Ultimately, asking why bookkeeping matters is like asking why a map matters to a traveler. Without it, you might be moving, but you probably aren’t getting where you want to go. Initially, many entrepreneurs view bookkeeping as mere paperwork—a boring obligation to satisfy the IRS. However, successful business owners know the truth. To them, bookkeeping is the engine that keeps the business running—quietly, efficiently, and powerfully. At Giesler-Tran Bookkeeping (GTB), we believe that organized financial data is the foundation of confidence. Therefore, in this guide, we will explore exactly why bookkeeping matters not just for compliance, but for your survival and growth.

Why Bookkeeping Matters: The Engine of Business Growth

Clarity, Confidence, and Smart Decision-Making

The Reality Check: Fundamentally, your numbers tell a story. If those numbers are accurate, they reveal a roadmap to profitability. However, if they are messy or nonexistent, they tell a story of risk and chaos. Understanding why bookkeeping matters is about realizing that you cannot manage what you do not measure. Ultimately, the difference between a struggling startup and a thriving enterprise often comes down to the quality of their financial records.

Listen on The Deep Dive — where we unpack financial strategy:

‘The Hidden Power: Why Your Books Determine Your Future’

Why Bookkeeping Matters for Financial Clarity

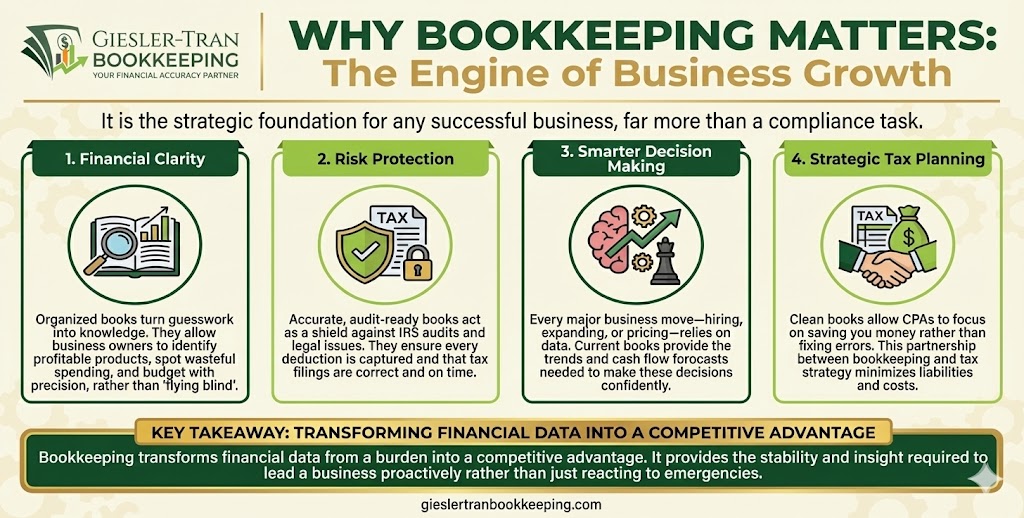

Without organized books, your business operates in the dark. Essentially, you are flying a plane without an instrument panel. Bookkeeping brings transparency, showing exactly what’s coming in, what’s going out, and where your money is working hardest. This is the primary reason why bookkeeping matters—it turns guesswork into knowledge.

Moreover, clear records give you specific powers. For example, you can identify your most profitable products or services. Conversely, you can spot wasteful spending before it drains your cash flow. By budgeting with confidence and precision, you ensure that every dollar has a purpose. According to the Small Business Administration, lack of financial clarity is a leading cause of business failure.

Why Bookkeeping Matters for Risk Protection

When your books are messy, mistakes can cost you—sometimes a lot. Errors in reporting, missing receipts, or untracked income can trigger compliance issues. Furthermore, these mistakes often lead to unwanted attention from the IRS. Therefore, understanding why bookkeeping matters is also about understanding risk management.

Specifically, accurate, audit-ready bookkeeping ensures that tax filings are correct and on time. It guarantees that every eligible deduction is captured, saving you money. Most importantly, it ensures your financial data stands up under scrutiny. At GTB, we maintain every client’s books as if an audit were coming tomorrow. This proactive approach means you never have to panic. Learn how we fix historical errors in our Cleanup Services guide.

Ask ChatGPT

Get an unbiased opinion!

Copy the prompt below to see the strategic value of clean books.

Why Bookkeeping Matters for Smarter Decisions

Every major business move—hiring, pricing, investing, or expanding—depends on data. Consequently, bookkeeping gives you the real numbers behind those decisions. When you ask why bookkeeping matters, the answer is often “profitability.”

When your books are current, you can track profit trends month-to-month. Additionally, you can forecast cash flow accurately, ensuring you have enough in the bank to cover payroll. This insight allows you to make informed choices about growth or cost-cutting. Instead of relying on gut feelings, you rely on hard facts. Check out Investopedia’s guide on how financial habits drive success.

Why Bookkeeping Matters for Tax Strategy

Tax season shouldn’t be a time of stress and surprises. Ideally, strong bookkeeping transforms it into a strategic advantage. When your books are accurate and categorized properly, your CPA spends less time cleaning up data and more time finding you savings.

Furthermore, organized records help you maximize deductions and minimize liabilities. You are always ready for quarterly or annual filings, avoiding late fees and penalties. Clean books equal faster filing and lower accounting costs. At GTB, bookkeeping and tax preparation work hand-in-hand to ensure you keep more of what you earn. See our Pricing Guide to understand the value of this integration.

Q&A: Understanding Why Bookkeeping Matters

Q: Why does bookkeeping matter if my business is small?

A: Small mistakes in a small business can have huge impacts. Good habits started now will scale with you as you grow.

Q: Can’t I just look at my bank balance?

A: No. Your bank balance doesn’t show outstanding checks, future bills, or profit margins. Only bookkeeping gives the full picture.

Q: How does bookkeeping help with loans?

A: Lenders require accurate financial statements. If you can’t prove your income with clean books, you likely won’t get approved.

Q: Does bookkeeping prevent fraud?

A: Yes. Regular reconciliation detects unauthorized transactions early. It creates a paper trail that holds everyone accountable.

Q: How often should I update my books?

A: We recommend monthly. Waiting until year-end guarantees stress and errors.

Key Takeaways

- Clarity: Accurate records show you where you are making money and where you are losing it.

- Protection: Audit-ready books protect you from the IRS and legal risks.

- Growth: Investors and lenders trust businesses with professional financial records.

- Stability: Knowing your numbers allows you to weather economic storms with confidence.

In Summary: The Foundation of Success

Ultimately, bookkeeping isn’t just about today—it’s about sustaining success tomorrow. When your financial foundation is solid, you gain the stability to handle anything: growth, audits, investments, or even downturns. It is the difference between reacting and leading. At GTB, we make sure every client has the tools, data, and structure to stay ahead—not just survive.

The Bottom Line

Precision. Strategy. Partnership.

Discover the real power of bookkeeping.

Schedule Your Free Consultation

Proudly supporting entrepreneurs and organizations from Camas, WA and Vancouver, WA to Portland, OR, Washougal, WA, and throughout Seattle, Los Angeles, San Francisco, San Diego, Phoenix, Denver, Dallas, Houston, Chicago, Miami, Atlanta, Boston, New York, Philadelphia, and every community in between. Wherever your business calls home—across the Pacific Northwest, the West Coast, or anywhere nationwide—Giesler-Tran Bookkeeping delivers expert financial clarity and trusted service in all 50 states.

This content is for educational purposes only and not intended as tax, legal, or financial advice. Consult a qualified professional for guidance specific to your business.

One Response