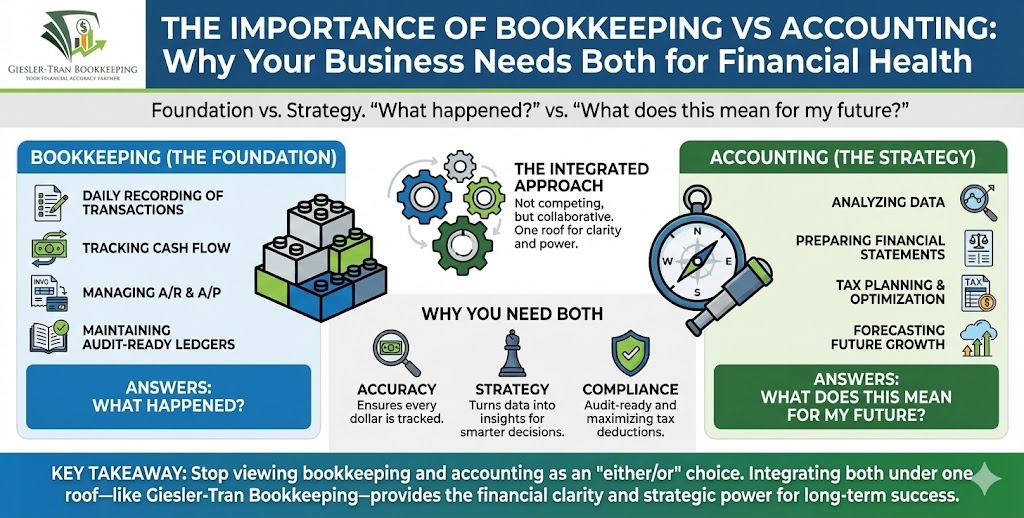

Understanding the nuance between bookkeeping vs accounting is often the first step toward true financial maturity for any business owner. Initially, many entrepreneurs use these terms interchangeably, assuming that recording transactions is the same as analyzing them. In reality, while both functions deal with financial data, they serve distinct but equally vital roles in your company’s ecosystem. Specifically, bookkeeping builds the foundation of accurate records, whereas accounting uses that data to build the roof of strategy and tax planning. However, failing to distinguish between the two can lead to missed deductions, cash flow gaps, and compliance nightmares. Therefore, at Giesler-Tran Bookkeeping, we believe that integrating these services provides the clarity you need to scale. By reading this guide, you will master the critical differences and learn why successful operators never choose just one.

Bookkeeping vs Accounting: Understanding the Difference for Your Business (and Why You Need Both)

A GTB long-form guide for owners and operators.

The Reality Check: Fundamentally, the debate of bookkeeping vs accounting isn’t about choosing a winner; it is about understanding how they collaborate. While a bookkeeper ensures your daily transactions are accurate and compliant, an accountant transforms that clean data into actionable business intelligence. Consequently, trying to run a business with only one is like trying to drive a car with only three wheels—you might move forward, but the ride will be rough and dangerous. Remember, precision in the books enables power in the boardroom.

Listen on The Deep Dive — where we dig deeper into this:

‘Bookkeeping vs. Accounting – The Costly Mistake That’s Undervaluing Your Business’

What Is Bookkeeping? — The Foundation of Data

Undoubtedly, bookkeeping acts as the bedrock of your entire financial structure. Without a diligent bookkeeper, an accountant has nothing to analyze but chaos. Essentially, bookkeeping is the process of recording daily transactions, tracking cash flow in real-time, and maintaining clean, audit-ready ledgers. This creates the “evidence” of your business activity.

Specifically, professional bookkeeping involves several non-negotiable tasks. First, we record all transactions accurately and consistently to ensure no dollar goes missing. Next, we manage Accounts Receivable (A/R) and Accounts Payable (A/P) so you know exactly who owes you and whom you owe. Additionally, reconciling bank and credit card statements prevents fraud and identifies bank errors immediately. Finally, categorizing expenses correctly in your Chart of Accounts is crucial for tax time. For more on this daily grind, read our guide on What Does a Bookkeeper Do?

What Is Accounting? — The Architecture of Strategy

In contrast, if bookkeeping records the story, accounting interprets the plot. Once the data is organized, accountants take those raw numbers and transform them into actionable insights and compliance reports. Therefore, accounting is less about data entry and more about data analysis, strategy, and tax optimization.

Typically, accounting responsibilities encompass higher-level financial functions. We prepare financial statements like the Profit & Loss, Balance Sheet, and Cash Flow Statement to give you a clear picture of health. Then, we analyze profitability trends and cost structures to advise on growth. Crucially, tax planning and preparation fall under this umbrella, ensuring you keep more of what you earn. Also, budgeting and forecasting help you model future cash flow scenarios. Ultimately, ensuring compliance with IRS and GAAP standards protects your business from legal risk.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI financial strategist thinks about the bookkeeping vs accounting relationship.

Bookkeeping vs Accounting: The Symbiotic Relationship

Importantly, viewing bookkeeping vs accounting as a competition is a mistake; they are collaborators. Each function relies heavily on the other to operate effectively. For instance, bookkeeping feeds accounting; clean data ensures reliable financial analysis. Conversely, accounting strengthens bookkeeping by providing the strategic framework for how transactions should be categorized.

Without one or the other, you risk inaccurate reports and missed opportunities. Think of them like gears in a machine—one turns the other. Together, they power your business forward. If you try to save money by skipping one, you will likely pay double in clean-up costs later. To explore how we handle messy situations, review our Bookkeeping Cleanup services.

Why GTB Combines Both — The Integrated Advantage

Historically, businesses hired a bookkeeper for daily work and a separate CPA for year-end taxes. However, this disconnect often leads to communication gaps and errors. At Giesler-Tran Bookkeeping, we unify these roles to provide a seamless experience. Here is why integration wins:

- Consistent Accuracy: We ensure every transaction is recorded correctly the first time, eliminating year-end cleanup.

- Strategic Guidance: You receive insights and reports that drive smarter decisions throughout the year, not just at tax time.

- Effortless Compliance: Our tax-ready books give you audit confidence all year round.

- One Point of Contact: You stop wasting time playing telephone between your bookkeeper and your CPA.

- Flat-Rate Pricing: We offer transparent, predictable fees based on value, not hours.

Case Study: When “Cheap” Bookkeeping Cost Thousands

Recently, a client came to GTB after trying a low-cost, AI-based bookkeeping service to save money. Regrettably, the result was a disaster: over 4,000 transactions were misclassified, income was significantly underreported, and the balance sheets did not match the bank statements. Consequently, he was flying blind financially.

Immediately, we spent three weeks rebuilding his books. We fixed duplicate entries, reconciled every account, and produced lender-ready statements. Once completed, he secured funding for expansion—something his old “bookkeeping” made impossible. This proves that cheap bookkeeping often becomes expensive cleanup. Therefore, investing in quality from the start is the only true cost-saving strategy. For tips on choosing the right partner, see our Monthly Bookkeeping page.

Actionable Checklist: Evaluate Your Financial Support

Now, it is time to assess your current setup. Ask yourself these critical questions to see if your bookkeeping vs accounting needs are being met:

- Do your financial reports match your bank balances to the penny?

- Is your accountant spending more time fixing your books than filing your taxes?

- Are your invoices, bills, and payroll recorded in one centralized system?

- Do you have a clear, consistent month-end close schedule?

- Are your books ready if a lender or auditor asks for them tomorrow?

If you hesitated on even one of these, it is time to talk to GTB’s integrated team. Delaying will only compound the issues.

Q&A: Solving the Bookkeeping vs Accounting Puzzle

Q: Can one person do both bookkeeping and accounting?

A: Yes, but they need different skill sets. Ideally, you want a firm like GTB that has specialized staff for each role working together under one roof.

Q: Which service should I hire first?

A: Bookkeeping must come first. Without accurate records (bookkeeping), an accountant cannot perform any analysis or tax preparation effectively.

Q: Does bookkeeping software replace the accountant?

A: No. Software is a tool for the bookkeeper. It does not provide strategy, tax planning, or the human judgment required for complex accounting decisions.

Q: How often does an accountant need to see my books?

A: Ideally, monthly. Waiting until the end of the year prevents proactive tax planning and leaves you vulnerable to surprises.

Q: Why is “bookkeeping vs accounting” such a common search?

A: Because business owners often feel they have to choose between them to save money. However, the real value comes from integrating them.

In Summary: Integration is the Key

Ultimately, the debate of bookkeeping vs accounting ends when you realize you need both to thrive. Bookkeeping provides the data; accounting provides the direction. By integrating these services with Giesler-Tran Bookkeeping, you ensure accuracy, compliance, and growth. If you are ready to simplify your financial operations, let’s talk.

The Bottom Line

That’s not just bookkeeping.

That’s The GTB Advantage.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

6 Responses