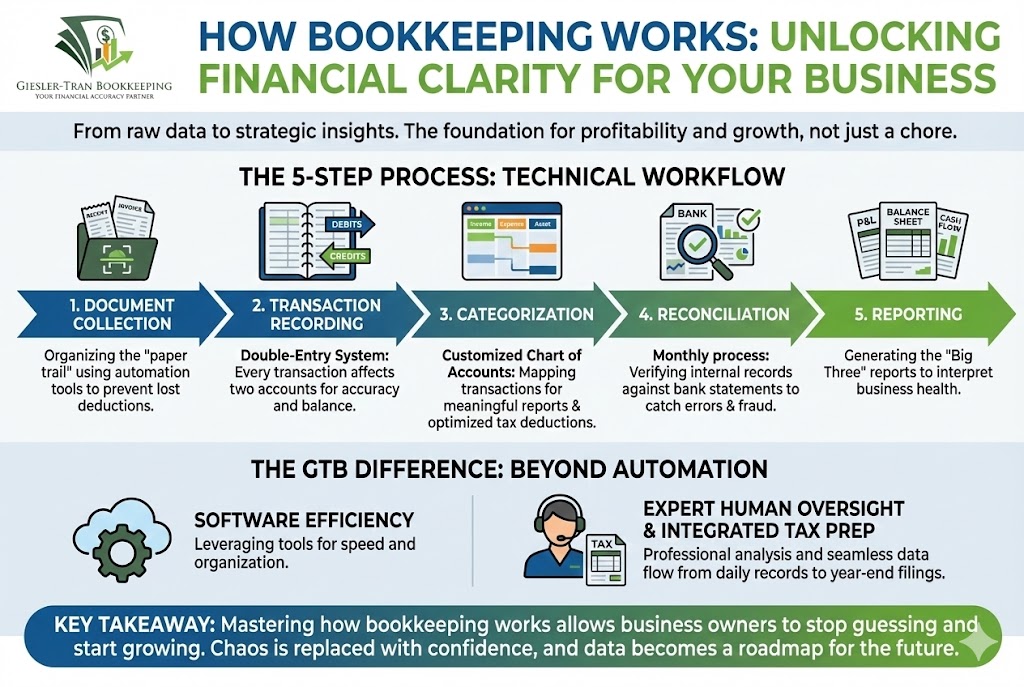

Understanding exactly how bookkeeping works is the first step toward transforming your financial records from a burden into one of your most powerful business assets. Initially, many business owners view bookkeeping as a tedious chore involving piles of receipts and confusing spreadsheets. However, at Giesler-Tran Bookkeeping (GTB), we see it differently. When done correctly, bookkeeping provides the clarity, confidence, and control needed to turn raw data into strategic direction. Consequently, mastering this process allows you to spot profitability trends, manage cash flow proactively, and avoid tax season panic. Therefore, this guide breaks down the mechanics of how bookkeeping works so you can stop guessing and start growing.

How Bookkeeping Works: The Giesler-Tran Approach to Financial Clarity

From Chaos to Confidence: The Mechanics of Money Management

The Reality Check: Fundamentally, explaining how bookkeeping works begins with its core purpose: it is the systematic recording of every financial transaction your business makes. While tax compliance is a major benefit, the real value lies in real-time insight. Specifically, accurate bookkeeping answers critical questions: Are you profitable? Where is your cash going? What do you own, and what do you owe? Remember, without accurate books, you are making decisions in the dark.

Listen on The Deep Dive — where we share insights and stories:

‘How Bookkeeping Works: Turning Data into Direction’

Step 1: Document Collection & Organization

First, every financial transaction leaves a trail—invoices, receipts, bank statements, and vendor bills. Therefore, the initial step in how bookkeeping works involves collecting and organizing these documents consistently. If you wait until the end of the year to hunt for receipts, you will inevitably lose deductions.

Fortunately, modern software tools like QuickBooks Online and Hubdoc automate document capture so nothing gets lost. At GTB, our clients never have to “chase receipts.” Instead, we automate uploads and sync data to ensure every expense is backed by proof. This level of organization prevents panic and makes tax time routine rather than stressful.

Step 2: Transaction Recording (The Double-Entry System)

Next, comes the heart of the operation. Basically, how bookkeeping works relies on the double-entry system. This means every transaction affects two accounts—one debit and one credit. Although this sounds technical, it ensures your books remain balanced, accurate, and audit-ready.

For example, if you spend $100 on office supplies, your cash account decreases (credit), and your expense account increases (debit). This system acts as a built-in accuracy check. When done right, errors are caught before they become costly liabilities. Accuracy in the details builds trust in the big picture.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI financial educator explains about the double-entry method.

Step 3: Categorization into the Chart of Accounts

Think of your Chart of Accounts as your business’s financial map. Crucially, it organizes transactions into clear categories—like revenue, expenses, assets, and liabilities—so your reports tell a meaningful story. When considering how bookkeeping works, proper categorization is essential for actionable insights.

At GTB, we customize every Chart of Accounts by industry. Whether you are a chiropractor, non-profit, or real estate investor, your data must reflect your specific reality. Proper categorization leads to smarter tax deductions and cleaner reporting. For insights on industry-specific needs, explore our Strategic Advantage.

Step 4: Reconciliation & Verification

Reconciliation is where the truth comes out. Each month, we match your internal records against your bank and credit statements. This step verifies accuracy and detects duplicates, errors, or missing entries. If you skip this, your financial statements are just guesses.

Moreover, monthly reconciliations act as your early-warning system against fraud. Identifying unauthorized charges quickly allows you to stop the bleeding before it is too late. When your books reconcile perfectly, you gain more than numbers—you gain peace of mind.

Step 5: Financial Reporting & Insights

Once everything is recorded, categorized, and reconciled, your numbers become your narrative. Finally, how bookkeeping works culminates in the production of three key financial reports:

- Profit & Loss Statement: This measures performance and profitability over a specific period.

- Balance Sheet: This shows a snapshot of what your business owns, owes, and retains at a specific moment.

- Cash Flow Statement: This tracks liquidity, showing exactly how cash moves through your business operations.

At GTB, we don’t just hand you reports; we interpret them. You will know why your cash flow dipped, where your profits are growing, and what to do next. Financial reports are not the finish line—they are your roadmap to smarter strategy.

The GTB Advantage: Where Bookkeeping Becomes Strategy

While every business needs bookkeeping, how it is done makes all the difference. That is where The GTB Way comes in. Here is what sets us apart:

- Automation with Accountability: We use advanced software to automate data entry, but every transaction is reviewed by certified professionals.

- Expert Oversight: Every GTB account is managed by a QuickBooks-Certified Bookkeeper and reviewed by a Senior Tax Accountant.

- Proactive Insights: We help you predict your next move, turning data into decisions.

- Integrated Tax & Bookkeeping: Your books flow directly into your tax prep—no delays, no miscommunication.

Q&A: Demystifying How Bookkeeping Works

Q: Is bookkeeping the same as accounting?

A: No. Bookkeeping is the recording of daily transactions. Accounting is the analysis and tax strategy based on that data. GTB integrates both.

Q: Can I use Excel for bookkeeping?

A: Technically yes, but it is risky. Excel lacks the double-entry checks and bank feed integration of software like QuickBooks, leading to errors.

Q: How often should I do my bookkeeping?

A: Ideally, weekly. At minimum, you must reconcile monthly. Waiting until year-end creates a massive headache and guarantees missed deductions.

Q: What happens if I make a mistake?

A: Errors can distort your tax filings and lead to penalties. Professional oversight ensures mistakes are caught during reconciliation, not during an IRS audit.

Q: Why does “how bookkeeping works” matter for loans?

A: Lenders require accurate financial statements. If your books are messy, banks cannot assess your risk, and your loan application will likely be denied.

In Summary: Clarity is Power

Ultimately, understanding how bookkeeping works empowers you to take control of your financial destiny. It transforms chaos into clarity and data into direction. If you are ready to stop guessing and start knowing, Giesler-Tran Bookkeeping is here to guide you.

The Bottom Line

That’s not just bookkeeping.

That’s The GTB Advantage.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response