Effectively, managing Payroll & 1099s is one of the most critical compliance tasks for any growing business. However, mixing up employee wages with contractor payments creates a bookkeeping nightmare and invites IRS scrutiny. Specifically, understanding the distinction ensures accurate tax filings and prevents costly penalties. Below, we break down exactly how to record Payroll & 1099s correctly so you can pay your team with confidence.

Payroll & 1099s: A Simple Guide to Contractor vs Employee Payments

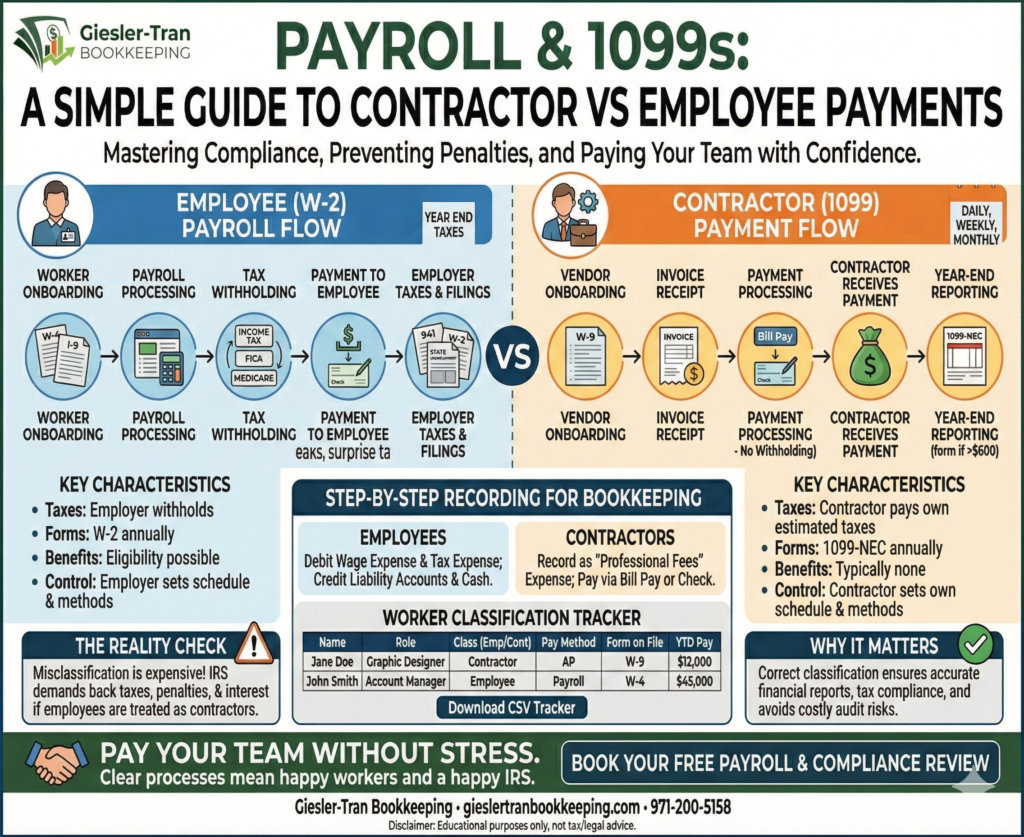

The Reality Check: Fundamentally, misclassifying a worker is expensive. If you treat an employee like a contractor to avoid taxes, the IRS can demand back taxes, penalties, and interest. Therefore, establishing clear workflows for Payroll & 1099s from day one is your best defense against an audit.

Listen on The Deep Dive — where we dig deeper into this topic:

‘Contractor vs. Employee: The Deep Dive on IRS Risk and Bookkeeping Workflows’

Why Correctly Managing Payroll & 1099s Matters

First, correct classification impacts taxes, benefits, and legal compliance[cite: 1]. Specifically, employees have taxes withheld, while contractors handle their own. Moreover, from a bookkeeping standpoint, the flows are distinct: employees go through payroll liability accounts, whereas contractors are recorded as simple expense items. Ultimately, getting your Payroll & 1099s right ensures your financial reports reflect true labor costs.

For official guidelines, refer to the IRS Contractor vs Employee Guide.

Key Differences: Payroll & 1099s at a Glance

Next, let’s compare the two categories side-by-side. Ideally, you should know these distinctions by heart[cite: 3]:

- Taxes: Employees have withholding; contractors pay their own estimated taxes.

- Forms: Employees get W-2s; contractors get 1099-NECs if paid over $600.

- Benefits: Employees may get health/retirement; contractors typically do not.

- Control: Employees follow your schedule/methods; contractors control their own work.

Additionally, using a service like Gusto can automate many of these Payroll & 1099s tasks.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a Payroll Specialist. Explain the bookkeeping difference between recording W-2 payroll and 1099 contractor payments, including why contractors are not subject to employer payroll tax liabilities. Clarify why employer payroll taxes must be recorded as a separate expense from gross wages to show true labor costs and stay compliant. Then explain how Giesler-Tran Bookkeeping ensures payroll and 1099s are classified correctly, employer taxes are tracked accurately, and clients avoid penalties and distorted financials.

Step-by-Step Recording for Payroll & 1099s

Furthermore, accurate recording is key. Specifically, follow this workflow[cite: 4]:

- Employees: Run payroll via software. Debit Wage Expense and Tax Expense; Credit Liability accounts and Cash.

- Contractors: Record invoices as “Professional Fees.” Pay via Bill Pay or Check.

- Filings: Reconcile 941 deposits to your liability accounts quarterly. Track contractor totals for year-end 1099s.

Moreover, if your payroll accounts are currently a mess, our cleanup services can reconcile them. Then, we can maintain compliance with our monthly bookkeeping support.

Worker Classification Tracker

To assist you, use this table to track your team. Simply copy this into a spreadsheet to manage your Payroll & 1099s data.

Jane Doe,Graphic Designer,Contractor,AP,Y,12000,Drive/Contracts/JaneDoe.pdf

John Smith,Account Manager,Employee,Payroll,Y,45000,Drive/HR/JohnSmith.pdf

Alternatively, download the ready-to-use file here: Download the CSV — Contractor vs. Employee Tracker.

Common Questions on Payroll & 1099s

- Q: What is the 1099 threshold?

- A: Generally, you must file a 1099-NEC if you pay an unincorporated contractor $600 or more in a calendar year[cite: 7].

- Q: Can I treat a contractor as an employee?

- A: If they meet the criteria, yes. However, simply switching them without adjusting taxes creates liability. Consult a pro[cite: 7].

- Q: What forms do I need at onboarding?

- A: W-4 and I-9 for employees; W-9 for contractors. Always collect these before the first payment[cite: 4].

- Q: Can I pay contractors through payroll?

- A: Some software allows this, but be careful not to commingle them in your ledger. It’s often cleaner to pay via AP.

Pay Your Team Without the Stress

Don’t let payroll confusion put your business at risk. Clear processes mean happy workers and a happy IRS.

Are your worker classifications correct?

We can double-check for you. Book a complimentary Payroll & Compliance Review today. We’ll audit your current roster and ensure your Payroll & 1099s are bulletproof.

Book Your Free Compliance Review

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.