Effectively, maintaining high bookkeeping ethics is not just an abstract concept; it is the set of everyday behaviors that keep your numbers trustworthy. However, many business owners view ethical controls as optional “red tape” rather than essential protection. Specifically, without these standards, you invite errors, penalties, and significant fraud risk. Below, we provide a practical, no-nonsense guide to integrity, documentation, and the controls necessary to keep your business audit-ready.

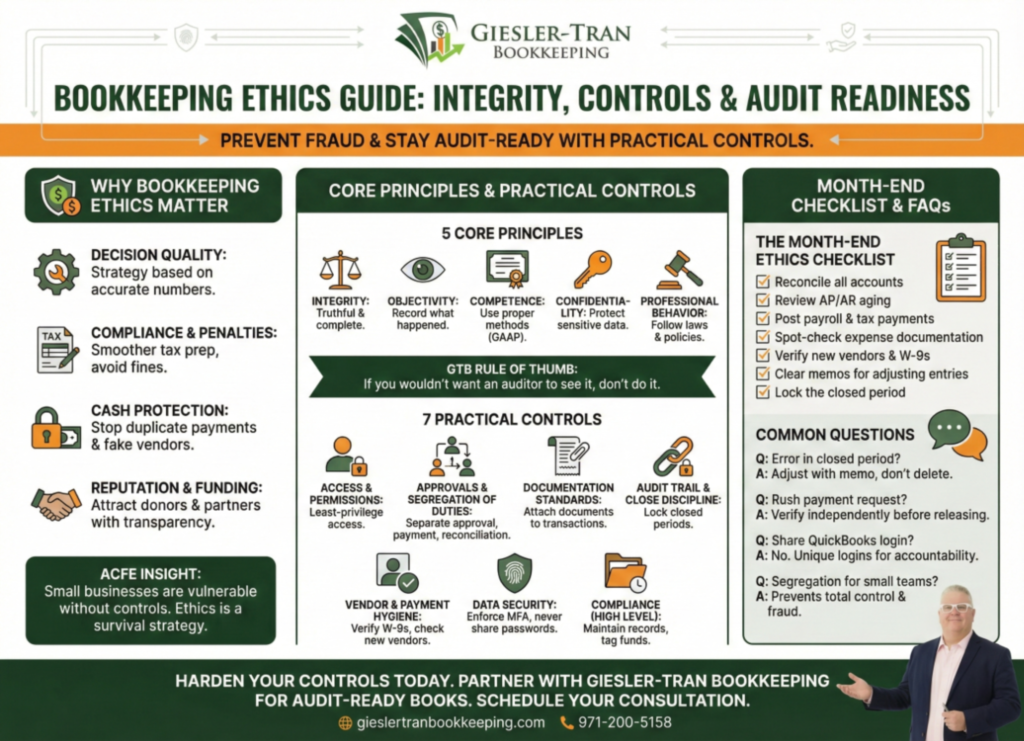

Bookkeeping Ethics Guide: Integrity, Controls & Audit Readiness

The Reality Check: Fundamentally, if your books lack integrity, your business decisions are based on fiction. Because regulators, lenders, and donors demand transparency, ethical failures can destroy your reputation faster than financial losses. Therefore, robust bookkeeping ethics must be the foundation of your operations, not an afterthought.

Why Bookkeeping Ethics Matter for Your Bottom Line

First, let’s define the stakes in plain business terms. Unlike simple data entry, ethical bookkeeping directly impacts your ability to scale safely. Specifically, prioritizing bookkeeping ethics delivers four clear benefits:

- Decision Quality: Strategy is only as strong as the numbers behind it.

- Compliance & Penalties: Clean books equal smoother tax prep, while poor controls lead to fines.

- Cash Protection: Ethical controls stop leakage, such as duplicate payments or fake vendors.

- Reputation & Funding: Donors and partners look for discipline and transparency.

Furthermore, the Association of Certified Fraud Examiners (ACFE) notes that small businesses are often the most vulnerable to fraud due to a lack of controls. Consequently, implementing these standards is a survival strategy.

Core Principles of Bookkeeping Ethics

Next, we stand on five pillars that define our approach at GTB. Crucially, these principles ensure that your financial story is told accurately:

- Integrity: Be truthful and complete. Never manipulate timing to “polish” results.

- Objectivity: Record what happened, not what you wish happened.

- Competence: Use proper methods (GAAP-style) and document your work.

- Confidentiality: Protect sensitive data like payroll and banking details.

- Professional Behavior: Follow all laws and internal policies diligently.

GTB Rule of Thumb: If you wouldn’t want a regulator, auditor, or major donor to see it, don’t do it.

7 Practical Controls for Bookkeeping Ethics

Moreover, you can implement specific controls this month to harden your system. Here is the GTB playbook for operationalizing bookkeeping ethics:

1. Access & Permissions

Specifically, grant “least-privilege” access. Start by reviewing user access quarterly and removing ex-staff immediately.

2. Approvals & Segregation of Duties

Crucially, separate the ability to approve, pay, and reconcile. For example, the person who signs the checks should not be the same person reconciling the bank statement. If you have a small team, use cloud approvals to enforce this separation.

3. Documentation Standards

Always attach documents to transactions in your accounting system. This ensures that every expense has a digital paper trail, which is vital for audit-ready books.

4. Audit Trail & Close Discipline

Ideally, you must close and lock the period using a password in QuickBooks Online. This prevents accidental deletion of posted transactions.

5. Vendor & Payment Hygiene

Furthermore, centralize vendor setup and require W-9 verification before the first payment. Also, watch for new vendor names that look suspiciously like existing ones.

6. Data Security

Technically, enforce Multi-Factor Authentication (MFA) on all bank and accounting logins. Never share passwords via email.

7. Compliance (High Level)

Finally, maintain records according to IRS rules, typically 3–7 years. For non-profits, carefully tag restricted versus unrestricted funds to respect donor intent.

The Month-End Ethics Checklist

Now, copy and paste this checklist to ensure your team maintains bookkeeping ethics every single month:

- ✅ All bank/credit/loan accounts reconciled

- ✅ AP/AR aging reviewed for unusual balances

- ✅ Payroll entries posted & tax payments confirmed

- ✅ Expense documentation attached (spot-check)

- ✅ New vendors verified; W-9s on file

- ✅ Adjusting entries include clear memos

- ✅ Period closed & locked securely

Common Questions on Bookkeeping Ethics

- Q: What if I find an error from a closed period?

- A: Do not delete history. Instead, use an adjusting journal entry in the current period with a clear memo explaining the correction.

- Q: How do I handle a “rush” payment request?

- A: Treat “rush” requests with skepticism. Always verify the vendor and approval independently before releasing funds.

- Q: Can I share my QuickBooks login?

- A: No. Every user should have their own unique login to preserve the audit trail and accountability.

- Q: Why is segregation of duties important for small teams?

- A: It prevents one person from having total control, which significantly reduces the risk of undetected fraud or errors.

For more on our approach, check our About Us page.

Harden Your Controls Today

Ethical bookkeeping isn’t just about following rules; it’s about building a business that can withstand scrutiny. Never back-date entries, always separate duties, and document everything.

Are your books truly audit-ready?

Partner with Giesler-Tran Bookkeeping to ensure your controls are rock-solid. Schedule a complimentary consultation to review your current setup.

Need help vetting a suspicious rating? Contact us immediately.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.