Effectively, Oil & Gas bookkeeping requires a level of precision that few other industries demand. Specifically, managing Joint Interest Billings (JIBs), tracking Authorization for Expenditures (AFEs), and reconciling complex revenue statements can overwhelm generalist bookkeepers. However, without specialized financial oversight, operators and investors risk massive cash leaks and compliance failures. Below, we outline exactly how Giesler-Tran Bookkeeping partners with energy companies to ensure financial clarity from the wellhead to the bank.

Oil & Gas Bookkeeping: Managing JIBs, AFEs, and Revenue with Precision

From the field to the ledger: precision matters.

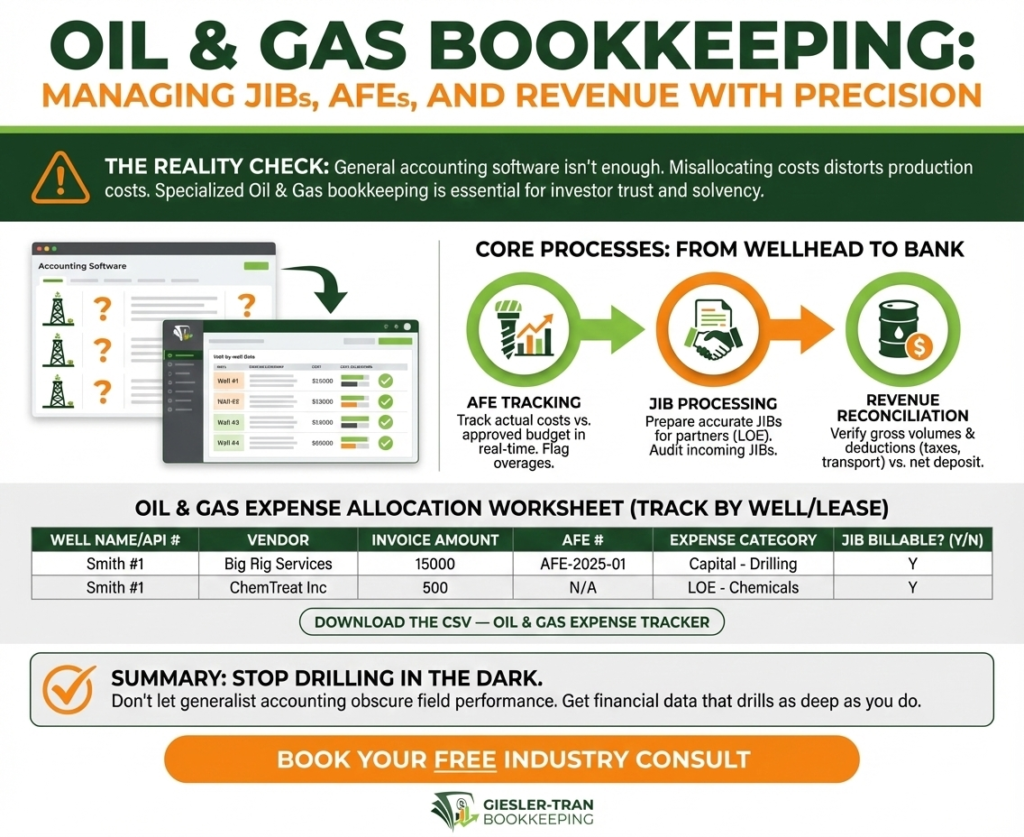

The Reality Check: Fundamentally, general accounting software is often not enough for the energy sector. If you are treating a drilling AFE like a standard expense or misallocating royalty payments, you are distorting your true cost of production. Therefore, specialized Oil & Gas bookkeeping is essential for maintaining investor trust and operational solvency.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Drilling Down: The Unique Challenges of Oil & Gas Accounting’

Why Specialized Oil & Gas Bookkeeping is Critical

First, the energy sector operates on a unique financial language. Specifically, operators must track costs by well, handle complex ownership percentages (Working Interest vs. Royalty Interest), and manage rigorous regulatory reporting. Moreover, failing to properly allocate costs via Joint Interest Billings (JIBs) means you might be subsidizing your partners’ expenses. Ultimately, correct Oil & Gas bookkeeping ensures you collect what you are owed and pay only what is fair.

For industry standards, the Council of Petroleum Accountants Societies (COPAS) sets the benchmark for energy accounting practices.

How We Manage AFEs and JIBs

Next, let’s look at the core of our service. Ideally, your financial workflow should look like this:

Authorization for Expenditure (AFE) Tracking

Crucially, we track actual costs against your approved AFE budget in real-time. This means flagging overages before they become disasters, ensuring capital is deployed efficiently.

Joint Interest Billing (JIB) Processing

Furthermore, for operators, we prepare accurate JIB statements to bill partners for their share of lease operating expenses (LOE). Conversely, for non-operators, we audit incoming JIBs to ensure you aren’t being overcharged.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as an Energy Sector CFO. Explain the importance of accurate AFE tracking and Joint Interest Billing (JIB) in Oil & Gas bookkeeping. Describe how poor tracking can lead to cash flow deficits for operators — and show how Giesler-Tran Bookkeeping ensures precise, reconciled records and reporting to maintain cash flow and operational efficiency.

Revenue Reconciliation: Following the Dollars

Additionally, revenue checks in this industry are notoriously complex. Specifically, they include deductions for severance taxes, transportation, and gathering fees. Instead of simply booking the net deposit, we verify the gross production volumes and deductions. This ensures you are receiving fair market value for your production and that tax liabilities are recorded correctly.

Oil & Gas Expense Allocation Worksheet

To assist you, use this table to organize expenses by well or lease. Simply copy this into a spreadsheet to streamline your Oil & Gas bookkeeping.

Smith #1,Big Rig Services,15000,AFE-2025-01,Capital – Drilling,Y

Smith #1,ChemTreat Inc,500,N/A,LOE – Chemicals,Y

Jones #2,Power Co,250,N/A,LOE – Utilities,Y

Corporate,Office Depot,150,N/A,G&A – Overhead,N

Alternatively, download the ready-to-use file here: Download the CSV — Oil & Gas Expense Tracker.

Moreover, if your current records are a mess of commingled costs, our cleanup services can untangle them well by well. Then, we can maintain order with our monthly bookkeeping support.

Common Questions on Oil & Gas Bookkeeping

- Q: Do you handle royalty distributions?

- A: Yes. We can calculate and prepare royalty checks for interest owners based on your division orders.

- Q: Can you integrate with WolfePak or other O&G software?

- A: Absolutely. We are experienced with industry-specific ERPs as well as QuickBooks/Xero configurations for smaller operators.

- Q: What about severance tax filings?

- A: We prepare the data and reports needed for state severance tax filings, ensuring you remain compliant with state agencies.

- Q: How do you handle “dry hole” costs?

- A: We properly classify these as exploration expenses rather than capital assets, adhering to the Successful Efforts or Full Cost accounting methods you utilize.

Stop Drilling in the Dark

Don’t let generalist accounting obscure your field performance. You need financial data that drills as deep as you do.

Ready to optimize your operations?

We specialize in the complexities of the energy sector. Book a complimentary Oil & Gas Financial Review today. We’ll assess your current JIB and AFE processes and show you where you can save.

Book Your Free Industry Consult

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.