, you face multiple moving parts. Specifically, you might sell on your own website while also fulfilling orders via Amazon FBA. Consequently, each channel has unique reporting requirements.

Furthermore, payment processors like PayPal and Stripe create confusion. Typically, they deposit “net revenue” into your bank, which hides the fees, refunds, and chargebacks that occurred. Without a proper system, your Profit & Loss (P&L) statement remains inaccurate, leading to poor business decisions.

The “Clearing Account” Method in E-Commerce Bookkeeping

Next, we must address a critical error: recording net deposits as income. This is wrong because it understates your actual sales and hides your expenses. Instead, effective e-commerce bookkeeping utilizes a “Clearing Account.” Here is the workflow:

- Deposit Phase: Payment processors deposit funds into a clearing account (a liability account in QuickBooks).

- Record Gross Sales: We record the total sales figure before fees are taken out.

- Record Fees & Refunds: We itemize the processing fees and returns as separate expenses.

- Transfer Net: Finally, we transfer the matching net deposit to your main checking account.

Crucially, this method creates a verifiable trail. In an IRS audit, unverified revenue entries trigger red flags. Thus, a clearing account makes your numbers reliable and defensible.

Inventory and COGS in E-Commerce Bookkeeping

Moreover, you must track physical goods accurately. Specifically, Cost of Goods Sold (COGS) fluctuates with supplier pricing and shipping costs. Ideally, you should decide between FIFO (First-In, First-Out) or LIFO (Last-In, First-Out) valuation methods.

Additionally, “shrinkage” (damaged or lost stock) must be accounted for as a separate expense. If you mismanage this, you inflate your taxable income artificially. For guidance, refer to the IRS Publication 538 on Accounting Periods and Methods.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

“Act as an E-Commerce CFO advising Giesler-Tran Bookkeeping clients. Explain why recording net deposits from Stripe, Amazon, or other payment processors as income is dangerous for tax compliance. Detail the risks of misstated revenue and audit exposure, and describe the benefits of using a Clearing Account for proper reconciliation, ensuring accurate financial statements and a defensible audit trail.”

Sales Tax & Automation Challenges

Furthermore, e-commerce businesses face a nationwide challenge regarding sales tax nexus. While platforms like Amazon may collect taxes for you, your reporting must reflect this correctly to avoid penalties. Also, consult the SBA Guide on business obligations for more context.

Ultimately, manual entry is a huge time sink. By connecting bank feeds and payment processors to QuickBooks Online, you automate categorization. If your books are currently behind, our cleanup services can reconcile your past transactions to get you audit-ready.

Common Questions on E-Commerce Bookkeeping

- Q: Why can’t I just use spreadsheets?

- A: Spreadsheets lack an immutable audit trail and cannot automate bank feeds. They often lead to lost data and inaccurate tax filings as you scale.

- Q: What is a clearing account?

- A: It is a temporary holding account in your books used to separate gross sales, fees, and refunds before the net cash hits your bank.

- Q: Are Facebook Ads fully deductible?

- A: Yes, advertising costs are 100% deductible, but they must be properly documented and reconciled against your bank statements.

- Q: Do you support Amazon FBA sellers?

- A: Absolutely. We specialize in industries with complex inventory needs, including FBA and Shopify sellers.

- Q: How do I handle returns?

- A: High return rates require accurate reversal accounting. We track returns as a reduction in revenue to ensure you don’t pay taxes on money you refunded.

Learn more about our approach on our Monthly Services page.

Scale With Confidence, Not Guesswork

E-commerce is highly competitive. Your financial systems must keep pace. Investing in proper bookkeeping is not just a cost—it is a strategic advantage that protects your revenue and reduces tax risk.

Are your inventory numbers accurate?

Stop juggling flaming swords. Book a complimentary E-Commerce Financial Review today to secure your profit margins.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.