Stop Overpaying Taxes Because Your Books Aren’t Audit‑Ready.

- Home

- Audit-Ready Bookkeeping

Audit-Ready Bookkeeping Vancouver WA (Serving Portland, OR) — Smart Tax Books Everywhere

Audit Ready Bookkeeping: Stop Overpaying Taxes. We provide Audit Ready Bookkeeping for medical and service businesses in Vancouver, WA and Portland, OR. Using the Smart Tax Clarity System™, we replace “fix it later” chaos with weekly accuracy—capturing every deduction and eliminating IRS risk. Backed by 75+ years of experience, we ensure your numbers are defensible, not just “good enough”.

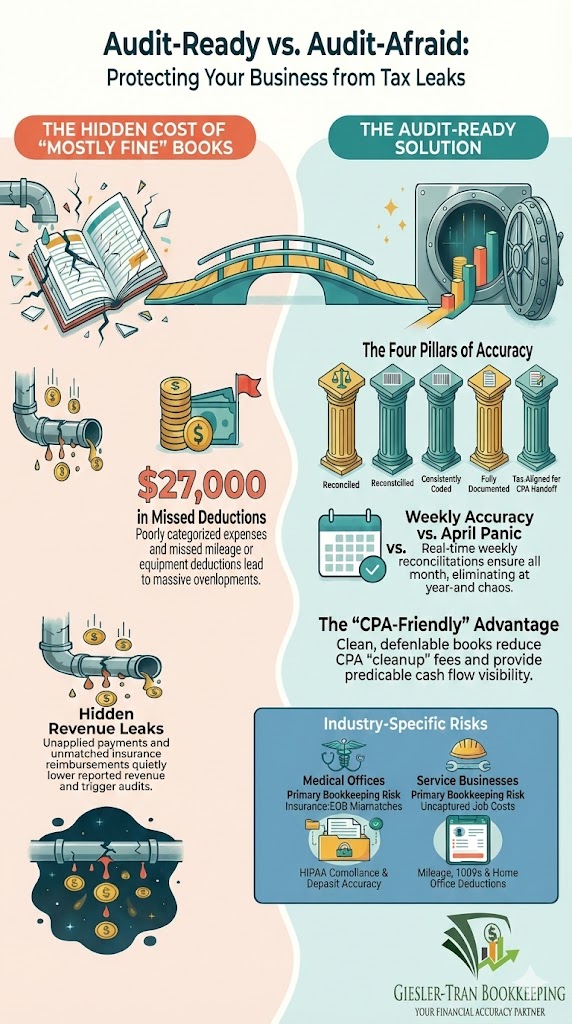

The hidden tax risk in “mostly fine” books

Smart tax decisions rely on Audit-Ready Bookkeeping — and right now, many medical practices and service businesses are bleeding money because their books are chaotic.

The daily bookkeeping issues that quietly raise your tax bill

Medical offices (HIPAA-aware, deposit + insurance accuracy)

- Insurance reimbursements don’t match deposits

- Unapplied payments lowering reported revenue

- Mis-coded medical expenses

- Provider compensation off by thousands

- Payroll classifications triggering IRS red flags

- Chart of Accounts not optimized for deductions

Service businesses (fast-moving cash flow, clean job profitability)

- Fuel, tools, materials, subs — not properly categorized

- Missed home-office, mileage, and equipment deductions

- Revenue recorded in the wrong period

- Cash payments never documented

- 1099/employee mistakes leading to penalties

Every error compounds: higher taxes, higher risk, lower profit

Without Audit-Ready Bookkeeping, messy books don’t just create stress—they quietly raise your tax bill and increase compliance risk.

That’s the villain.

The Standard of Audit Ready Bookkeeping (Vancouver–Portland Businesses)

Far from being a buzzword, Audit Ready Bookkeeping ensures your financials are:

Accurate (reconciled and supported)

Consistent (clean chart of accounts and coding rules)

Documented (clear audit trail)

CPA-friendly (easy handoff, fewer questions)

Tax-aligned (built to support proactive planning)

In real life, audit-ready bookkeeping gives you:

Weekly financial confidence

Predictable cash flow visibility

Fewer surprises, fewer penalties, fewer headaches

Clean reports you can actually make decisions with

With Audit-Ready Bookkeeping, you’re not buying ‘debits and credits.’ You’re buying control.

Introducing: The Smart Tax Clarity System™ (Audit‑Ready by Design)

Our process delivers Audit-Ready Bookkeeping specifically for medical offices and service-based businesses that need clean books, clean reporting, and clean compliance.

What's included:

Weekly accuracy for Audit-Ready Bookkeeping (so month-end stays clean)

Real-time reconciliations so your numbers stay accurate all month—not “caught up later.”

Tax-aligned chart of accounts (The foundation of Audit-Ready Bookkeeping)

A structure designed to support deductions and make tax filing smoother.

Insurance + deposit reconciliation (Audit-Ready Bookkeeping for medical offices)

We tie EOB → deposit → book entry so your revenue is accurate and defensible.

Expense categorization for Audit-Ready Bookkeeping

No guesswork. No sloppy coding. No missed deductions.

Year-round Audit-Ready Bookkeeping (no April panic)

Decisions made proactively throughout the year—not at the last minute.

Quarterly review + tax-readiness check

We keep you audit-ready, not audit-afraid.

A Year-End Handoff of Audit-Ready Bookkeeping Your CPA Can Trust

Your CPA receives clean books, clean support, and clean reporting—so you avoid “cleanup season” fees.

Who This Is Built For

We provide audit-ready bookkeeping in Vancouver WA, and Portland OR for businesses that need accurate numbers, strong documentation, and tax-smart reporting.

Medical offices that need audit-ready documentation

Medical offices that need audit-ready documentation

Ideal if you need:

HIPAA-aware handling

Deposit + insurance accuracy

Clean documentation and audit trail

- Chiropractors • Dentists • Therapists •

PT Clinics • NP-owned practices • Wellness clinics • Nonprofit healthcare

Service businesses that want clean books and tax-ready reporting

Service businesses that want clean books and tax-ready reporting

Ideal if you want:

Clean month-to-month reporting

Job/service profitability visibility

Reliable cash flow tracking

- Contractors • Trades (HVAC, plumbing, electrical) • Home-service pros • Consultants • Agencies • E-commerce / Shopify • Specialty service providers

If your business relies on accurate numbers, compliance, and tax-smart operations… The Smart Tax Clarity System™ is built for you.

The ROI of Audit-Ready Bookkeeping: Lower Taxes, Higher Profit

When your books are tax-aligned and audit-ready:

You legally reduce your tax bill

1. You Legally Reduce Your Tax Bill Don’t let sloppy coding cost you. We ensure Audit Ready Bookkeeping captures every legitimate deduction and codes expenses correctly. This means a tax-aligned chart of accounts and zero “we need to fix your books” fees from your CPA

2. You Avoid IRS Penalties Stop worrying about red flags. Our process guarantees no late filings and no misclassifications. We build a clean, documented audit trail so that if the IRS looks, they have nothing to question.

3. You Keep More Profit Bad bookkeeping leaks money; Audit Ready Bookkeeping stops the bleeding. By identifying missed deductions and ensuring accurate reimbursements, we help you protect the profit you’ve earned.

4. You Scale Faster You aren’t just buying data entry; you are buying control. Clean numbers lead to smarter decisions and sustainable growth.

Why GTB Delivers Audit-Ready Bookkeeping (Not Just “Good Enough”)

Medical + service-industry workflows (not generic templates)

Insurance reconciliation expertise

HIPAA-aware bookkeeping

75+ years combined experience across our team

Certified experts only (no junior staff on your account)

Hands-on accuracy (we don’t rely on broad AI transaction matching)

Flat-rate pricing for predictable monthly support

Your CPA will love the clean handoff. The IRS will have nothing to question. That’s the certainty of Audit Ready Bookkeeping.

Real Results: What Clients Say About Our Audit‑Ready Bookkeeping

“GTB caught $27,000 in missed deductions from my previous bookkeeper. That is the difference Audit Ready Bookkeeping makes.” — Dental Clinic Owner

“Our reimbursements finally tie out correctly. Zero IRS fear now.” — Wellness Practice

“Brian found mistakes that caused us to overpay taxes for years. Finally, we have accurate numbers we can trust.” — Home Services Company

Audit-Ready Bookkeeping Vancouver WA (Serving Portland) — FAQs

Who is this service for?

We provide Audit Ready Bookkeeping specifically for medical offices and service-based businesses that need accurate records, proper categorization, and clean documentation to avoid tax mistakes

What does “audit-ready” mean for my business?

Audit Ready Bookkeeping means your financials are reconciled, fully documented, consistently categorized, and tax-aligned—making them easy for a CPA (or auditor) to follow.

Can you work with my CPA?

Yes. We provide Audit Ready Bookkeeping that makes the year-end handoff seamless for your existing CPA. Alternatively, we can handle tax filing in-house with our Senior Tax Accountant.

Do you help with cleanup if my books are messy?

Yes. We turn chaotic records into Audit Ready Bookkeeping. We fix misclassifications, reconcile accounts, and rebuild your books so they are fully documented and structured for tax optimization.

What makes GTB different from a typical bookkeeper in Vancouver (Portland)?

Unlike typical firms that rely on junior staff or broad AI tools, GTB provides Audit Ready Bookkeeping backed by 75+ years of combined experience. We ensure hands-on accuracy and year-round tax positioning, so your books are always defensible and optimized for savings.

How do I get started?

Start with a Free Financial Health Evaluation. We’ll review your current books, identify tax risks, and provide a clear, flat-rate monthly proposal.

Stop overpaying taxes. Start saving with Audit Ready Bookkeeping.

Start with a Free Financial Health Evaluation. We’ll review your current books, identify tax risks, and provide a clear, flat-rate monthly proposal.

- 50% Off Your First Month • Audit-Ready • Smart Tax • Compliance First