The Hidden Bill: Why Cheap Bookkeeping Alternatives Often Cost More Than a Firm

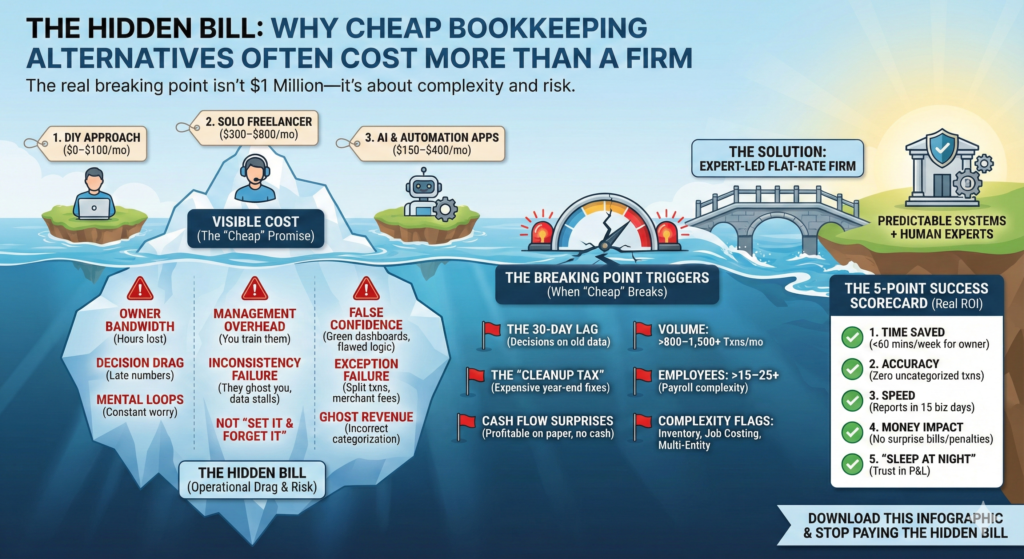

But in reality, revenue is a lagging indicator. The real breaking point isn’t about how much money you make; it’s about complexity and risk. Cheap bookkeeping options—like DIY or automated apps—often fail to account for these risks.

For most service businesses, the cracks start showing around $250k–$500k in annual revenue. For medical practices—where insurance reimbursements, payroll, and compliance add friction—the strain often hits even earlier. While cheap bookkeeping services promise savings, they rarely deliver the specialized attention these industries require.

If you are currently debating between DIY, hiring a freelancer, or using an “AI” app, you need to look beyond the monthly subscription fee. Many cheap bookkeeping alternatives come with hidden costs. If you’re comparing ultra-low offers, start here: $9.99–$19.99/day bookkeeping. If you’re considering automation, read this first: AI bookkeeping goes wrong. Every alternative has a “hidden bill”—a cost paid in time, stress, or bookkeeping cleanup fees later.

Here is the honest breakdown of your alternatives, where cheap bookkeeping fails, and the exact thresholds where you need to upgrade.

Part 1: The Signals (It’s Not Just About Revenue)

You don’t wake up one day with a “Bookkeeping Emergency.” The breaking point happens gradually, and **cheap bookkeeping** services often miss the specific operational triggers.

The General “Breaking Point” Triggers:

- The “30-Day” Lag: Your reconciliations are consistently 30–60 days behind. You are making today’s decisions based on numbers from two months ago.

- Cash Flow Surprises: You are profitable on paper, yet always short on cash.

- The “Tax Extension” Panic: Every year, you pay a CPA expensive hourly rates to “fix the books” just to file an extension.

- The “Cleanup” Tax: You realize fixing 12 months of small errors at year-end is more expensive than paying someone to do it right monthly.

The Triggers for Medical Practices:

- The A/R Black Box: You can’t easily answer, “How much is stuck in 90+ day aging?”

- Payroll Complexity: You’ve grown past 5 employees, and now you’re juggling benefits, overtime, and PTO accruals.

- Profitability Blindness: You can see the total bank balance, but you don’t know the profitability per provider or per location.

Part 2: The Alternatives (And Their Hidden Costs)

When you realize you can’t do it alone, you have three common options. Here is why these cheap bookkeeping options look attractive upfront—and where the hidden costs usually bury you.

1. The DIY Approach (The “Free” Option)

The Visible Cost: $0 – $100/month.

The Hidden Bill: Owner Bandwidth & Opportunity Cost.

Why it fails: You carry constant “mental open loops” (Did I categorize that loan correctly?). Worse, decision drag sets in—because numbers are late, you delay critical hiring or purchasing decisions.

2. The Solo Freelancer

The Visible Cost: $300 – $800/month (hourly).

The Hidden Bill: Management Overhead & Inconsistency.

Freelancers can be great, but they are not a “set it and forget it” solution. You are still the manager. You have to train them, review their work, and answer their questions. If they get sick or “ghost” you, your financial data stalls immediately.

A solo consultant with steady monthly revenue and no payroll hired a freelancer for a light monthly scope. Why it worked: The complexity was low. The owner didn’t need advisory or job costing—just accuracy. The Lesson: Freelancers work when your business is static. They struggle when you are scaling.

3. AI & Automation-Only Apps

The Visible Cost: $150 – $400/month.

The Hidden Bill: False Confidence & Exception Failures.

This is the most dangerous cheap bookkeeping alternative because it looks like it’s working. The dashboard is green, but the logic underneath is often flawed. The “False Confidence” Trap: Automation helps, but it struggles with edge cases: split transactions, merchant fees, chargebacks, and inter-account transfers.

One practice used an automated app that promised to “categorize everything.” The Result: The software treated patient payments, insurance reimbursements, and refunds as simple sales. It couldn’t map the difference between the deposit and the adjustment. The Cost: The owner was making decisions on “clean” looking charts that were actually full of ghost revenue. We had to rebuild the entire year to separate processor fees from revenue.

⚠️ Two “Solutions” I Advise Against

I am not against technology or global talent—we use both. But I advise against relying on them in these specific formats:

- “Autopilot” Dashboards: If the software makes a mistake, who catches it? If the answer is “nobody,” you have a liability, not a solution.

- Ultra-Low-Cost Offshore (Without a US Manager): If you are the one responsible for accuracy, documentation, and answering questions about US tax code, you haven’t outsourced the problem—you’ve just hired an assistant you have to train.

Part 3: The Quantitative Thresholds (When You NEED a Firm)

Sometimes the signs are subtle, but sometimes the math just tells you it’s time. Here are the hard numbers where cheap bookkeeping models consistently break.

1. Transaction Volume (The Universal Trigger)

- 150–300 transactions/month: DIY starts breaking.

- 300–800 transactions/month: A solo freelancer often struggles unless they are very strong and you have clean processes.

- 800–1,500+ transactions/month: You need a firm. At this volume, coverage, review, and continuity matter. Volume creates edge cases, and errors compound fast.

2. Employee Count (The Compliance Trigger)

- 0–5 employees: A solid freelancer + Gusto is fine.

- 6–15 employees: Workable with a freelancer, but requires tighter controls.

- 15–25+ employees: You need a firm. Payroll, reimbursements, multi-state compliance, and benefits create too many recurring exceptions for one person to reliably cover.

3. The “Complexity Flags” (The Override)

Even at lower volume, you need a firm if you have:

- Multiple entities or locations.

- Material Inventory/COGS (Retail/E-com).

- Essential Job Costing (Contractors).

- Proactive tax planning needs (not just “books done”).

Part 4: The “Middle Way” – The Expert-Led Flat-Rate Firm

There is a fourth option that bridges the gap between expensive full-service accounting and risky, cheap bookkeeping freelance work: The Expert-Led Flat-Rate Firm.

This model isn’t selling you hours; it’s selling you a result.

How it wins on Total Cost:

- Predictability: Unlike hourly freelancers, the cost doesn’t spike when you have a busy month.

- Systems, Not Just People: You aren’t relying on one person’s memory. You are buying into a standardized process that ensures accuracy regardless of who is on vacation.

- Exception Handling: We use modern automation tools, but we have experts who handle the “exceptions” and judgment calls. The technology supports accuracy; it doesn’t replace the accountant.

Part 5: The Toolkit (If You aren’t Ready for a Firm)

If you decide to stick with DIY or a freelancer for now, use these tools to protect yourself.

🛠️ The Recommended Tech Stacks

For Medical Practices

(The “Clean Close” Stack)

- Core: QuickBooks Online (or Xero).

- Receipts: Dext (Best for audit trails).

- Payroll: Gusto or QBO Payroll (Do not cut corners here).

- Rule: Keep your EHR/Practice Management system as the source of truth for patient A/R.

For Contractors

(The “Job Costing” Stack)

- Core: QuickBooks Online Plus/Advanced (You need “Projects”).

- Receipts: Dext (Critical for job receipts).

- Time Tracking: QuickBooks Time (TSheets) for labor costing.

- Rule: Job costs (materials, subs, labor) must be coded consistently, or your “profit per job” will be fiction.

🛡️ The Security Protocol

Treat hiring a freelancer like hiring someone to handle cash.

- Least Access: Never share bank logins. Use “Accountant” invites only.

- Bill Pay: Use Bill.com or Melio so they prepare payments, but you approve them.

- Trust But Verify: In the first 60 days, spot-check the “Audit Log” weekly and demand a formal month-end package (P&L + Balance Sheet + Reconciliation Reports).

💡 The Vetting Secret

If you interview a freelancer, ask this exact question to separate a “data entry clerk” offering cheap bookkeeping from a pro:

“Walk me through your month-end close checklist—step by step—and how you prove the books tie to the bank.”

- Red Flag: They talk about “categorizing transactions” or “using bank rules.”

- Green Light: They describe a repeatable workflow: Reconcile > Review > Adjust > Lock Period > Deliver Reports.

Part 6: How to Measure Success (The 5-Point Scorecard)

Whatever option you choose, you need to validate that it’s actually working. Use this scorecard to measure your ROI.

1. Time Saved (Are you off the hook?)Are you spending less than 30–60 minutes/week on bookkeeping? Are you no longer the “traffic cop” for receipts and questions?

2. Accuracy (The Non-Negotiable)

Are all bank and credit card accounts reconciled monthly? Are there zero “uncategorized” transactions at month-end?

3. Speed (Decision-Ready)

Do you get month-end reports within 15 business days? Late numbers = delayed decisions.

4. Money Impact (The Real ROI)

Fewer cleanup bills at tax time? No penalties for missed filings? Better cash flow because bills and taxes are planned, not surprises?

5. The “Sleep at Night” Factor

Do you trust your P&L? Do you feel calm going into tax time?

The Bottom Line

The right choice isn’t just about finding cheap bookkeeping to save money—it’s about getting accurate, on-time numbers you trust, with minimal owner involvement.

If your current solution isn’t passing the scorecard above, it might be time to stop looking for a “cheap bookkeeper” and start looking for a partner.

2 Responses