Implementing a rigorous monthly bookkeeping checklist is often the dividing line between businesses that scale and those that stall. Recently, I spoke with a business owner who viewed bookkeeping as a once-a-year panic before tax season. In reality, this approach leaves you blind to cash flow leaks and profitability trends for eleven months of the year. However, by breaking down financial tasks into a consistent schedule, you turn your accounting from a burden into a strategic asset. For instance, regularly reviewing Accounts Receivable ensures you get paid faster, while reconciling bank feeds prevents fraud. Therefore, this guide outlines the exact monthly bookkeeping checklist we use at Giesler-Tran Bookkeeping to keep our clients audit-ready and financially healthy.

The Ultimate Monthly Bookkeeping Checklist: Transforming Chaos into Clarity

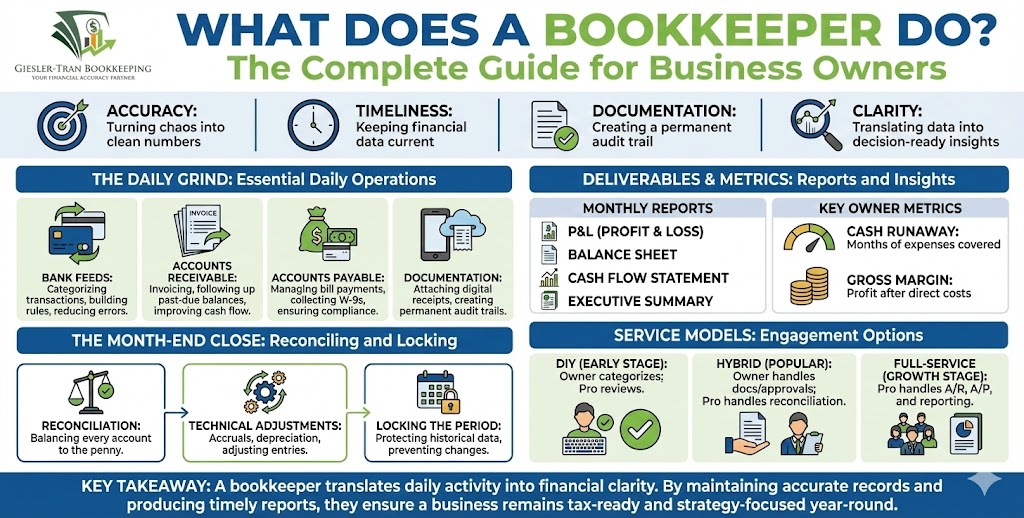

Accuracy. Timeliness. Documentation. Clarity.

The Reality Check: Fundamentally, a bookkeeper does more than just data entry; they execute a precise monthly bookkeeping checklist to ensure every dollar is accounted for. Specifically, this involves capturing transactions accurately, attaching documentation for an audit trail, and closing the books on a strict schedule. Remember, the goal isn’t just to please the IRS; it is to give you decision-ready numbers that help you run your business with confidence.

Listen on The Deep Dive — where we explore this topic further:

‘Bookkeeping Is Business Financial Architecture’

Day-to-Day Tasks: The Foundation of Your Monthly Bookkeeping Checklist

Before you can tackle the month-end close, you must master the daily workflow. Undoubtedly, letting transactions pile up is the quickest way to create a stressful month-end. Ideally, keeping up with these daily items makes the final monthly bookkeeping checklist a breeze rather than a burden.

Here are the essential daily components:

- Bank Feeds & Categorization: Every day, import transactions from your bank and credit accounts. Then, match them to existing records or categorize them immediately. Building rules for recurring vendors helps reduce manual errors significantly.

- Accounts Receivable (A/R): Promptly create and send invoices as soon as work is completed. Additionally, apply customer payments as they come in to keep customer balances accurate.

- Accounts Payable (A/P): Capture bills via email or a document portal immediately. Maintaining vendor profiles, including collecting W-9s before the first payment, saves massive headaches later.

- Receipt Management: Instantly attach digital receipts to transactions using a phone app. This ensures your documentation is organized for tax and audit readiness from day one.

The Core Monthly Bookkeeping Checklist

Crucially, the month-end close is where the magic happens. This is the process that turns raw data into decision-ready financials. If you want to sleep well at night, you must strictly follow this monthly bookkeeping checklist.

1. Reconciliations

First, tie out every single account. This includes bank accounts, credit cards, loans, and merchant processors like Stripe or Square. By matching your ledger to the external statements, you identify missing entries, bank errors, and potential fraud signals immediately.

2. Adjustments & Accruals

Next, record necessary journal entries. Specifically, look for prepaid expenses, deferred revenue, or accrued expenses that need to be recognized in the current month. Also, reclassify any items that were posted to the wrong accounts during the daily rush.

3. Sales Tax & Compliance

Then, address your compliance obligations. Track taxable sales by jurisdiction and reconcile collected tax against what you owe. If you are approaching economic nexus thresholds in new states, flag this for your tax professional immediately. For more on this, check our Strategic Advantage insights.

4. Close Discipline

Finally, lock the period. Once the books are closed, set a “closing date password” in your accounting software to prevent accidental changes to historical data. Saving PDF exports of your statements ensures you have a permanent audit trail.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see what an AI financial controller suggests regarding month-end procedures.

Deliverables From Your Monthly Bookkeeping Checklist

Ultimately, the output of your monthly bookkeeping checklist is clarity. You should expect a specific set of reports that tell the story of your business performance. Here are the non-negotiables:

- Profit & Loss (P&L): View Month-over-Month (MoM) and Year-to-Date (YTD) comparisons with variance notes.

- Balance Sheet: Ensure balances are clean and explainable, with no mystery negative numbers.

- Cash Flow Statement: Understand exactly why your cash balance changed, distinct from profit.

- Aging Summaries: Review AR and AP reports to see who owes you money and whom you owe.

- Executive Summary: A simple one-page breakdown of what changed, red flags, and next steps.

If you aren’t getting these from your current process, it might be time for a Bookkeeping Cleanup.

Common Problems Your Monthly Bookkeeping Checklist Fixes

Admittedly, skipping the checklist leads to predictable disasters. However, sticking to the routine solves these common headaches quickly. Here are the quick wins you will experience:

- “Cash says X, books say Y”: Solved by monthly reconciliations and locked periods.

- Late Invoices: Fixed by A/R automation and scheduled reminders.

- Bleeding Subscriptions: Stopped by vendor reviews and virtual card limits.

- Messy 1099 Season: Prevented by collecting W-9s before the first vendor payment.

- Sales Tax Headaches: Cured by using item-level tax codes and monthly validation.

Q&A: Mastering the Monthly Bookkeeping Checklist

Q: When should I complete my monthly bookkeeping checklist?

A: Ideally, you should aim to close the books by the 10th or 12th of the following month. This ensures the data is still fresh and relevant for decision-making.

Q: Can I automate the checklist?

A: Yes, partially. Tools like QuickBooks Online can automate bank feeds and recurring invoices, but the reconciliation and review steps require human oversight.

Q: What if I find an error from three months ago?

A: If the period is locked, you should not simply delete the transaction. Instead, create an adjusting journal entry in the current period to correct the balance while preserving the audit trail.

Q: Why do I need to attach receipts if I have the bank feed?

A: Because the bank feed proves payment, but the receipt proves what was bought. The IRS requires the receipt to validate the business purpose of the expense.

Q: Do I need a professional for this?

A: For very early-stage solopreneurs, DIY is possible. However, as complexity grows, outsourcing ensures the monthly bookkeeping checklist is followed without consuming your valuable time.

In Summary: Consistency is Key

Ultimately, a bookkeeper translates activity into clarity. By strictly following a monthly bookkeeping checklist, you ensure that you are always tax-ready and strategy-focused. If you need assistance establishing this rhythm, visit our Monthly Bookkeeping page.

The Bottom Line

No Pressure. Only Clarity.

Get clean, decision-ready books every month.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response