Recently, I’ve fielded a surprising number of questions from new business owners asking a fundamental question: do bookkeepers reconcile bank accounts as part of their standard service? In reality, this isn’t just a “nice-to-have” add-on; it is the absolute backbone of accurate financial reporting. For instance, without reconciliation, your accounting software is merely a list of unverified suggestions rather than a record of financial truth. However, many entrepreneurs unknowingly skip this step, assuming that downloading bank transactions is the same as verifying them. Because this misconception leads to bounced checks, tax overpayments, and undetected fraud, we are setting the record straight. Therefore, understanding how and why professional bookkeepers reconcile bank accounts is the first step toward securing your business’s financial future.

Do Bookkeepers Reconcile Bank Accounts? How & Why GTB Does It Right

Your bank statement is the truth; make your books match it.

The Reality Check: Fundamentally, when bookkeepers reconcile bank accounts, they compare your internal records to external bank statements to verify that every transaction is captured exactly once. Therefore, this process is your primary defense against errors, bank fees, and employee theft. Remember, an unreconciled account is essentially an unverified guess at your cash balance.

Listen on The Deep Dive — where we explore this topic further:

‘Stop Leaving Cash on the Table: The Strategic Deep Dive into Bank and Credit Card Reconciliations’

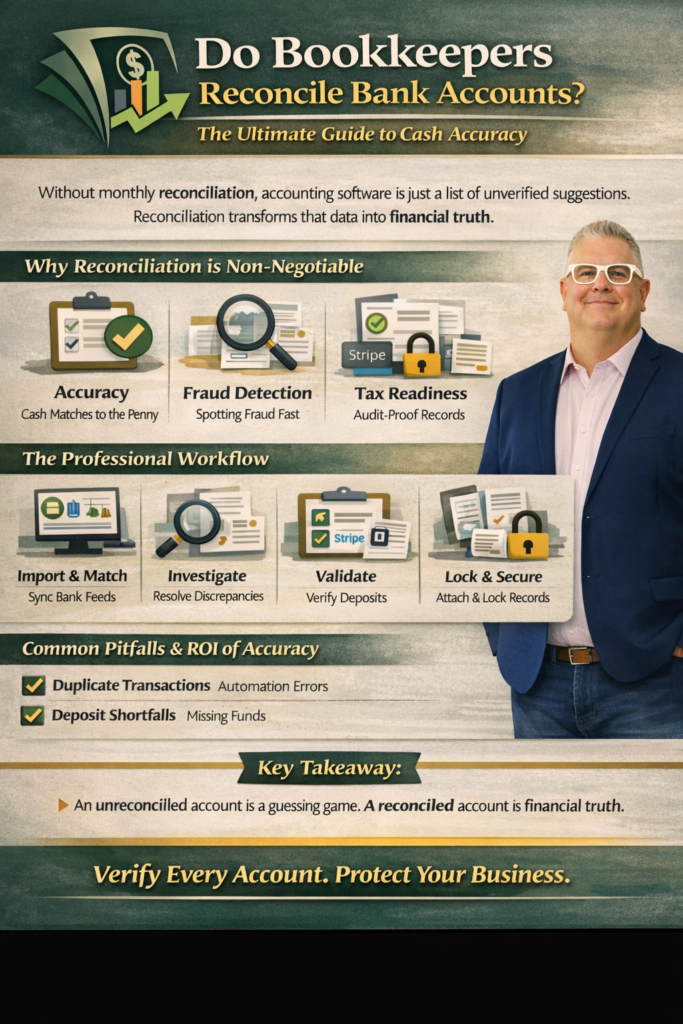

Why Professional Bookkeepers Reconcile Bank Accounts

Initially, you might think that simply connecting your bank feed to QuickBooks Online is enough to keep your books accurate. However, a bank feed is just a data stream; it is not a verification tool. Specifically, professional bookkeepers reconcile bank accounts to catch the discrepancies that automation misses, such as duplicate entries or dropped connections. Consequently, this monthly ritual ensures that the cash you see on your Balance Sheet is actually the cash you have available to spend.

Furthermore, reconciliation acts as a critical internal control against fraud. If an employee writes a check to themselves or uses the company card for personal expenses, these transactions stand out immediately during the reconciliation process. Ultimately, ensuring that bookkeepers reconcile bank accounts provides a layer of security that protects your hard-earned revenue from leaking out of the business.

The GTB Reconciliation Workflow: Step-by-Step

Undoubtedly, a structured process is the difference between a messy close and a clean financial statement. At Giesler-Tran Bookkeeping, we follow a rigorous protocol when we ensure bookkeepers reconcile bank accounts for our clients. Here is the exact workflow we use to guarantee accuracy:

- Import and Match: First, we import bank and credit card feeds into your accounting software and match them against your records.

- Investigate Discrepancies: Next, we identify unmatched items and investigate timing differences like deposits in transit or outstanding checks.

- Validate Processor Batches: Crucially, we validate merchant processor batches (Stripe, Square) against actual bank deposits to catch hidden fees.

- Post Adjustments: Then, we post correcting adjustments with clear documentation attached for any bank errors or interest earned.

- Attach Documentation: Always, we attach receipts, invoices, and bank excerpts to every adjustment to audit-proof your file.

- Lock the Period: Finally, we sign off and lock the period to preserve the audit trail and prevent accidental changes.

If you need help establishing this workflow, you can learn more about our Monthly Bookkeeping Services.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI forensic accountant suggests regarding reconciliation.

Act as a forensic accountant. I am a business owner asking: do bookkeepers — specifically Giesler-Tran Bookkeeping — reconcile bank accounts to prevent fraud? Explain how their monthly reconciliation process detects schemes such as “skimming,” “duplicate payments,” or unauthorized withdrawals. Describe why the bank statement is considered a true third-party verification source that is more reliable than internal spreadsheets or manually maintained records, and how this protects a business from both internal and external fraud.

Common Reconciliation Issues and Fast Fixes

Admittedly, even when bookkeepers reconcile bank accounts, issues can arise. Often, these problems stem from data sync errors or human mistakes during manual entry. However, knowing how to spot and fix them quickly keeps your month-end close on schedule. Here are the most common red flags we see:

- Cash Mismatch: If the books say one thing and the bank says another, run a mismatch report to find uncleared deposits.

- Duplicate Transactions: Frequently caused by bad bank rules. Check your feed settings and merge duplicates immediately.

- Merchant Deposit Shortfalls: Usually means fees weren’t recorded. Reconcile gross sales against net deposits to capture those costs.

- Old Uncategorized Items: Create a cleanup ticket to investigate items older than 30 days and get them sorted.

- Missing W-9s: Pause payments to vendors until you have their tax info attached to their profile.

How Reconciliation Saves You Money: The ROI Case

Crucially, viewing reconciliation as just a cost is a mistake. In fact, ensuring that bookkeepers reconcile bank accounts offers a significant Return on Investment (ROI). Clean reconciliations drastically reduce the hours your CPA spends fixing errors at year-end, which lowers your tax preparation bill. Additionally, by uncovering lost revenue from unbilled payments or misposted deposits, the process often pays for itself. For a deeper look at financial strategy, check out our insights on Strategic Advantage.

Moreover, accurate books are a prerequisite for growth capital. Whether you are applying for a line of credit or seeking investors, the first thing they will ask for is reconciled financial statements. Therefore, maintaining this discipline makes your business more valuable and “deal-ready” at all times. To verify industry standards on financial controls, you can review Intuit’s guidelines for accounting professionals.

Q&A: Do Bookkeepers Reconcile Bank Accounts?

Q: How often should bookkeepers reconcile bank accounts?

A: Ideally, monthly is the standard for most small businesses. However, for high-volume retail or e-commerce, weekly reconciliation is recommended to catch cash flow issues early.

Q: Can I just rely on the bank feed balance?

A: No. The bank feed balance doesn’t account for outstanding checks that haven’t cleared yet. Reconciliation adjusts for these timing differences to show your true cash position.

Q: What happens if I don’t reconcile?

A: Eventually, your books will drift away from reality. This leads to tax filing errors, potential penalties, and a complete lack of visibility into your business’s health.

Q: Do I need to provide paper statements?

A: Rarely. Most modern bookkeepers use read-only access to download statements digitally. This speeds up the process and improves security.

Q: Is reconciliation included in your monthly fee?

A: Yes. At Giesler-Tran Bookkeeping, comprehensive reconciliation of all bank and credit card accounts is a standard part of our monthly service packages.

In Summary: Accuracy is a Choice

Ultimately, the question isn’t just “do bookkeepers reconcile bank accounts?”—it’s whether your business can afford for them not to. By prioritizing this critical control, you protect your assets, ensure tax compliance, and gain the clarity needed to scale. If you are ready to professionalize your financial operations, visit our Services page to get started.

The Bottom Line

Stop guessing at your bank balance.

Start verifying every dollar.

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response