Missing receipts can feel like a ticking time bomb for business owners juggling client acquisition and employee management. Consequently, in the whirlwind of daily operations, administrative tasks often fall to the bottom of the priority list, leading to gaps in essential documentation.

Recently, a client panicked during our year-end review because they discovered a significant gap in their financial records. Specifically, they feared that these missing receipts for several large purchases would automatically disqualify their hard-earned deductions.

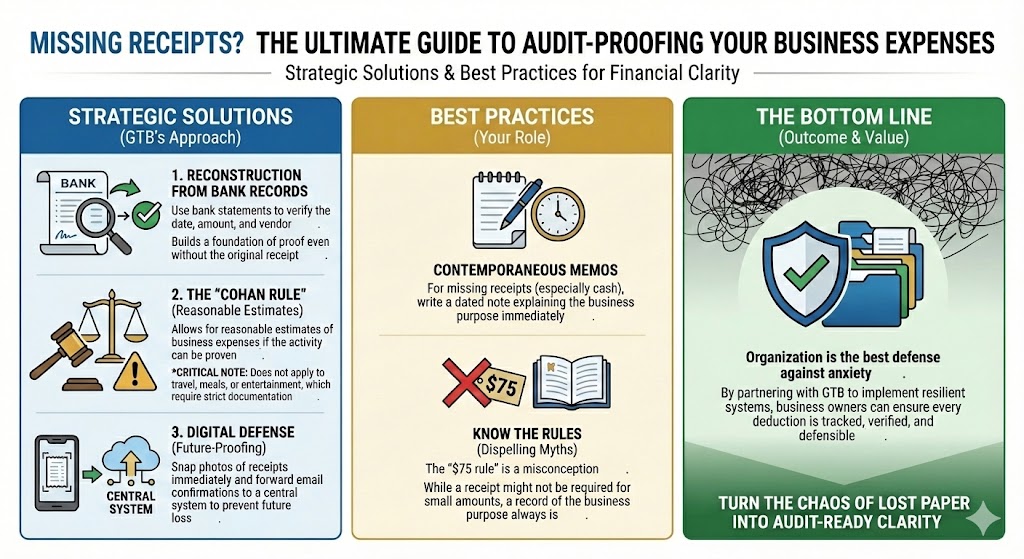

However, at Giesler-Tran Bookkeeping (GTB), we know that paperwork sometimes slips through the cracks. In fact, accurate bookkeeping isn’t about being perfect; it involves knowing how to legitimately reconstruct the narrative of your business expenses to satisfy the IRS.

If you are losing sleep over missing receipts, you are not alone. More importantly, you are not necessarily out of luck.

Missing Receipts: The Ultimate Guide to Audit-Proofing Your Deductions

Organization defeats anxiety every time.

The Reality Check: Fundamentally, a credit card statement proves you spent money, but it does not prove business intent. For example, a charge at Amazon could be for office toner or a personal gift.

Therefore, relying solely on bank feeds to cover for missing receipts—especially for meals and travel—leaves you vulnerable. Always annotate the business purpose to stay safe. Documentation is your only shield against an auditor’s red pen.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Myth of the Lost Receipt’

How We Handle Missing Receipts Strategically

First, do not panic. Missing receipts happen to every business owner, from solo freelancers to Fortune 500 CEOs. However, ignoring the problem will only make it worse.

Consequently, we employ a specific cleanup strategy to help you stay compliant and organized, even if you lack physical paper.

- Reconstruction: We use your bank and credit card statements to verify the date, amount, and vendor of business expenses to fill in the gaps. While this doesn’t replace the receipt, it builds a foundation of proof.

- Expense Memos: For transactions containing missing receipts, we recommend you add a note explaining the business purpose directly in your bookkeeping software. This acts as your safety net if you ever face an audit.

- Digital Solutions: Ultimately, we help you set up systems (like snapping photos for QuickBooks Online) so you never lose a document again. Automation is the cure for disorganization.

Furthermore, successful reconstruction requires diligence. If you can prove that you regularly purchase office supplies from a specific vendor, the IRS is more likely to accept a reconstructed record for a missing receipt than if the expense appears to be a one-off outlier.

What Happens If You Get Audited With Missing Receipts?

Crucially, the IRS generally accepts secondary evidence if you can prove the expense occurred. However, specific rules apply depending on the expense type, and understanding these nuances is critical for your defense. Therefore, having a knowledgeable partner like GTB is essential.

The Cohan Rule and Reasonable Estimates

Historically, a famous tax court ruling known as the “Cohan Rule” allows business owners to estimate expenses if they can prove the business activity happened. This rule originated when Broadway pioneer George M. Cohan sued the IRS and won, establishing that a lack of paper should not entirely disqualify legitimate business costs.

Nevertheless, this does not apply to travel, meals, or entertainment. Under Section 274(d) of the Internal Revenue Code, strict substantiation is required for these categories. Therefore, having audit-ready documentation for those categories remains non-negotiable. For more on substantiation, review IRS Publication 463.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify the rules.

Best Practices to Avoid Missing Receipts

Moving forward, consistency saves you time and anxiety. Specifically, we advise all our clients to implement a proactive system rather than a reactive one.

Here are the best practices to eliminate the problem of missing receipts forever:

- Snap a photo immediately: Receipts printed on thermal paper fade quickly. By digitizing them instantly, you ensure the record lasts forever.

- Email digital receipts: Forward email confirmations directly to your bookkeeping software or a dedicated Google Drive folder. This centralizes your data.

- Keep a log for cash: Cash expenses are the most dangerous because they leave no digital paper trail at the bank. Therefore, a written log is essential for these items.

Additionally, consider using dedicated expense management apps. Tools like Dext or the receipt capture feature in QuickBooks Online can automate this process. For a comparison of these tools, check out NerdWallet’s guide to expense trackers.

Common Questions About Missing Receipts

Q: Can I just use my bank statement?

A: Sometimes. For simple supplies, yes. However, for meals and large assets, the IRS requires itemized proof of purchase to verify exactly what was bought.

Q: What about the $75 rule?

A: Technically, the IRS says you don’t need a receipt for expenses under $75 (excluding lodging). But you still must document the business purpose, date, and location in your books to survive an audit.

Q: What if I paid with cash?

A: Unfortunately, missing receipts for cash are the hardest to prove. We strongly recommend writing a dated memo immediately to create a contemporaneous record.

Q: Does a credit card slip count?

A: Not entirely. It proves the amount and date, but not the item. Ideally, you want the itemized invoice.

Q: Can you help me reconstruct last year’s books?

A: Yes. Our cleanup services are designed exactly for this scenario. We excel at piecing together the financial puzzle.

Key Takeaways

- Don’t Panic: Missing receipts are not the end of the world; reconstruction is possible with the right strategy.

- Know the Rules: Understand that travel and meals require stricter proof than office supplies due to IRS regulations.

- Go Digital: Stop relying on shoeboxes. Cloud storage is secure, searchable, and audit-proof.

- Seek Expertise: Partnering with GTB ensures you have an expert to guide you through substantiation questions.

In Summary: Documentation is Key

Ultimately, don’t let missing receipts keep you up at night. While perfect records are the goal, resilient systems are the reality.

By partnering with Giesler-Tran Bookkeeping, you ensure that every deduction gets tracked, verified, and defended. We turn the chaos of lost paper into the clarity of digital order.

Experience the peace of mind that comes from knowing your financial house is audit-ready. Book your free consultation with Giesler-Tran Bookkeeping today.

Stop Worrying About Lost Paperwork

Have missing receipts or questions about documentation?

We’re here to help—no judgment, just solutions!

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response