Every small business owner eventually faces a critical crossroads: continue managing finances on a spreadsheet or invest in professional business bookkeeping services. Initially, the DIY approach seems cost-effective, but as transaction volume grows, so does the complexity. Consequently, what worked for a solo operator often becomes a liability for a growing team. At Giesler-Tran Bookkeeping (GTB), we believe that your financial foundation should be as unique as your business model. Therefore, we reject the “one-size-fits-all” mentality in favor of custom business bookkeeping services that deliver clear P&Ls, accurate cash flow reports, and seamless payroll coordination. By choosing a tailored approach, you can scale with confidence, knowing your numbers reflect reality.

Small Business Bookkeeping Services: Why Custom Plans Outperform Generic Apps

Tailored Plans for Your Unique Needs

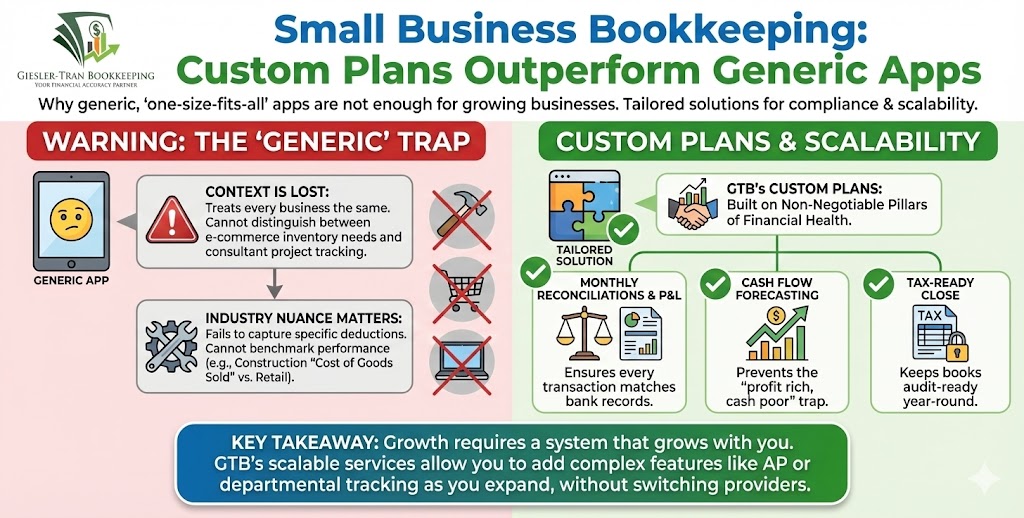

The Reality Check: Fundamentally, most automated or generic business bookkeeping services treat a construction company exactly the same as a digital marketing agency. However, this lack of nuance is dangerous. While a generic tool might track expenses, it often misses industry-specific deductions, job costing intricacies, and revenue recognition rules. Ultimately, if your bookkeeping doesn’t fit your industry, it is not serving your growth.

Listen on The Deep Dive — where we unpack the value of customization:

‘DIY Bookkeeping Kills Small Business Profit’

Why Tailored Business Bookkeeping Services Matter

Every small business is different, and your bookkeeping shouldn’t be a generic template. At Giesler-Tran Bookkeeping, we offer customized plans designed to fit your industry, size, and goals—so you get exactly what you need, and nothing you don’t. When you engage with professional business bookkeeping services, you should expect more than just data entry; you should expect a strategic partner.

Specifically, tailored plans address the nuance of your operations. For example, an e-commerce brand needs rigorous inventory tracking and sales tax management across state lines. In contrast, a service-based consultant focuses heavily on time-tracking and project profitability. Therefore, a generic plan often leaves gaps that become costly liabilities during tax season. By aligning your financial tracking with your operational reality, we ensure that your reports actually tell the story of your business.

Industry Expertise in Business Bookkeeping Services

Whether you are in retail, healthcare, real estate, or professional services, our plans are built to address your sector’s unique challenges. Undoubtedly, industry expertise is the differentiator between a data processor and a financial advisor. For instance, in construction, job costing is essential to know which projects are profitable and which are bleeding cash.

Furthermore, specialized business bookkeeping services help you benchmark your performance against competitors. If your “Cost of Goods Sold” is 10% higher than the industry average, we can flag that immediately. This insight allows you to pivot strategies quickly rather than waiting until the end of the year. For more on how we tailor our approach, read about our Strategic Advantage.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see why tailored bookkeeping is essential for valuation.

Core Features of Our Business Bookkeeping Services

While customization is key, every healthy business requires a strong foundation. Consequently, our business bookkeeping services always include these non-negotiable pillars of financial health:

- Monthly Reconciliations & P&L: We ensure every bank and credit card transaction matches your records to the penny, providing you with an accurate Profit & Loss statement every single month.

- Cash Flow Forecasting: You will know exactly when cash is tight and when it is safe to invest. This prevents the common “profit rich, cash poor” trap.

- Tax-Ready Close Process: Never scramble in April again. We keep your books audit-ready year-round, making tax filing seamless.

- Payroll Coordination: We ensure your team gets paid correctly and that all payroll liabilities are recorded accurately in your ledger.

Flexible Scope and Scalable Support

Growth is the goal, but growing pains are real. Fortunately, our business bookkeeping services are designed to scale with you. Initially, you may only need basic reconciliation and monthly reporting. However, as you expand, you might need Accounts Payable (AP) management, Accounts Receivable (AR) collections, or complex departmental tracking.

Instead of switching providers every time you hit a revenue milestone, GTB evolves with you. You can add services as needed, ensuring you never pay for bloated packages you don’t use. This scalability is vital for startups and established businesses alike. According to the U.S. Small Business Administration, scalable financial systems are a top predictor of long-term survival.

How We Build Your Custom Plan

Building the perfect plan requires a partnership, not just a transaction. Here is our proven process for onboarding new clients into our business bookkeeping services:

- Free Evaluation: We start with a complimentary review of your current books, business model, and goals to identify immediate red flags.

- Personal Consultation: You work directly with a certified expert to discuss your pain points. Do you hate invoicing? Are you worried about tax compliance? We listen first.

- Custom Proposal: Next, you get a detailed, written plan outlining all recommended services and clear next steps, ensuring total transparency.

- Ongoing Adjustments: Finally, quarterly reviews ensure your plan always fits your evolving needs. If your business pivots, so do we.

Ready to see what this looks like for your budget? Check our guide on Pricing & Plans.

Q&A: Choosing the Right Business Bookkeeping Services

Q: Do I really need a custom plan? Can’t I just use a flat-rate app?

A: While apps are cheap, they lack context. Generic services often misclassify transactions, costing you thousands in missed deductions. Custom plans pay for themselves in tax savings.

Q: What if I am behind on my books?

A: Don’t worry; it happens. We offer specialized Bookkeeping Cleanup services to get you current before starting your monthly plan.

Q: Will I have a dedicated bookkeeper?

A: Yes. Unlike call-center style services, GTB provides you with a dedicated point of contact who knows your business inside and out.

Q: Is this service tax preparation?

A: Our primary focus is bookkeeping, which prepares the data for taxes. However, we work seamlessly with your CPA or our internal tax partners to ensure filing is effortless.

Q: How do I get started?

A: Simply schedule a free consultation. We will assess your needs and provide a quote with no obligation.

Key Takeaways

- Customization Wins: Tailored plans ensure you capture industry-specific deductions and insights.

- Scalability is Key: Choose a partner that can grow from basic reconciliation to full advisory support.

- Transparency Matters: Avoid hidden fees with clear, custom quotes based on your actual volume.

- Expertise Over Apps: Human oversight prevents the costly errors common in automated solutions.

In Summary: Stop Settling for Generic

Ultimately, your business is too important to trust to a generic algorithm. By investing in professional, customized business bookkeeping services, you gain more than just compliance; you gain a competitive edge. Stop settling for generic solutions. Start demanding a plan that fits your vision.

The Bottom Line

Save time. Save money. Reduce stress.

Get a bookkeeping plan that fits.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.