Effectively, gathering the right documents for your bookkeeper to review is the single most important step you can take to ensure accurate financials. However, many business owners find this process overwhelming, leading to delays and increased costs. Specifically, providing a complete, organized set of records allows your bookkeeper to work efficiently, catch errors early, and maximize your tax deductions. Below, we provide a comprehensive checklist and worksheet to streamline the handoff of all necessary documents for your bookkeeper‘s analysis.

Documents For Your Bookkeeper: The Ultimate Checklist for a Smooth Handoff

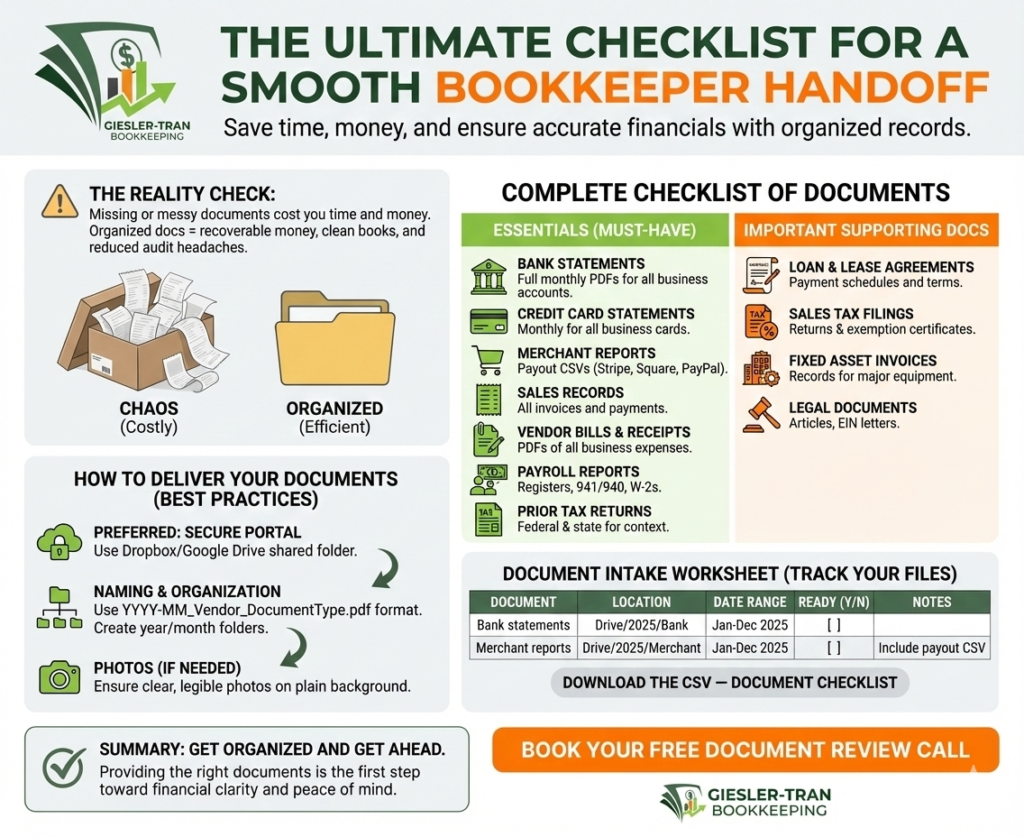

The Reality Check: Fundamentally, missing or messy documents cost you time, money, and accuracy. Therefore, a quick, organized handoff saves hours of cleanup and reduces the chance of missed deductions or audit headaches. Give your bookkeeper clean inputs, and they’ll give you clean, actionable books.

Listen on The Deep Dive — where we dig deeper into this topic:

‘The Organized Handoff: How to Save $6,400 and Unlock Tax Credits with Perfect Bookkeeping.’

Why Providing the Right Documents for Your Bookkeeper Matters

First, let’s establish why this is critical. Consider a small bakery we worked with that saved $6,400 in one quarter after a cleanup. Initially, the owner had been handing over shoeboxes of crumpled receipts. Instead, we asked for three months of organized digital records. Once we matched deposits to sales reports, we found missing COGS entries and a misclassified loan payment. Ultimately, the corrected books unlocked a valid tax credit the owner hadn’t claimed. The moral is simple: organized docs equal recoverable money.

For more on recordkeeping requirements, check the IRS Recordkeeping Guide.

Complete Checklist of Documents for Your Bookkeeper

Next, use this checklist to gather everything we need. Ideally, provide these as PDFs or CSVs:

Essentials (Must-Have)

- Bank statements: Full monthly PDFs for all business accounts.

- Credit card statements: Monthly statements for all business cards.

- Merchant processor reports: Payout CSVs from Stripe, Square, PayPal, etc.

- Sales records: All invoices issued and confirmed payments.

- Vendor bills & receipts: PDFs of all business expenses.

- Payroll reports: Payroll registers, tax filings (941/940), and W-2s.

- Prior year tax returns: Federal and state returns for historical context.

Important Supporting Docs

- Loan & lease agreements: Payment schedules and terms.

- Sales tax filings: Returns and exemption certificates.

- Fixed asset invoices: Records for major equipment purchases.

- Legal documents: Articles of organization, EIN letters.

Ask ChatGPT

Get an unbiased answer from ChatGPT!

Copy the prompt below, click the button, and paste it into ChatGPT for instant insight.

Act as a professional bookkeeper. Create a prioritized checklist of the essential documents a bookkeeper needs to start a new engagement. Explain why merchant processor payout reports are critical for accurate revenue tracking — and describe how Giesler-Tran Bookkeeping organizes these records from day one to ensure clean, reconciled, and audit-ready books.

How to Deliver Your Documents for Your Bookkeeper

Furthermore, how you send files matters as much as what you send. Specifically, follow these best practices:

- Preferred: Use a secure client portal (like Dropbox or Google Drive) with a shared folder.

- Alternate: Send encrypted email attachments or use a secure upload link.

- Photos: If you must send photos, ensure they are clear, legible, and show the entire document on a plain background.

- Naming: Use a consistent format like `YYYY-MM_Vendor_DocumentType.pdf`.

- Organization: Create folders by year and subfolders by month or vendor.

Also, for seamless integration, check out QuickBooks Online for document management features.

Document Intake Worksheet

To assist you, use this table to track your file uploads. Simply copy this into a spreadsheet to manage the handoff of your documents for your bookkeeper to review.

Bank statements (Primary checking),Drive/2025/Bank,Jan 2025-Dec 2025,,

Credit card statements (Business),Drive/2025/CC,Jan 2025-Dec 2025,,

Merchant processor reports (Stripe/Square),Drive/2025/Merchant,Jan 2025-Dec 2025,,Include payout CSV

Sales invoices / receipts,Drive/2025/Sales,Jan 2025-Dec 2025,,

Vendor bills & receipts,Drive/2025/Bills,Jan 2025-Dec 2025,,

Payroll register & tax filings,Drive/Payroll/2025,Jan 2025-Dec 2025,,Include 941s

Alternatively, download the ready-to-use file here: Download the CSV — Document Checklist.

Moreover, if your records are currently disorganized, our cleanup services can get you sorted out. Then, we can maintain order with our monthly bookkeeping support.

Common Questions on Documents for Your Bookkeeper

- Q: How should I send sensitive documents (W-2, SSNs)?

- A: Use encrypted uploads or a secure client portal. Avoid sending unencrypted sensitive documents via regular email.

- Q: What if I only have paper receipts?

- A: Photograph them clearly by month, name the files, and upload. For high volumes, we recommend using a receipt-capture app.

- Q: How much history should I send?

- A: Send at least the last 12 months for a clean monthly close. For cleanups, send records back to formation or at least 24 months.

- Q: How long do you keep client documents?

- A: We recommend keeping originals per IRS guidance, typically 3–7 years depending on the document type.

Get Organized and Get Ahead

Don’t let disorganized records hold your business back. Providing the right documents is the first step toward financial clarity and peace of mind.

Ready to streamline your bookkeeping?

Use the worksheet above to collect your files, then book a complimentary Document Review Call. We’ll assess what you’ve gathered and map out a plan tailored to your business.

Book Your Free Document Review Call

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.