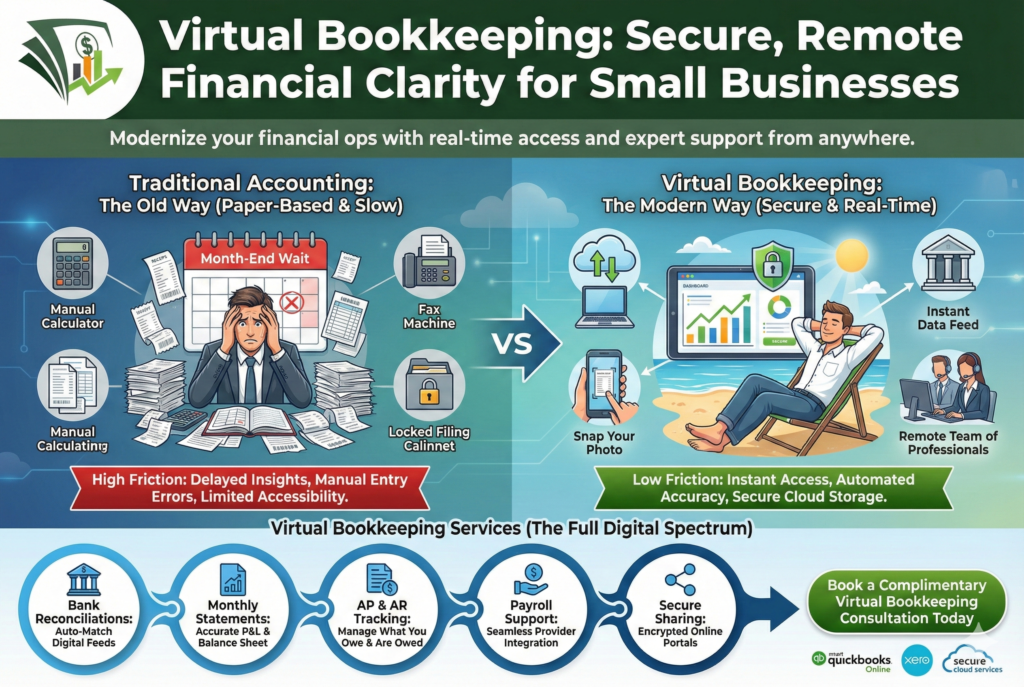

Effectively, modern businesses demand agility, and virtual bookkeeping delivers exactly that by untethering your finances from a physical office. However, many owners still struggle with piles of paper receipts and outdated desktop software that slows down decision-making. Specifically, our virtual bookkeeping model provides secure, real-time access to your financial health without the overhead of hiring in-house staff. Below, we outline how shifting to a remote financial team can streamline your operations and clarify your cash position.

Virtual Bookkeeping: Secure, Remote Financial Clarity for Small Businesses

The Reality Check: Fundamentally, you cannot grow a modern business with yesterday’s data. If you are waiting until the end of the month to see your bank balance, you are driving blind. Therefore, virtual bookkeeping is not just a convenience; it is a strategic necessity for real-time visibility.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Remote Advantage: How Virtual Bookkeeping Saves Time & Money’

Why Virtual Bookkeeping Works for Small Businesses

First, the primary benefit of going digital is accessibility. Unlike traditional methods that require on-site visits, virtual bookkeeping allows you to check your books anytime, anywhere. Furthermore, we utilize automated bank feeds to import transactions instantly. Consequently, this automation saves you hours of manual data entry every month and reduces human error.

Additionally, this approach ensures a timely monthly close. Specifically, our certified experts reconcile your accounts remotely, so you always know exactly where you stand. Ultimately, you receive clear financial statements and dashboards that help you make smarter business decisions without the wait.

For insights on cloud security standards, visit the AICPA’s Technology Resources.

Virtual Bookkeeping Services We Offer

Next, it is important to understand that “virtual” does not mean “limited.” In fact, our remote capabilities cover the full spectrum of financial management. Ideally, your virtual bookkeeping package should include:

- Bank Reconciliations: We match your digital feeds to your bank statements perfectly.

- Monthly Statements: We deliver accurate P&L and Balance Sheet reports.

- AP & AR Tracking: We manage who you owe and who owes you.

- Payroll Support: We coordinate with your payroll provider for seamless entries.

- Secure Sharing: You upload receipts safely using encrypted online portals.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a Small Business Advisor working with Giesler-Tran Bookkeeping. Explain the security and efficiency benefits of virtual bookkeeping compared to traditional paper-based accounting. Describe how automated bank feeds reduce manual errors and significantly improve accuracy in financial reporting.

How to Get Started with Virtual Bookkeeping

Furthermore, transitioning to a digital system is easier than you think. Typically, we start by connecting your accounts to secure cloud software like Xero or QuickBooks Online. Then, if your historical data is messy, our cleanup services bring you up to date.

Moreover, once the foundation is set, we move to monthly recurring support. Thus, you gain peace of mind knowing a professional is watching your transactions daily.

Also, see how Cloud Accounting powers remote teams.

Common Questions on Virtual Bookkeeping

- Q: Is virtual bookkeeping secure?

- A: Yes. We use bank-grade encryption (256-bit SSL) and secure client portals. We never ask for your direct banking passwords.

- Q: How do I send you receipts?

- A: You can simply snap a photo via a mobile app or forward email receipts to a dedicated address. We handle the digital filing.

- Q: Do I lose control of my finances?

- A: Never. You maintain full approval authority on all payments. We prepare the data; you push the button.

- Q: Can you help with taxes?

- A: While we focus on virtual bookkeeping, we prepare audit-ready financial packages that make your CPA’s job faster and cheaper at tax time.

Learn more about our team on our About Us page.

Remote Convenience, Local Care

Remote bookkeeping that feels local. Get real-time updates, expert eyes on your money, and the freedom to run your business from anywhere.

Ready to go virtual?

We make the transition seamless. Book a complimentary Virtual Bookkeeping Consultation today. We’ll show you how easy it is to modernize your financial ops.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.