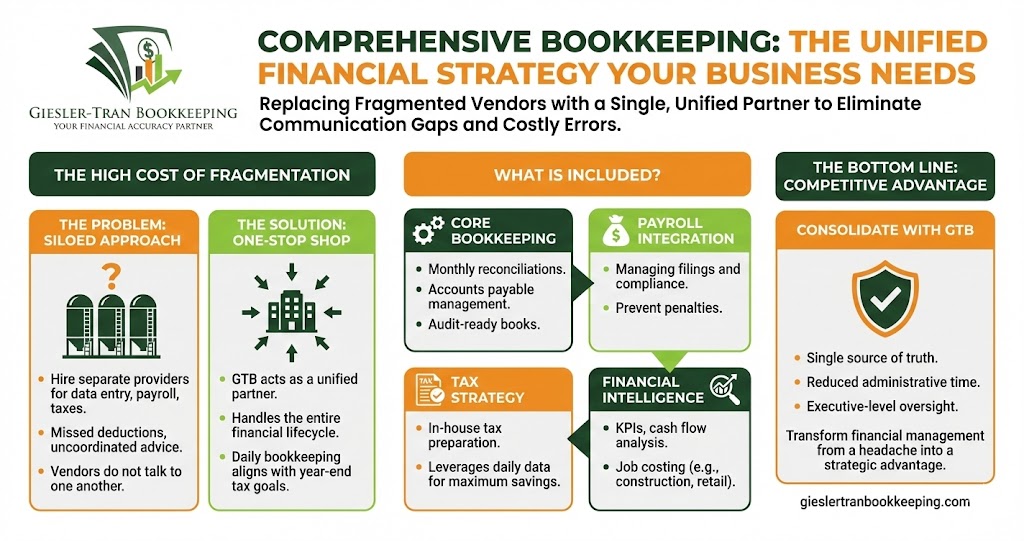

Running a business requires wearing many hats, but wearing the “CFO” hat shouldn’t consume your entire day. For ambitious entrepreneurs, searching for comprehensive bookkeeping is the smartest move to streamline operations. Often, business owners try to piece together a financial team by hiring a payroll app here, a tax preparer there, and a data-entry clerk somewhere else. However, this fragmented approach often leads to communication gaps and costly errors. Therefore, Giesler-Tran Bookkeeping (GTB) acts as your one-stop shop for complete financial management. By offering comprehensive bookkeeping, we unite payroll, tax strategy, and daily accounting into a single, powerful engine that drives your business forward.

Comprehensive Bookkeeping: Unifying Your Financial World

One partner. Complete clarity. Zero headaches.

The Reality Check: Fundamentally, fragmentation is the enemy of accuracy. When your tax preparer doesn’t talk to your bookkeeper, deductions get missed. When your payroll provider doesn’t understand your cash flow, overdrafts happen. Comprehensive bookkeeping solves this by placing every piece of your financial puzzle under one roof. You shouldn’t have to be the messenger between three different vendors; you should have one partner who handles it all.

Listen on The Deep Dive — simplifying finance:

‘The Power of All-in-One Financial Management’

The High Cost of Non-Comprehensive Solutions

First, let’s address why businesses often end up with messy financials. Many business owners mistakenly believe they save money by hiring a cheap freelancer for data entry and a separate, expensive CPA for taxes. In reality, this disconnection costs significantly more in the long run. Because the CPA only sees the books once a year, they often charge thousands to “fix” the low-quality work done by the freelancer.

Furthermore, this approach lacks strategic oversight. Without comprehensive bookkeeping, no one is watching the shop day-to-day with a tax strategist’s eye. For instance, a disconnected bookkeeper might categorize a new vehicle purchase incorrectly, causing you to lose out on depreciation benefits. At GTB, your tax strategist and your bookkeeper are on the same team, ensuring that nothing slips through the cracks. To understand the risks of poor record-keeping, refer to this IRS guide on compliance.

The Scope of Our Comprehensive Bookkeeping Services

We built our offerings to cover every aspect of your financial lifecycle. Consequently, there are no gaps in your coverage. Unlike basic data entry, our comprehensive bookkeeping approach ensures every part of your financial engine works together seamlessly.

Core Bookkeeping

Stay on top of your transactions and accounts payable. Also, we handle monthly reconciliations to ensure you always have clear, audit-ready books. This isn’t just about recording history; rather, it gives you accurate data for future decisions.

Payroll Integration

We provide accurate, on-time payroll for your team. Furthermore, we handle all filings and compliance tasks so you never worry about penalties. By integrating payroll with your comprehensive bookkeeping, we prevent common errors that plague disconnected systems.

Tax Preparation & Strategy

Enjoy end-to-end support for business and personal tax returns. Our in-house Senior Tax Accountant manages this crucial part of your health. Thus, your smart tax bookkeeping aligns perfectly with year-end filing goals.

Financial Reporting & Insights

We deliver custom reports and KPI dashboards. Consequently, you always know exactly where your business stands. We translate complex data into plain English, turning your numbers into a roadmap for growth.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the value of integration.

Moving Beyond Data Entry to Financial Intelligence

Crucially, modern business demands more than just historical recording. While basic bookkeeping tells you where you spent money last month, comprehensive bookkeeping tells you how to make money next month. At GTB, we leverage technology to provide real-time insights. Instead of waiting until April to know if you made a profit, you receive monthly reports that highlight trends, margins, and opportunities.

Additionally, this holistic view allows for better cash flow management. When we see the full picture—including upcoming tax liabilities and payroll cycles—we can advise you on when to invest and when to conserve cash. This level of advisory is often reserved for large corporations with in-house CFOs, but we make it accessible to small businesses. For more on the importance of financial intelligence, Investopedia offers great resources.

Industry-Specific Solutions

Moreover, we understand that every industry operates differently. A retailer has vastly different needs than a construction company. Therefore, our comprehensive bookkeeping services are tailored to your specific sector.

- Retail & E-Commerce: We focus on inventory management, sales tax compliance across state lines, and margin analysis.

- Service & Construction: We implement job costing to ensure you know exactly which projects are profitable and which are draining your resources.

- Medical Practices: We handle the complexities of patient billing reconciliation and ensure your books are compliant with industry standards.

If you have fallen behind on your records, do not worry. Our catch-up plans are designed to perform fast, thorough clean-ups. Specifically, we fix prior years so you can move forward with confidence.

Why Choose GTB for Comprehensive Bookkeeping?

Choosing a partner for your financials is a major decision. Here is why clients rely on GTB for their total financial health. We believe in building relationships, not just processing transactions.

- Everything Under One Roof: You no longer need to juggle multiple vendors or transfer files between them.

- Maximum Efficiency: We provide the seamless integration of bookkeeping, payroll, and tax, reducing administrative time by hours every week.

- Executive Oversight: Also, you receive personalized service and oversight for every client, ensuring quality control.

- Scalable Solutions: Finally, our comprehensive bookkeeping services grow alongside your business, from startup to enterprise.

Q&A: All-in-One Finance

Q: Do I have to switch my payroll provider to work with you?

A: Not always, but we highly recommend integrating payroll into our ecosystem. This allows us to catch errors instantly and ensure tax compliance is automatic.

Q: What if I only need tax prep?

A: While we can do tax-only work, the real value comes from comprehensive bookkeeping. When we handle the daily books, we can guarantee the tax return is optimized for maximum savings.

Q: Is this service more expensive than hiring a freelancer?

A: It might have a higher monthly fee, but it is cheaper than the cost of fixing mistakes. Plus, the tax savings strategies we implement often pay for the service itself.

Q: How does onboarding work?

A: We start with a deep dive into your current systems. Then, we build a custom workflow, gain access to your accounts, and begin the cleanup process immediately.

Q: Can you handle multi-state businesses?

A: Yes. Our comprehensive bookkeeping covers complex nexus issues, multi-state payroll, and varying sales tax requirements.

Key Takeaways

- Stop Fragmenting: Using separate vendors for tax, payroll, and books creates costly data silos.

- Gain Clarity: Comprehensive bookkeeping provides a single source of truth for your business finances.

- Save Time: Eliminate the need to coordinate between different providers; we handle it all.

- Plan Ahead: Integrated services mean your tax strategy happens all year long, not just in April.

In Summary: Your Unified Financial Future

Ultimately, successful businesses run on clear, accurate, and timely data. With GTB, you get more than a bookkeeper; you get a dedicated partner committed to your business’s success. By choosing our comprehensive bookkeeping packages, you free yourself from the weeds of administration and gain the freedom to focus on growth. Experience the simplicity and confidence of a unified financial strategy. Book your free consultation with Giesler-Tran Bookkeeping today.

Simplify Your Financial Life

One partner. One vision. Zero stress.

Switch to comprehensive bookkeeping today.

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.