Effectively, Nonprofit Audit Prep is the single most important activity for reducing administrative stress during tax season. However, many leaders view the annual audit as a terrifying season of scrutiny. Specifically, preparing a single, organized audit package in advance transforms the process from a chaotic scramble into a confident demonstration of stewardship. Below, we outline exactly how to master your Nonprofit Audit Prep to shorten auditor fieldwork, reduce fees, and minimize findings.

Nonprofit Audit Prep: The Ultimate Checklist to Slash Fees

Preparation pays off in lower fees.

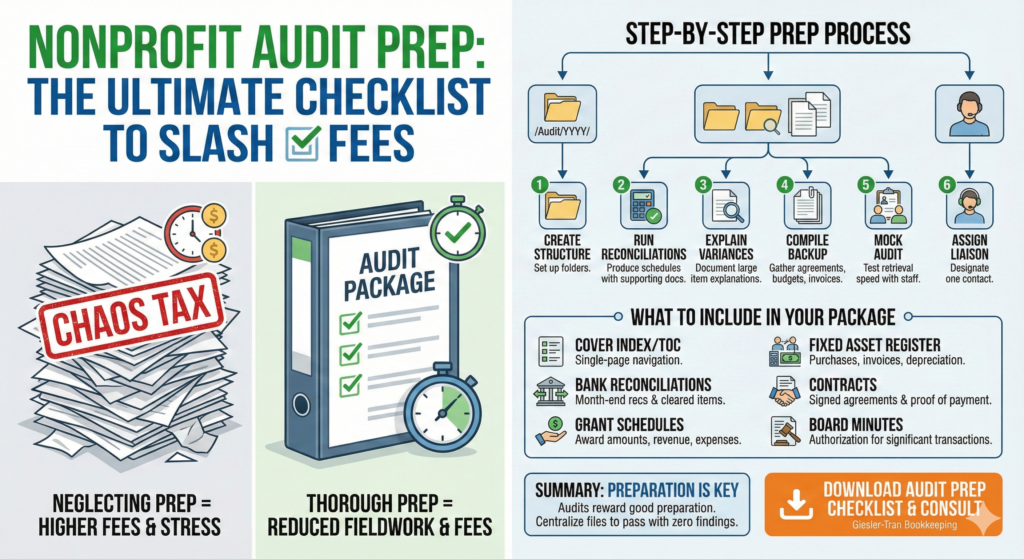

The Reality Check: Fundamentally, auditors bill by the hour. Therefore, if they have to dig through messy inboxes to find a grant agreement, you pay more. Consequently, neglecting your Nonprofit Audit Prep effectively imposes a “chaos tax” on your organization in the form of higher fees.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Bulletproof Nonprofit Audit Package’

Why Thorough Nonprofit Audit Prep Matters

First, audits—whether funder, state, or external—consume massive amounts of staff time. Specifically, excellent Nonprofit Audit Prep reduces fieldwork time and minimizes the chance of “findings” (official notes of deficiency). Moreover, structured files demonstrate good stewardship to funders, proving your organization is a safe investment.

Consider a child-services organization that faced a state audit mid-year. Initially, documents were scattered across inboxes and laptops. By focusing on Nonprofit Audit Prep in advance, they saved two weeks of staff time. Additionally, they prevented findings related to subgrantee payments. Now, they use a template for every future audit.

What to Include in Your Nonprofit Audit Prep Package

Next, you need to know exactly what the auditor wants. Typically, a complete Nonprofit Audit Prep package includes the following core elements:

- Cover index / Table of Contents: A single-page index listing all schedules and file paths makes navigation easy.

- Bank reconciliations: Provide month-end recs with supporting cleared transactions.

- Grant schedules: List award amounts, periods, revenue recognized, and expenses charged.

- Payroll & benefits: Include registers, deposit confirmations, and W-2s.

- Fixed asset register: Document purchases, invoices, and depreciation schedules.

- Contracts: Organize signed contracts and proof of payments for subgrants.

- Board minutes: Show authorization for significant transactions.

For more on audit standards, the National Council of Nonprofits offers a comprehensive guide.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Step-by-Step Nonprofit Audit Prep Process

Furthermore, following a sequence prevents overwhelm. Ideally, use this Nonprofit Audit Prep workflow:

- Create structure: Set up folders like /Audit/YYYY/BankRecs and /Audit/YYYY/Grants.

- Run reconciliations: Produce schedules with supporting docs attached immediately.

- Explain variances: Document explanations for large items in a one-page narrative.

- Compile backup: Gather agreements, budgets, and invoices for each grant.

- Mock audit: Have a non-finance staffer request items to test your retrieval speed.

- Assign a liaison: Designate one person to handle all auditor communications.

Also, reviewing the AICPA Audit Committee Toolkit can help your board prepare.

Download Your Nonprofit Audit Prep Checklist

To help you get started, we created a CSV checklist. Simply paste this into Excel to track your Nonprofit Audit Prep progress.

Cover index / TOC,Drive/Audit/2025/CoverIndex.pdf,2025,N,Prepare before auditor arrives

Bank reconciliations – Main checking,Drive/Audit/2025/BankRecs,Jan-Dec 2025,N,Include cleared items

Grant schedules – all active awards,Drive/Audit/2025/Grants,Jan-Dec 2025,N,Group by fund

Payroll registers & deposit confirmations,Drive/Audit/2025/Payroll,Jan-Dec 2025,N,Include tax deposit receipts

Fixed asset register & invoices,Drive/Audit/2025/FixedAssets,All,N,Include capitalization policy

Alternatively, download the file here: Download the CSV — NonProfit Audit Checklist.

Moreover, if your books are currently disorganized, consider our cleanup services to get them audit-ready. Then, maintain that standard with our monthly bookkeeping support.

Summary: Preparation is Key

Ultimately, audits do not need to be painful—they reward good preparation. By prioritizing Nonprofit Audit Prep and centralizing your files, you can pass your audit with zero findings.

Turn Audit Anxiety into Assurance

Don’t let a disorganized audit package risk your reputation or drain your budget. A clean audit protects your funding and proves your stewardship.

You don’t have to guess if you’re ready.

We offer a complimentary Audit-Readiness Review where we stress-test your files before the auditor arrives. We’ll help you identify gaps, organize your files, and hand you a prioritized checklist to fix issues fast.

Claim Your Free Audit-Readiness Review

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.