The urgent need to fix prior years of financial records is the primary reason many business owners approach us, worried that their bookkeeping challenges span far beyond the current calendar year. Naturally, they feel overwhelmed and ask if we only handle current records or if we possess the capability to help with older, messier situations.

Specifically, the most common question we hear is whether we can legitimately clean up this neglected data without triggering an audit. Below, we explain exactly how we tackle multi-year catch-ups to get your bookkeeping back on track, compliant, and audit-ready.

Can Giesler-Tran Fix Prior Years of Bookkeeping?

It’s never too late to get organized.

The Reality Check: Fundamentally, ignoring prior years doesn’t make them go away; it usually makes tax issues worse. While you might be tempted to just start fresh in January, the IRS requires continuity. Therefore, taking the time to fix prior years isn’t just about organization—it’s essential for legal compliance, securing loans, and sleeping better at night.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Multi-Year Catch-Up Strategy’

We Can Fix Prior Years and the Current Year

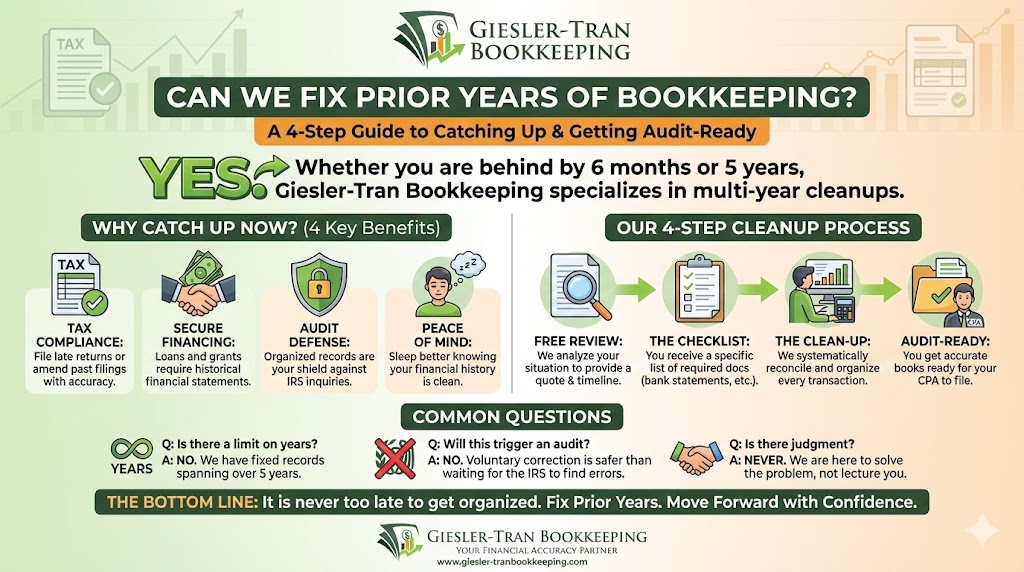

First and foremost, the answer is a resounding yes. At Giesler-Tran Bookkeeping (GTB), we understand that bookkeeping challenges rarely stick to a single calendar year. Consequently, we routinely clean up and organize books for previous years, not just the current one.

Whether you have fallen behind by a few months or need to fix prior years stretching back half a decade, we possess the expertise to get your records up to date. Of course, we also handle current-year catch-up and ongoing monthly services simultaneously. This holistic approach ensures that once you are caught up, you stay caught up forever.

Why Catch Up on Prior Years?

Furthermore, why is it so critical to address these old records instead of just moving forward? Specifically, catching up on historical data is vital for several strategic reasons beyond simple compliance.

- Tax Compliance: Filing late tax returns or amending past filings accurately requires precise data.

- Financing: Applying for loans or grants almost always requires historical financial statements to prove stability.

- Audit Defense: Preparing defensively for potential audits or IRS inquiries starts with organized, proof-backed records.

- Business Strategy: Gaining a clear financial picture allows you to identify trends and make better future business decisions.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below to verify the urgency.

What’s the Process to Fix Prior Years?

Next, you might wonder how we tackle such a large project without disrupting your current operations. Generally, our process follows four clear, methodical steps designed to minimize your stress.

- Free Review: First, we review your unique situation to provide a custom quote and timeline for every year needing catch-up.

- Checklist: Then, you receive a specific list of required documents for each year (like old bank statements and tax returns).

- Clean-up: We organize, reconcile, and document everything systematically—either one year at a time or concurrently, based on your urgency.

- Audit-Ready Results: Ultimately, your books become accurate, organized, and ready for tax time or loan applications.

How Many Years Can You Fix?

Finally, is there a limit to how far back we go? In short, no. We have helped clients fix prior years ranging from a single missed quarter to over five years of neglected records. While the timeline and cost depends on volume and complexity, we always provide a clear estimate before we start.

Additionally, we prioritize the years that are most urgent. For instance, if you have an IRS notice regarding 2022, we will focus on that year first while queuing up 2023 and 2024. This strategic approach ensures you put out the hottest fires first.

“I was three years behind. Brian and his team got me caught up, organized, and ready for my CPA—without judgment or stress.”

Q&A: Catching Up on Old Books

Q: Will fixing old books trigger an audit?

A: Actually, accurate books are your best defense. Filing corrected returns voluntarily is much safer than waiting for the IRS to find errors.

Q: Do I need all my old receipts?

A: Ideally, yes. However, if receipts are lost, we can use bank statements to reconstruct expenses using valid accounting methods.

Q: Can I pay in installments?

A: Yes. We understand cash flow is tight, so we offer flexible payment plans for large multi-year cleanup projects.

Q: How long does it take?

A: Typically, we can turn around a full year of records in 2-4 weeks, depending on how quickly we receive your documents.

Q: Can you work with my CPA?

A: Absolutely. We prefer to collaborate directly with your tax professional to ensure the amended returns are filed correctly.

Key Takeaways

- No Limits: We can fix prior years regardless of how far back they go.

- Strategic Value: Catching up is essential for loans, compliance, and peace of mind.

- Proven Process: Our four-step system ensures nothing falls through the cracks.

- Judgment Free: We are here to help you solve the problem, not to lecture you about the past.

In Summary: It’s Never Too Late

Ultimately, don’t let shame or stress stop you from fixing older records. The relief of being fully caught up is priceless. Instead, let us handle the heavy lifting so you can move forward with confidence. When you choose to fix prior years with GTB, you are investing in a clean slate and a brighter financial future.

Get Your Business Back on Track

Ready to get every year caught up?

Let’s make tax time easier than ever!

Audit-Ready. Tax-Smart. Built for Medical & Service-Based Businesses.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response