Eventually, every growing business hits a period of chaotic expansion where the administrative tasks simply cannot keep up with the revenue. Consequently, the monthly reconciliation gets pushed to “next weekend,” and then to “next month.” Before you know it, you are six months behind, tax season is looming, and your financial data is a black box. This is not a moral failing; it is a common operational bottleneck. However, the solution is not to panic or to hastily enter data yourself. The solution is a professional bookkeeping cleanup. At Giesler-Tran Bookkeeping (GTB), we view cleanup not as a chore, but as a financial rescue mission that restores your confidence and compliance.

Bookkeeping Cleanup: Rescuing Your Business from Financial Chaos

Why Catch-Up Work is the Foundation of Future Growth

The Reality Check: Fundamentally, you cannot file accurate taxes or make smart decisions based on messy data. If you hand a CPA a shoebox of receipts or a QuickBooks file full of uncleared transactions, they will either fire you or charge you triple to fix it. A bookkeeping cleanup is the prerequisite to a successful tax season. It stops the bleeding, organizes the history, and builds a clean foundation for the future.

Listen on The Deep Dive — where we unpack the process:

‘The Rescue Mission: Fixing Black Box Bookkeeping and Ghost Assets’

Signs You Need a Professional Bookkeeping Cleanup

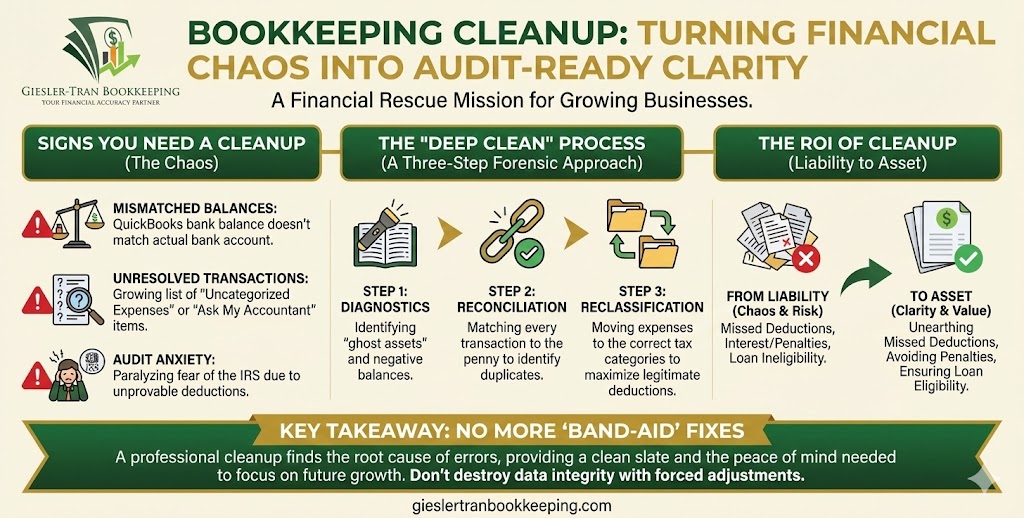

Often, business owners think they just need to “enter a few receipts” to catch up. However, true financial disarray runs deeper. Here are the clear signals that you need a forensic bookkeeping cleanup rather than just data entry.

First, your bank balance in QuickBooks does not match your actual bank balance. If these numbers don’t agree, every report you print is fiction. Second, you have a growing list of “Uncategorized Expenses” or “Ask My Accountant” transactions that never get resolved. Third, you are terrified of an audit because you know you couldn’t prove your deductions. According to Entrepreneur Magazine, ignoring these signs is a primary cause of cash flow failure.

The Anatomy of a Cleanup: It’s Not Just Data Entry

Why does a professional cleanup cost more than a freelancer’s hourly rate? Because we aren’t just typing; we are investigating. A proper bookkeeping cleanup involves three distinct phases.

- Phase 1: Diagnostics: We review the Balance Sheet for “ghost assets” (items that shouldn’t be there) and negative balances.

- Phase 2: Reconciliation: We match every single bank and credit card transaction to the penny, identifying duplicates and missing data.

- Phase 3: Reclassification: We move expenses into the correct tax categories to maximize your deductions and ensure compliance.

Ultimately, the goal is to produce a set of books that could survive an IRS audit today. This level of detail requires an expert eye, which is why we discuss the value of expertise in our Hidden Bill article.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the ROI of cleaning up your books.

The “Band-Aid” Fix vs. The Deep Clean

Occasionally, a business owner will try to apply a “band-aid” fix. They might force a reconciliation adjustment just to make the balance match. While this clears the error message, it destroys the integrity of your data. Adjustments without explanation are red flags to auditors.

In contrast, a GTB bookkeeping cleanup is a deep clean. We investigate the discrepancy. Was it a duplicate deposit? Was it a personal expense paid from the business account? We find the root cause and fix it. This ensures that your financial history is accurate, not just convenient. Check our Strategic Advantage page to understand why accuracy is non-negotiable for us.

The ROI: Why Cleanup Pays for Itself

Initially, the cost of a cleanup project can seem high. However, consider the alternative costs. Missed deductions from lost receipts can cost you thousands in taxes. Interest and penalties from underpayment are wasted money. Moreover, if you need a loan, a bank will reject an application with messy financials instantly.

Therefore, a bookkeeping cleanup is an investment. It unlocks tax savings, secures financing eligibility, and most importantly, gives you the peace of mind to sleep at night. You stop worrying about “what if” and start focusing on “what’s next.” See Investopedia’s guide on Forensic Accounting to see how deep financial investigation adds value.

Q&A: Everything You Need to Know About Cleanup

Q: How long does a cleanup take?

A: Typically, it takes 2 to 4 weeks depending on the volume and complexity. We prioritize speed without sacrificing accuracy.

Q: Do I need to find all my old receipts?

A: Ideally, yes, but we can work with bank statements to reconstruct the ledger. We will guide you on what is critical and what is optional.

Q: Can you fix my books from two years ago?

A: Yes. We can go back as far as necessary. However, fixing closed tax years may require you to file amended returns.

Q: Will my CPA be involved?

A: Absolutely. We often work directly with your CPA to ensure the cleaned books match their tax filing requirements.

Q: How do we prevent this from happening again?

A: Once the cleanup is done, we transition you to our monthly maintenance plan. This ensures you never fall behind again.

Key Takeaways

- Audit Readiness: A bookkeeping cleanup transforms your fear of the IRS into confidence.

- Tax Savings: Accurate categorization finds deductions you would otherwise miss.

- Root Cause Fixes: We don’t use “plug” numbers; we find the actual error and correct it.

- Fresh Start: Cleanup gives you a clean slate to build a profitable future.

In Summary: Stop Looking Back, Start Moving Forward

Ultimately, carrying the mental load of messy books is exhausting. It drains your energy and clouds your judgment. By investing in a bookkeeping cleanup, you are not just buying organized data; you are buying freedom. At Giesler-Tran Bookkeeping, we handle the mess so you can handle the business. Don’t let the past hold your future hostage.

The Bottom Line

Chaos is expensive. Clarity is priceless.

Start your rescue mission today.

Schedule Your Cleanup Evaluation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

7 Responses